Silicon Valley Bank Results Presentation Deck

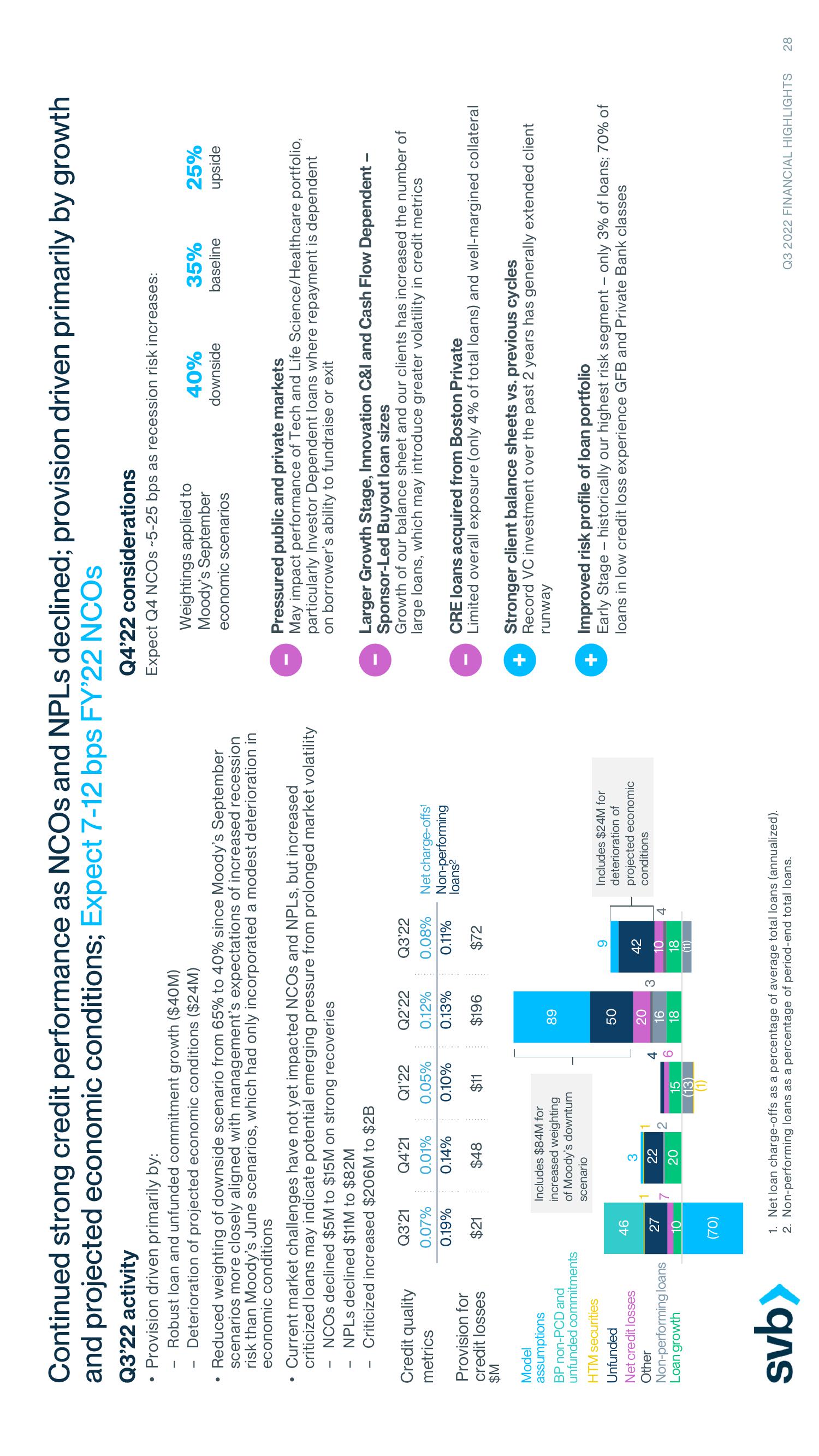

Continued strong credit performance as NCOs and NPLs declined; provision driven primarily by growth

and projected economic conditions; Expect 7-12 bps FY'22 NCOS

Q3'22 activity

Provision driven primarily by:

Robust loan and unfunded commitment growth ($40M)

Deterioration of projected economic conditions ($24M)

●

-

-

Reduced weighting of downside scenario from 65% to 40% since Moody's September

scenarios more closely aligned with management's expectations of increased recession

risk than Moody's June scenarios, which had only incorporated a modest deterioration in

economic conditions

Current market challenges have not yet impacted NCOS and NPLs, but increased

criticized loans may indicate potential emerging pressure from prolonged market volatility

NCOS declined $5M to $15M on strong recoveries

NPLs declined $11M to $82M

Criticized increased $206M to $2B

Credit quality

metrics

Provision for

credit losses

$M

Model

assumptions

BP non-PCD and

unfunded commitments

HTM securities

Unfunded

Net credit losses

Other

Non-performing loans

Loan growth

svb>

Q3'21

0.07%

0.19%

$21

46

27

10

(70)

Q4'21

0.01%

0.14%

$48

Includes $84M for

increased weighting

of Moody's downturn

scenario

3

22

20

Q1'22

0.05%

0.10%

$11

2

15

(13)

(1)

96

4

Q2'22 Q3'22

0.12%

0.08%

0.13%

0.11%

$196

$72

89

50

20

16

18

3

9

42

10

18

(11)

4

Net charge-offs¹

Non-performing

loans²

Includes $24M for

deterioration of

projected economic

conditions

1. Net loan charge-offs as a percentage of average total loans (annualized).

2. Non-performing loans as a percentage of period-end total loans.

Q4'22 considerations

Expect Q4 NCOS ~5-25 bps as recession risk increases:

Weightings applied to

Moody's September

economic scenarios

40%

downside

35%

baseline

25%

upside

Pressured public and private markets

May impact performance of Tech and Life Science/Healthcare portfolio,

particularly Investor Dependent loans where repayment is dependent

on borrower's ability to fundraise or exit

Larger Growth Stage, Innovation C&I and Cash Flow Dependent -

Sponsor-Led Buyout loan sizes

Growth of our balance sheet and our clients has increased the number of

large loans, which may introduce greater volatility in credit metrics

CRE loans acquired from Boston Private

Limited overall exposure (only 4% of total loans) and well-margined collateral

Stronger client balance sheets vs. previous cycles

Record VC investment over the past 2 years has generally extended client

runway

Improved risk profile of loan portfolio

Early Stage - historically our highest risk segment only 3% of loans; 70% of

loans in low credit loss experience GFB and Private Bank classes

Q3 2022 FINANCIAL HIGHLIGHTS 28View entire presentation