GMS Results Presentation Deck

Solid Levels of Profitability

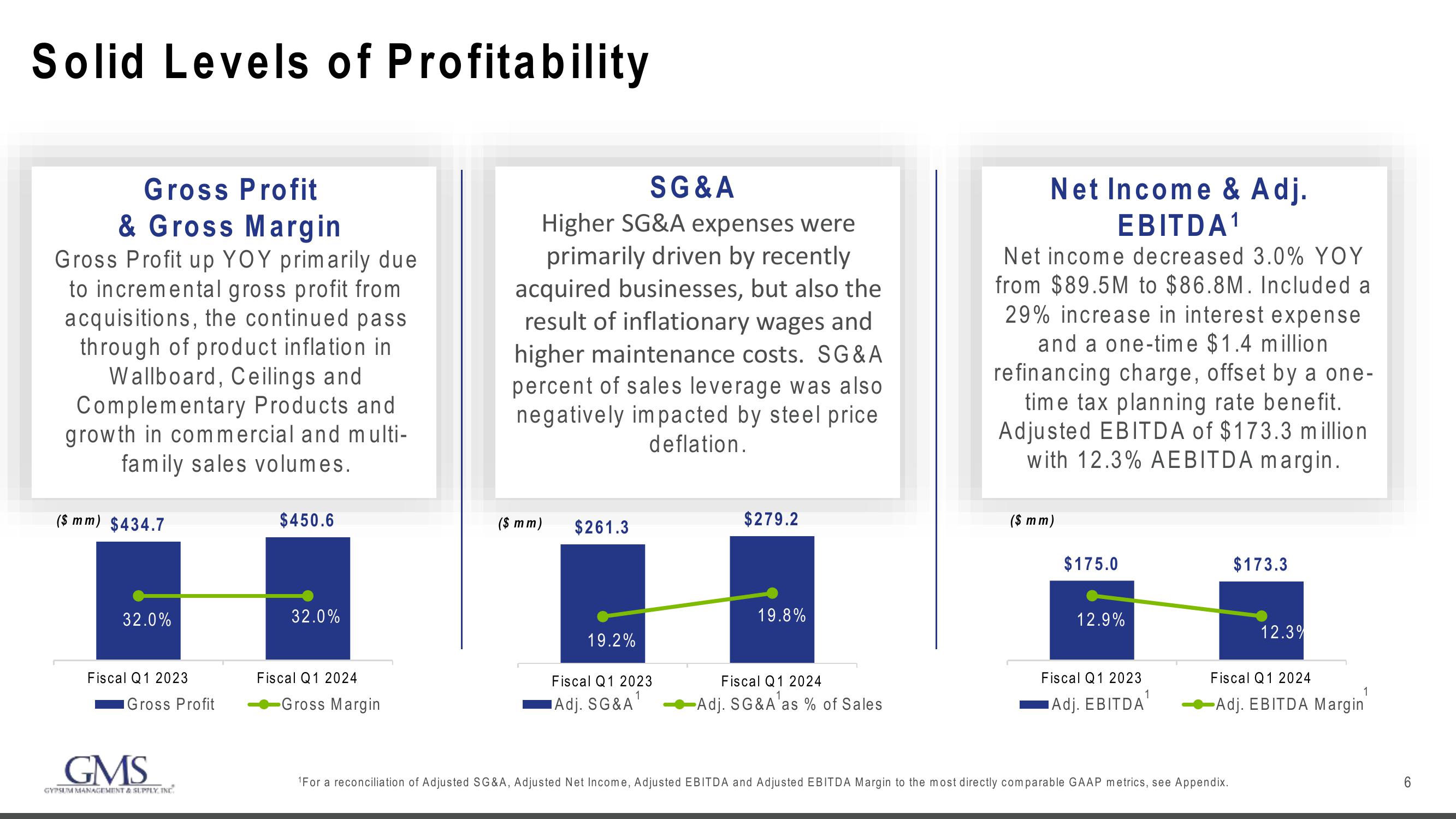

Gross Profit

& Gross Margin

Gross Profit up YOY primarily due

to incremental gross profit from

acquisitions, the continued pass

through of product inflation in

Wallboard, Ceilings and

Complementary Products and

growth in commercial and multi-

family sales volumes.

($ mm) $434.7

32.0%

Fiscal Q1 2023

Gross Profit

GMS

GYPSUM MANAGEMENT & SUPPLY INC.

$450.6

32.0%

Fiscal Q1 2024

Gross Margin

SG&A

Higher SG&A expenses were

primarily driven by recently

acquired businesses, but also the

result of inflationary wages and

higher maintenance costs. SG & A

percent of sales leverage was also

negatively impacted by steel price

deflation.

($ mm)

$261.3

19.2%

Fiscal Q1 2023

Adj. SG&A

$279.2

19.8%

Fiscal Q1 2024

-Adj. SG&A as % of Sales

Net Income & Adj.

EBITDA¹

Net income decreased 3.0% YOY

from $89.5M to $86.8M. Included a

29% increase in interest expense

and a one-time $1.4 million

refinancing charge, offset by a one-

time tax planning rate benefit.

Adjusted EBITDA of $173.3 million

with 12.3% AEBITDA margin.

($ mm)

$175.0

12.9%

Fiscal Q1 2023

1

Adj. EBITDA

$173.3

¹For a reconciliation of Adjusted SG&A, Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA Margin to the most directly comparable GAAP metrics, see Appendix.

12.3%

Fiscal Q1 2024

1

-Adj. EBITDA Margin

6View entire presentation