DraftKings Mergers and Acquisitions Presentation Deck

PRO FORMA DRAFTKINGS P&L AND ADJUSTED EBITDA RECONCILIATION

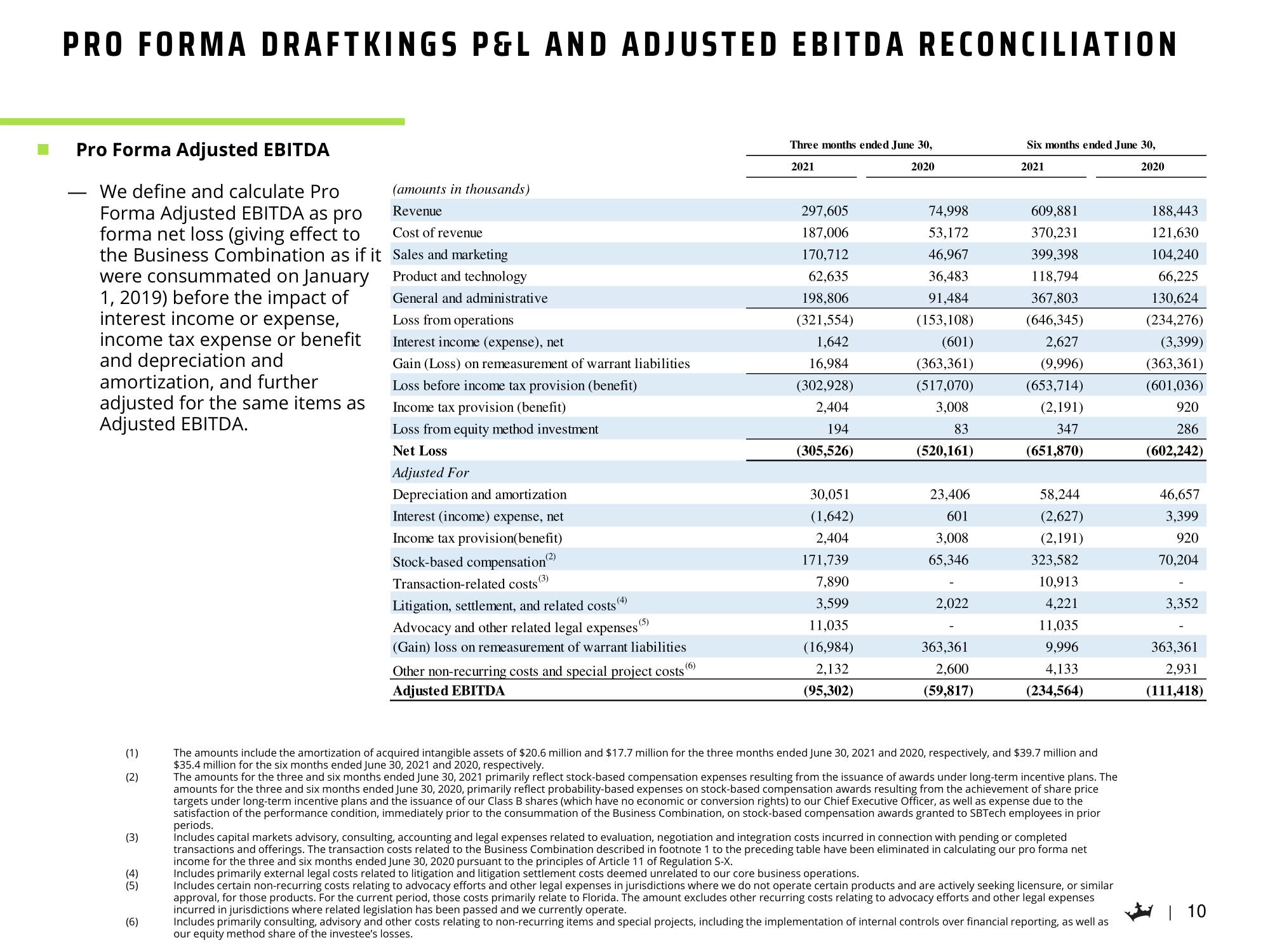

Pro Forma Adjusted EBITDA

We define and calculate Pro

Forma Adjusted EBITDA as pro

forma net loss (giving effect to

the Business Combination as if it

were consummated on January

1, 2019) before the impact of

interest income or expense,

income tax expense or benefit

and depreciation and

amortization, and further

adjusted for the same items as

Adjusted EBITDA.

