Ginkgo Results Presentation Deck

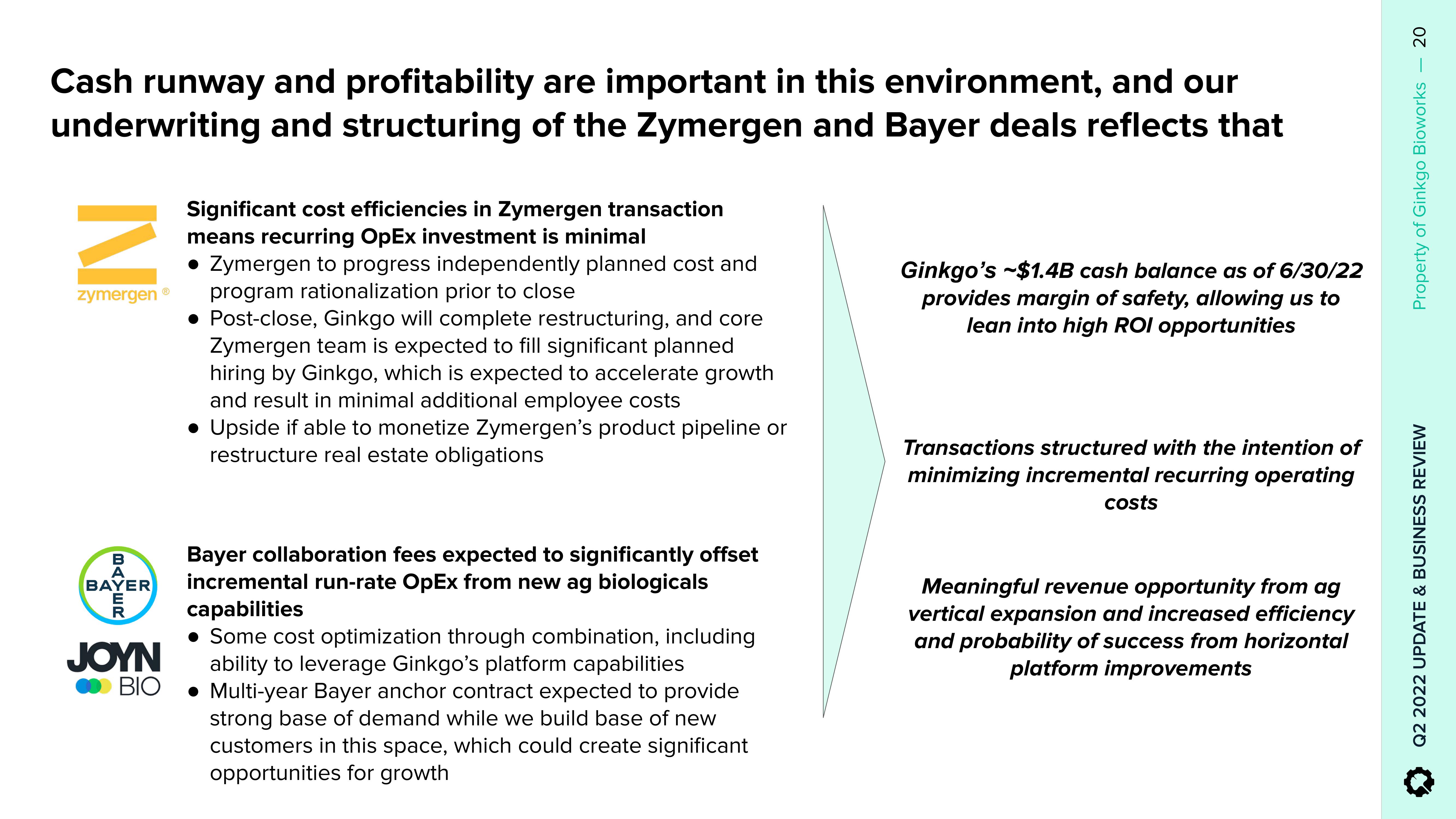

Cash runway and profitability are important in this environment, and our

underwriting and structuring of the Zymergen and Bayer deals reflects that

zymergen

BAYER

BAYER

JOYN

BIO

Significant cost efficiencies in Zymergen transaction

means recurring OpEx investment is minimal

• Zymergen to progress independently planned cost and

program rationalization prior to close

• Post-close, Ginkgo will complete restructuring, and core

Zymergen team is expected to fill significant planned

hiring by Ginkgo, which is expected to accelerate growth

and result in minimal additional employee costs

• Upside if able to monetize Zymergen's product pipeline or

restructure real estate obligations

Bayer collaboration fees expected to significantly offset

incremental run-rate OpEx from new ag biologicals

capabilities

• Some cost optimization through combination, including

ability to leverage Ginkgo's platform capabilities

● Multi-year Bayer anchor contract expected to provide

strong base of demand while we build base of new

customers in this space, which could create significant

opportunities for growth

Ginkgo's -$1.4B cash balance as of 6/30/22

provides margin of safety, allowing us to

lean into high ROI opportunities

Transactions structured with the intention of

minimizing incremental recurring operating

costs

Meaningful revenue opportunity from ag

vertical expansion and increased efficiency

and probability of success from horizontal

platform improvements

20

Property of Ginkgo Bioworks

Q2 2022 UPDATE & BUSINESS REVIEWView entire presentation