Babylon SPAC Presentation Deck

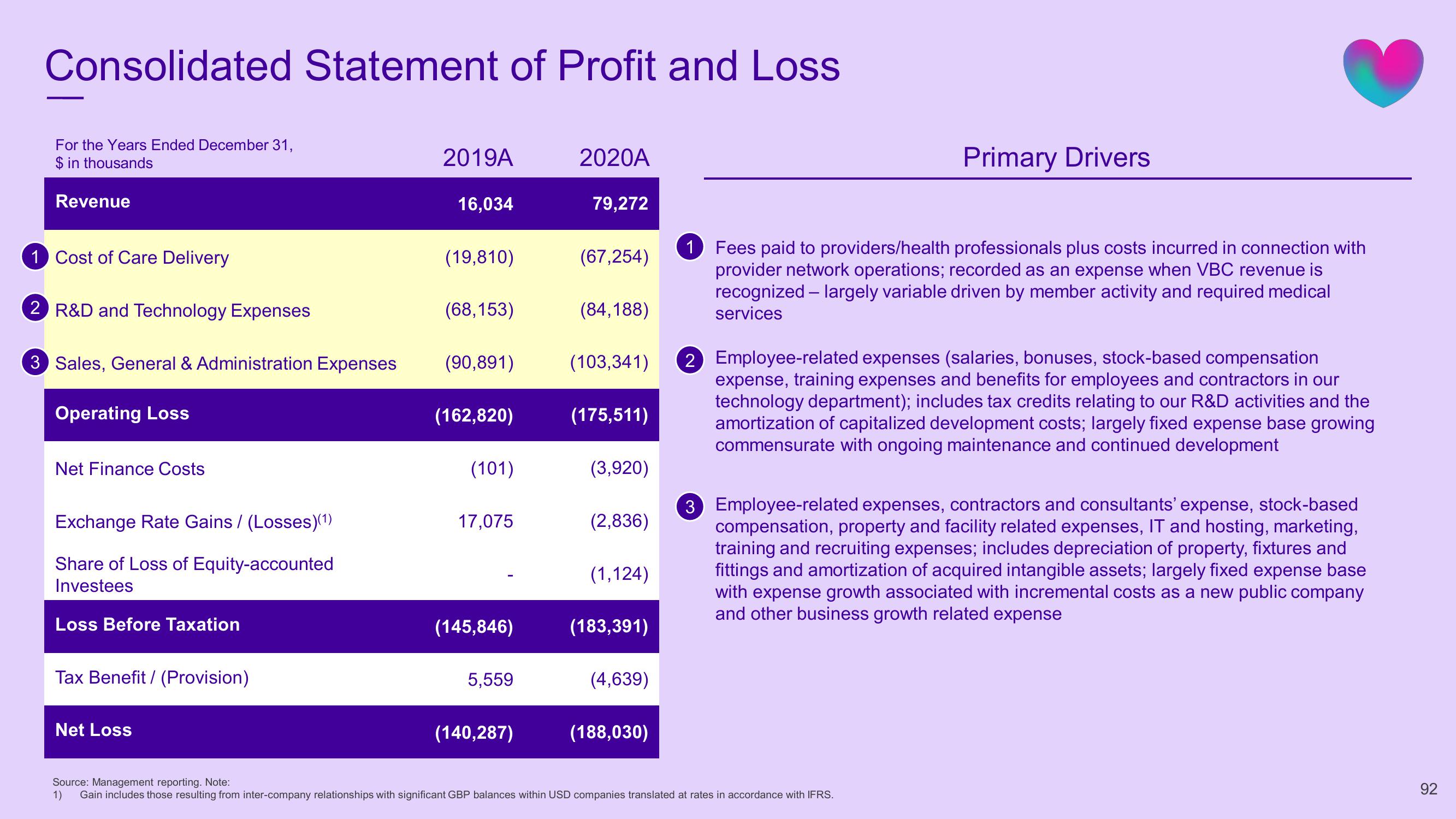

Consolidated Statement of Profit and Loss

For the Years Ended December 31,

$ in thousands

Revenue

1 Cost of Care Delivery

2 R&D and Technology Expenses

3 Sales, General & Administration Expenses

Operating Loss

Net Finance Costs

Exchange Rate Gains/ (Losses)(1)

Share of Loss of Equity-accounted

Investees

Loss Before Taxation

Tax Benefit/ (Provision)

Net Loss

2019A

16,034

(19,810)

(68,153)

(90,891)

(162,820)

(101)

17,075

(145,846)

5,559

(140,287)

2020A

79,272

(67,254)

(84,188)

(175,511)

(103,341) 2 Employee-related expenses (salaries, bonuses, stock-based compensation

expense, training expenses and benefits for employees and contractors in our

technology department); includes tax credits relating to our R&D activities and the

amortization of capitalized development costs; largely fixed expense base growing

commensurate with ongoing maintenance and continued development

(3,920)

(2,836)

(1,124)

(183,391)

(4,639)

(188,030)

Primary Drivers

1 Fees paid to providers/health professionals plus costs incurred in connection with

provider network operations; recorded as an expense when VBC revenue is

recognized - largely variable driven by member activity and required medical

services

3 Employee-related expenses, contractors and consultants' expense, stock-based

compensation, property and facility related expenses, IT and hosting, marketing,

training and recruiting expenses; includes depreciation of property, fixtures and

fittings and amortization of acquired intangible assets; largely fixed expense base

with expense growth associated with incremental costs as a new public company

and other business growth related expense

Source: Management reporting. Note:

1) Gain includes those resulting from inter-company relationships with significant GBP balances within USD companies translated at rates in accordance with IFRS.

92View entire presentation