Maersk Investor Presentation Deck

Financial highlights Q2 2020

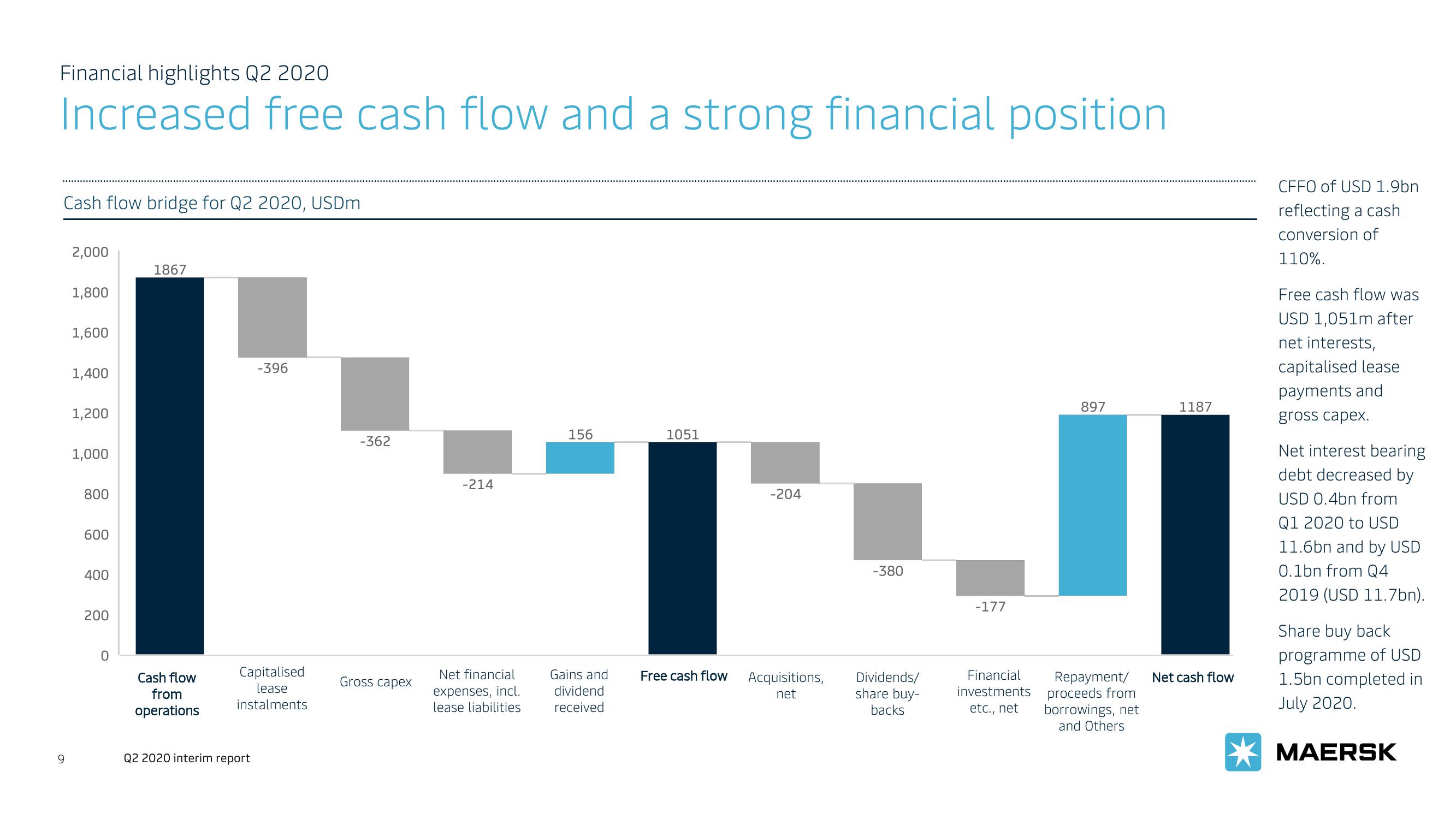

Increased free cash flow and a strong financial position.

Cash flow bridge for Q2 2020, USDm

9

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

1867

Cash flow

from

operations

-396

Capitalised

lease

instalments

Q2 2020 interim report

-362

Gross capex

-214

Net financial

expenses, incl.

lease liabilities.

156

Gains and

dividend

received

1051

-204

Free cash flow Acquisitions,

net

-380

Dividends/

share buy-

backs

-177

897

Financial

Repayment/

investments proceeds from

etc., net

borrowings, net

and Others

1187

Net cash flow

CFFO of USD 1.9bn

reflecting a cash

conversion of

110%.

Free cash flow was

USD 1,051m after

net interests,

capitalised lease

payments and

gross capex.

Net interest bearing

debt decreased by

USD 0.4bn from

Q1 2020 to USD

11.6bn and by USD

0.1bn from Q4

2019 (USD 11.7bn).

Share buy back

programme of USD

1.5bn completed in

July 2020.

MAERSKView entire presentation