Silicon Valley Bank Results Presentation Deck

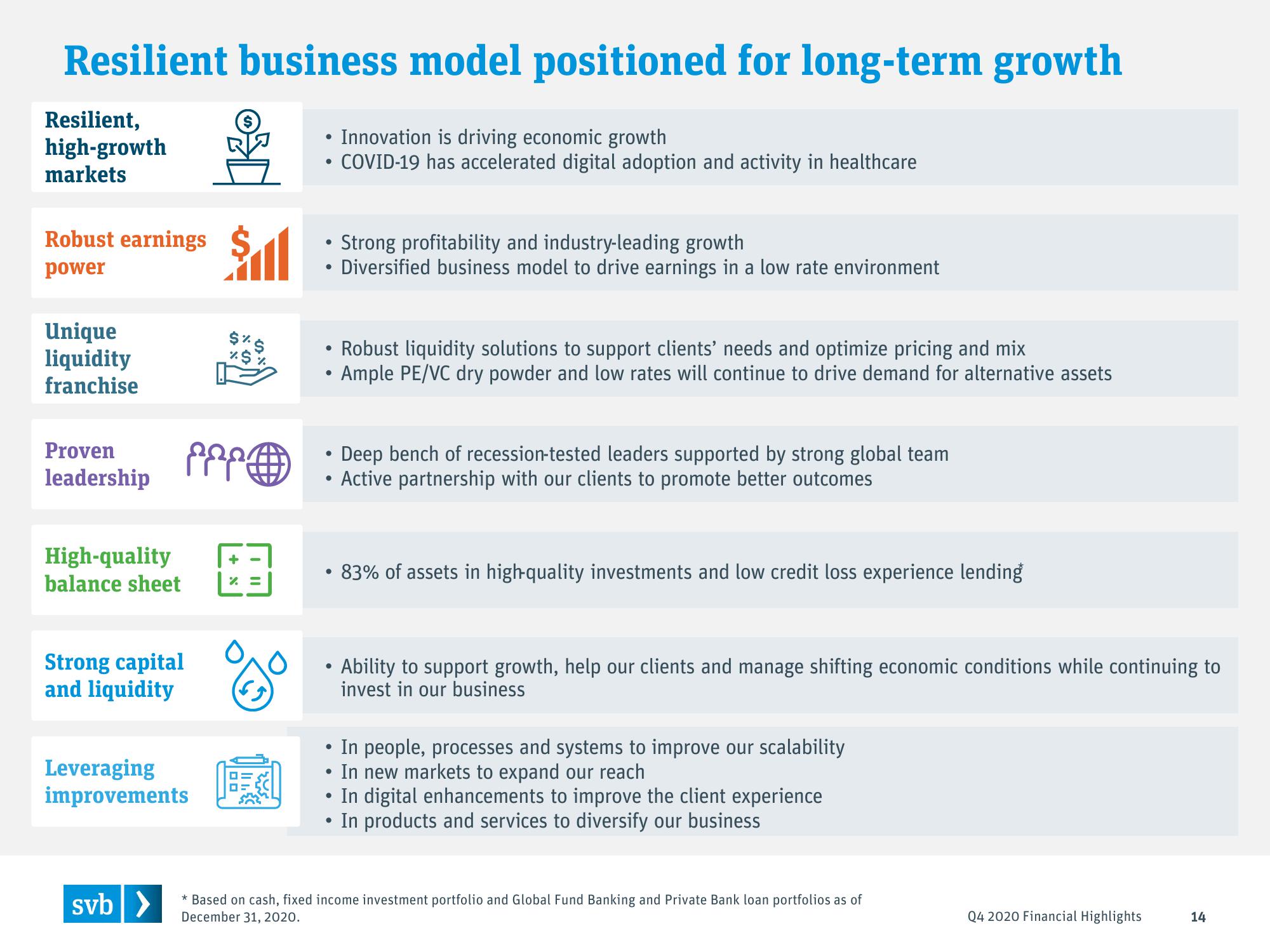

Resilient business model positioned for long-term growth

Resilient,

high-growth

markets

Robust earnings

power

Unique

liquidity

franchise

Proven

leadership

High-quality

balance sheet

Strong capital

and liquidity

Leveraging

improvements

svb >

$ul

$%$

%$

²²

|=|

●

●

●

●

●

●

●

●

Innovation is driving economic growth

COVID-19 has accelerated digital adoption and activity in healthcare

Strong profitability and industry-leading growth

Diversified business model to drive earnings in a low rate environment

Robust liquidity solutions to support clients' needs and optimize pricing and mix

Ample PE/VC dry powder and low rates will continue to drive demand for alternative assets

Deep bench of recession-tested leaders supported by strong global team

Active partnership with our clients to promote better outcomes

83% of assets in high-quality investments and low credit loss experience lending

• Ability to support growth, help our clients and manage shifting economic conditions while continuing to

invest in our business

In people, processes and systems to improve our scalability

●

In new markets to expand our reach

●

In digital enhancements to improve the client experience

●

In products and services to diversify our business

* Based on cash, fixed income investment portfolio and Global Fund Banking and Private Bank loan portfolios as of

December 31, 2020.

Q4 2020 Financial Highlights

14View entire presentation