AngloAmerican Results Presentation Deck

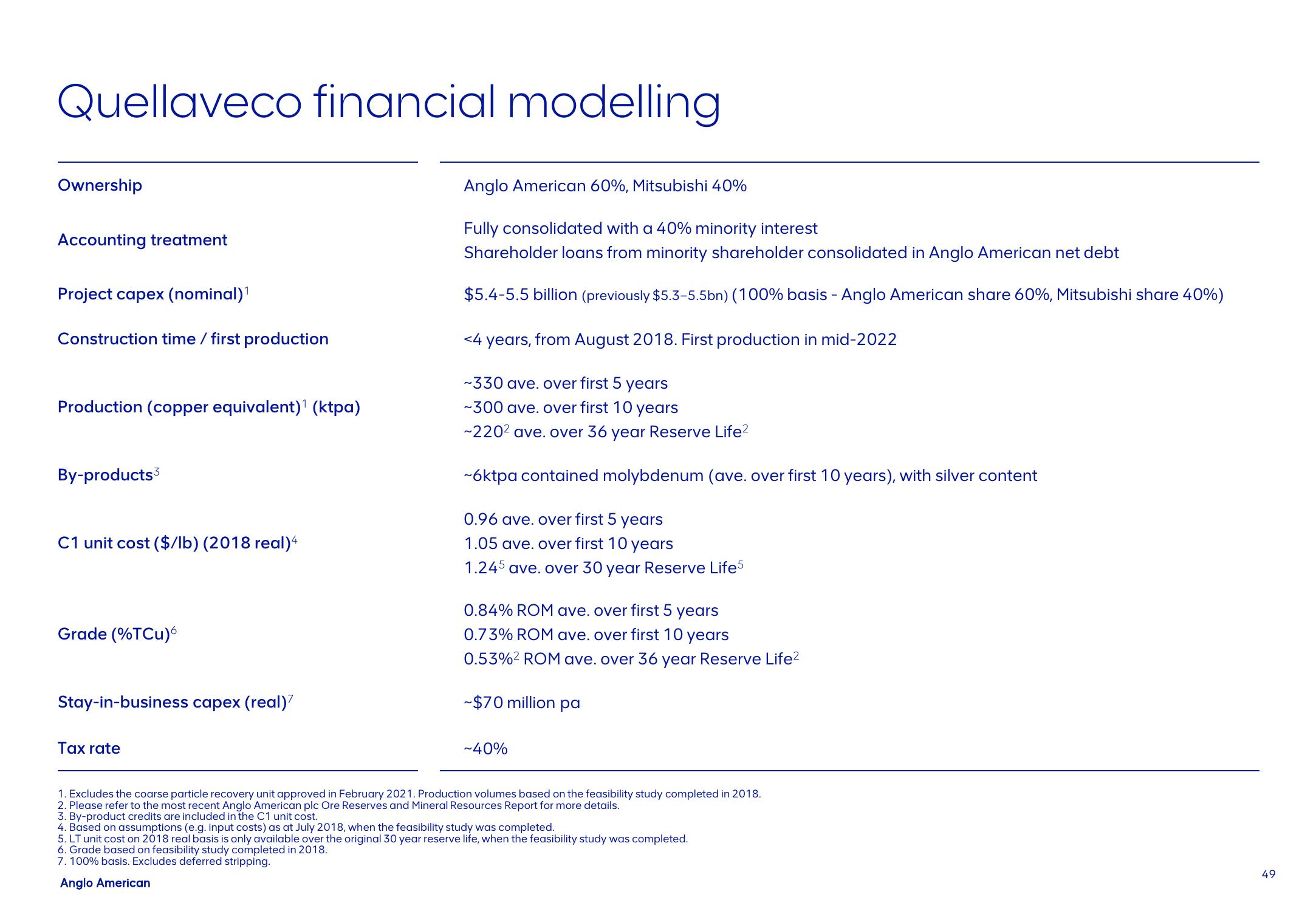

Quellaveco financial modelling

Ownership

Accounting treatment

Project capex (nominal) ¹

Construction time / first production

Production (copper equivalent)¹ (ktpa)

By-products3

C1 unit cost ($/lb) (2018 real)4

Grade (%TCu)

Stay-in-business capex (real)

Tax rate

Anglo American 60%, Mitsubishi 40%

Fully consolidated with a 40% minority interest

Shareholder loans from minority shareholder consolidated in Anglo American net debt

$5.4-5.5 billion (previously $5.3-5.5bn) (100% basis - Anglo American share 60%, Mitsubishi share 40%)

<4 years, from August 2018. First production in mid-2022

~330 ave. over first 5 years

~300 ave. over first 10 years

~220² ave. over 36 year Reserve Life²

~6ktpa contained molybdenum (ave. over first 10 years), with silver content

0.96 ave. over first 5 years

1.05 ave. over first 10 years

1.245 ave. over 30 year Reserve Life5

0.84% ROM ave. over first 5 years

0.73% ROM ave. over first 10 years

0.53%² ROM ave. over 36 year Reserve Life²

-$70 million pa

~40%

1. Excludes the coarse particle recovery unit approved in February 2021. Production volumes based on the feasibility study completed in 2018.

2. Please refer to the most recent Anglo American plc Ore Reserves and Mineral Resources Report for more details.

3. By-product credits are included in the C1 unit cost.

4. Based on assumptions (e.g. input costs) as at July 2018, when the feasibility study was completed.

5. LT unit cost on 2018 real basis is only available over the original 30 year reserve life, when the feasibility study was completed.

6. Grade based on feasibility study completed in 2018.

7. 100% basis. Excludes deferred stripping.

Anglo American

49View entire presentation