Rush Street SPAC Presentation Deck

Transaction Structure

Transaction Overview

●

RSI is a leading online gaming company with number one market share in online casino in the United States¹ as well as a top online sports betting offering

dMY Technology Group, Inc. (DMYT) is a publicly traded special purpose acquisition company with $230 million in cash held in trust

DMYT will combine with RSI in an Up-C structure

DMYT has obtained commitments for a $160 million PIPE at $10.00 per share of common stock to facilitate the combination with RSI

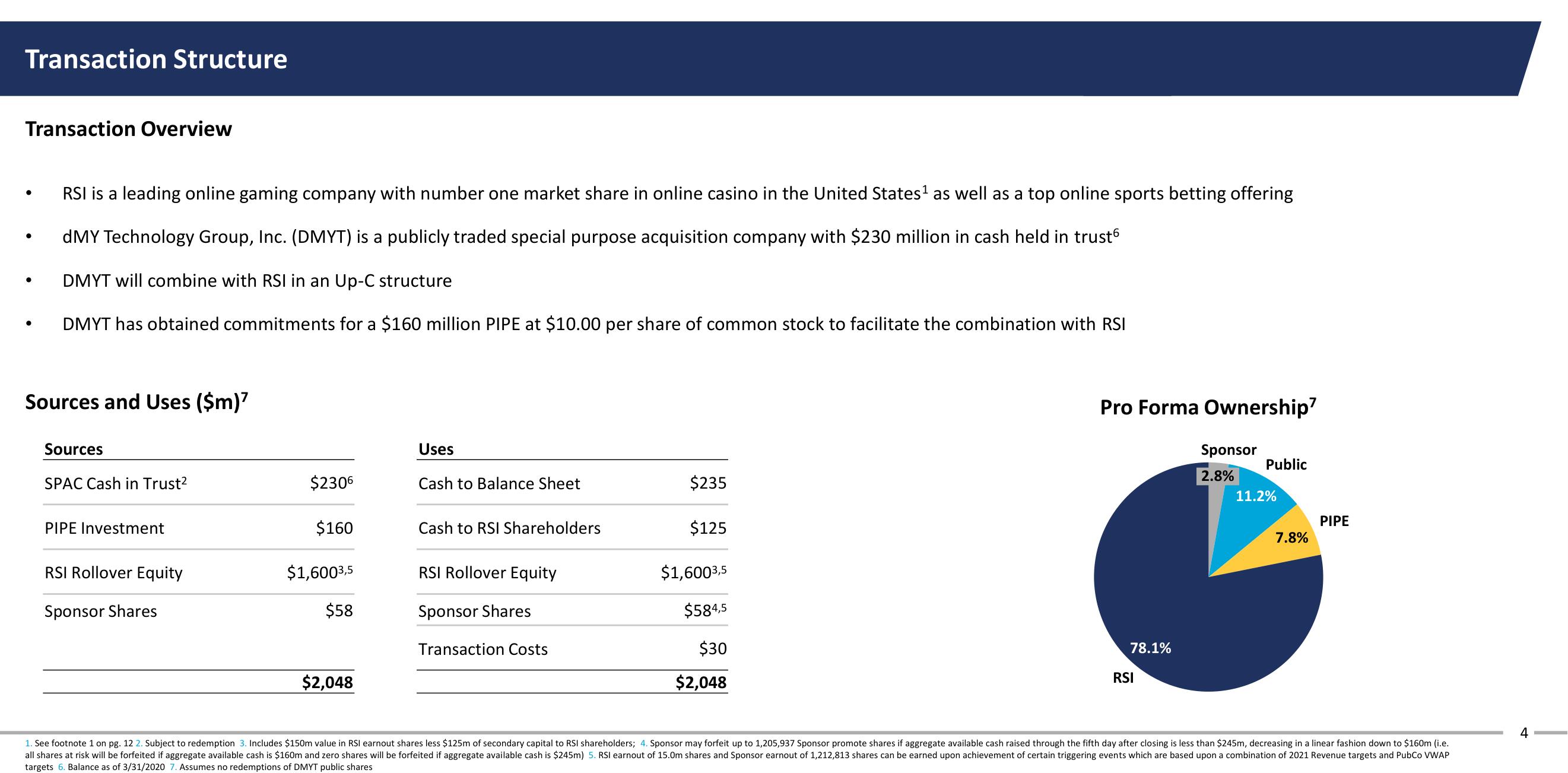

Sources and Uses ($m)7

Sources

SPAC Cash in Trust²

PIPE Investment

RSI Rollover Equity

Sponsor Shares

$2306

$160

$1,6003,5

$58

$2,048

Uses

Cash to Balance Sheet

Cash to RSI Shareholders

RSI Rollover Equity

Sponsor Shares

Transaction Costs

$235

$125

$1,6003,5

$584,5

$30

$2,048

Pro Forma Ownership7

Sponsor

2.8%

78.1%

RSI

Public

11.2%

7.8%

PIPE

1. See footnote 1 on pg. 12 2. Subject to redemption 3. Includes $150m value in RSI earnout shares less $125m of secondary capital to RSI shareholders; 4. Sponsor may forfeit up to 1,205,937 Sponsor promote shares if aggregate available cash raised through the fifth day after closing is less than $245m, decreasing in a linear fashion down to $160m (i.e.

all shares at risk will be forfeited if aggregate available cash is $160m and zero shares will be forfeited if aggregate available cash is $245m) 5. RSI earnout of 15.0m shares and Sponsor earnout of 1,212,813 shares can be earned upon achievement of certain triggering events which are based upon a combination of 2021 Revenue targets and PubCo VWAP

targets 6. Balance as of 3/31/2020 7. Assumes no redemptions of DMYT public shares

4View entire presentation