(1)

(2)

(3)

(4)

(5)

(6)

(amounts in thousands)

Revenue

Cost of revenue

Sales and marketing

Product and technology

General and administrative

Loss from operations

Interest income (expense), net

Gain (Loss) on remeasurement of warrant liabilities

Loss before income tax provision (benefit)

Income tax provision (benefit)

Loss from equity method investment

Net Loss

Adjusted For

Depreciation and amortization

Interest (income) expense, net

Income tax provision(benefit)

Stock-based compensation²)

Transaction-related costs (3)

(2)

(4)

Litigation, settlement, and related costs

Advocacy and other related legal expenses

(Gain) loss on remeasurement of warrant liabilities

Other non-recurring costs and special project costs)

Adjusted EBITDA

(5)

Three months ended June 30,

2021

2020

297,605

187,006

170,712

62,635

198,806

(321,554)

1,642

16,984

(302,928)

2,404

194

(305,526)

30,051

(1,642)

2,404

171,739

7,890

3,599

11,035

(16,984)

2,132

(95,302)

74,998

53,172

46,967

36,483

91,484

(153,108)

(601)

(363,361)

(517,070)

3,008

83

(520,161)

23,406

601

3,008

65,346

2,022

363,361

2,600

(59,817)

Six months ended June 30,

2021

2020

609,881

370,231

399,398

118,794

367,803

(646,345)

2,627

(9,996)

(653,714)

(2,191)

347

(651,870)

58,244

(2,627)

(2,191)

323,582

10,913

4,221

11,035

9,996

4,133

(234,564)

The amounts include the amortization of acquired intangible assets of $20.6 million and $17.7 million for the three months ended June 30, 2021 and 2020, respectively, and $39.7 million and

$35.4 million for the six months ended June 30, 2021 and 2020, respectively.

The amounts for the three and six months ended June 30, 2021 primarily reflect stock-based compensation expenses resulting from the issuance of awards under long-term incentive plans. The

amounts for the three and six months ended June 30, 2020, primarily reflect probability-based expenses on stock-based compensation awards resulting from the achievement of share price

targets under long-term incentive plans and the issuance of our Class B shares (which have no economic or conversion rights) to our Chief Executive Officer, as well as expense due to the

satisfaction of the performance condition, immediately prior to the consummation of the Business Combination, on stock-based compensation awards granted to SBTech employees in prior

periods.

Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with pending or completed

transactions and offerings. The transaction costs related to the Business Combination described in footnote 1 to the preceding table have been eliminated in calculating our pro forma net

income for the three and six months ended June 30, 2020 pursuant to the principles of Article 11 of Regulation S-X.

Includes primarily external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations.

Includes certain non-recurring costs relating to advocacy efforts and other legal expenses in jurisdictions where we do not operate certain products and are actively seeking licensure, or similar

approval, for those products. For the current period, those costs primarily relate to Florida. The amount excludes other recurring costs relating to advocacy efforts and other legal expenses

incurred in jurisdictions where related legislation has been passed and we currently operate.

Includes primarily consulting, advisory and other costs relating to non-recurring items and special projects, including the implementation of internal controls over financial reporting, as well as

our equity method share of the investee's losses.

188,443

121,630

104,240

66,225

130,624

(234,276)

(3,399)

(363,361)

(601,036)

920

286

(602,242)

46,657

3,399

920

70,204

3,352

363,361

2,931

(111,418)

| 10View entire presentation