LanzaTech SPAC Presentation Deck

Customer Unit Level Economics

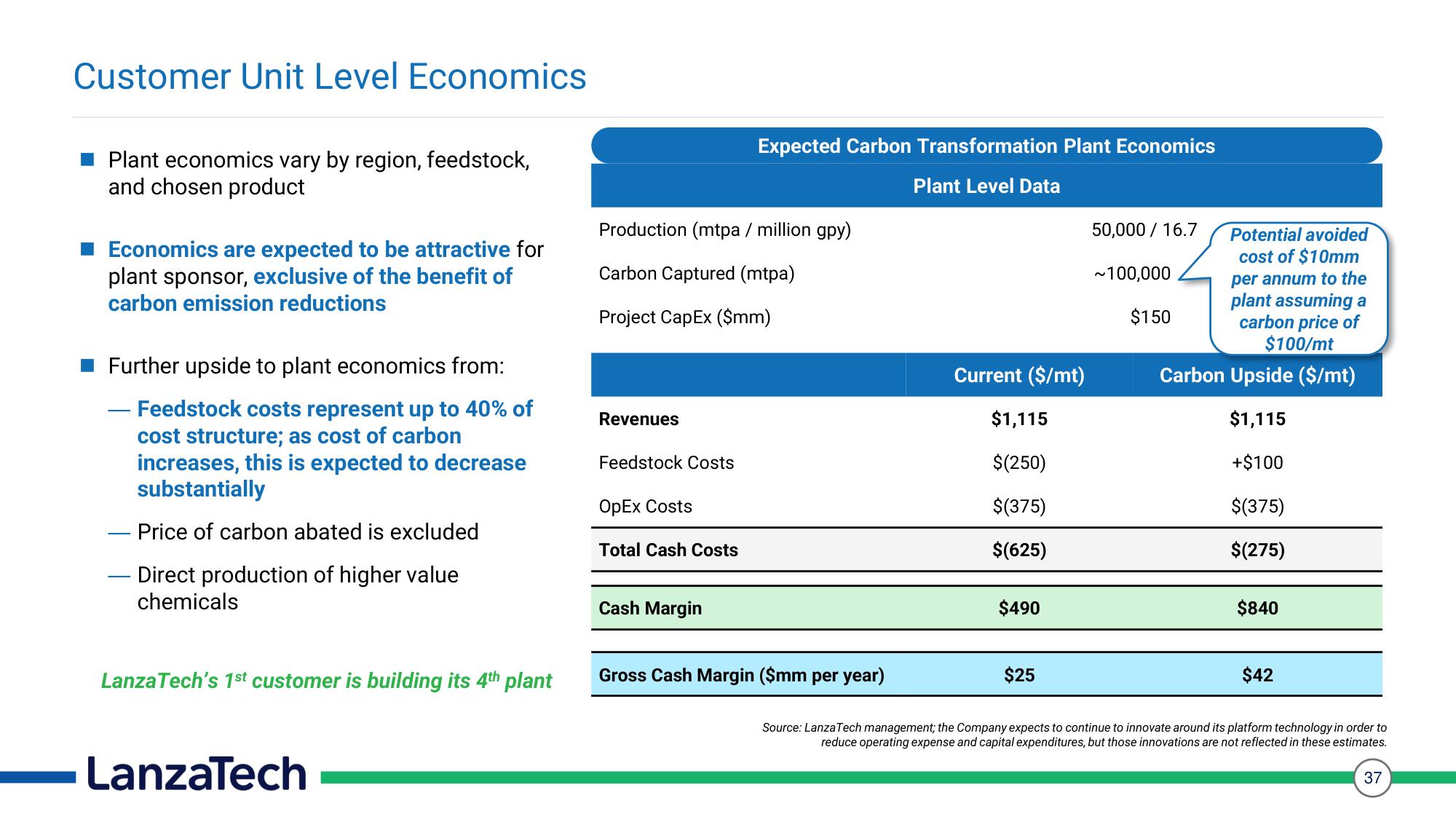

Plant economics vary by region, feedstock,

and chosen product

Economics are expected to be attractive for

plant sponsor, exclusive of the benefit of

carbon emission reductions

Further upside to plant economics from:

Feedstock costs represent up to 40% of

cost structure; as cost of carbon

increases, this is expected to decrease

substantially

Price of carbon abated is excluded

Direct production of higher value

chemicals

LanzaTech's 1st customer is building its 4th plant

LanzaTech

Production (mtpa / million gpy)

Carbon Captured (mtpa)

Project CapEx ($mm)

Revenues

Feedstock Costs

OpEx Costs

Total Cash Costs

Expected Carbon Transformation Plant Economics

Plant Level Data

Cash Margin

Gross Cash Margin ($mm per year)

Current ($/mt)

$1,115

$(250)

$(375)

$(625)

$490

$25

50,000/ 16.7

~100,000

Potential avoided

cost of $10mm

per annum to the

plant assuming a

carbon price of

$100/mt

Carbon Upside ($/mt)

$1,115

+$100

$(375)

$(275)

$150

$840

$42

Source: LanzaTech management; the Company expects to continue to innovate around its platform technology in order to

reduce operating expense and capital expenditures, but those innovations are not reflected in these estimates.

37View entire presentation