UBS Fixed Income Presentation Deck

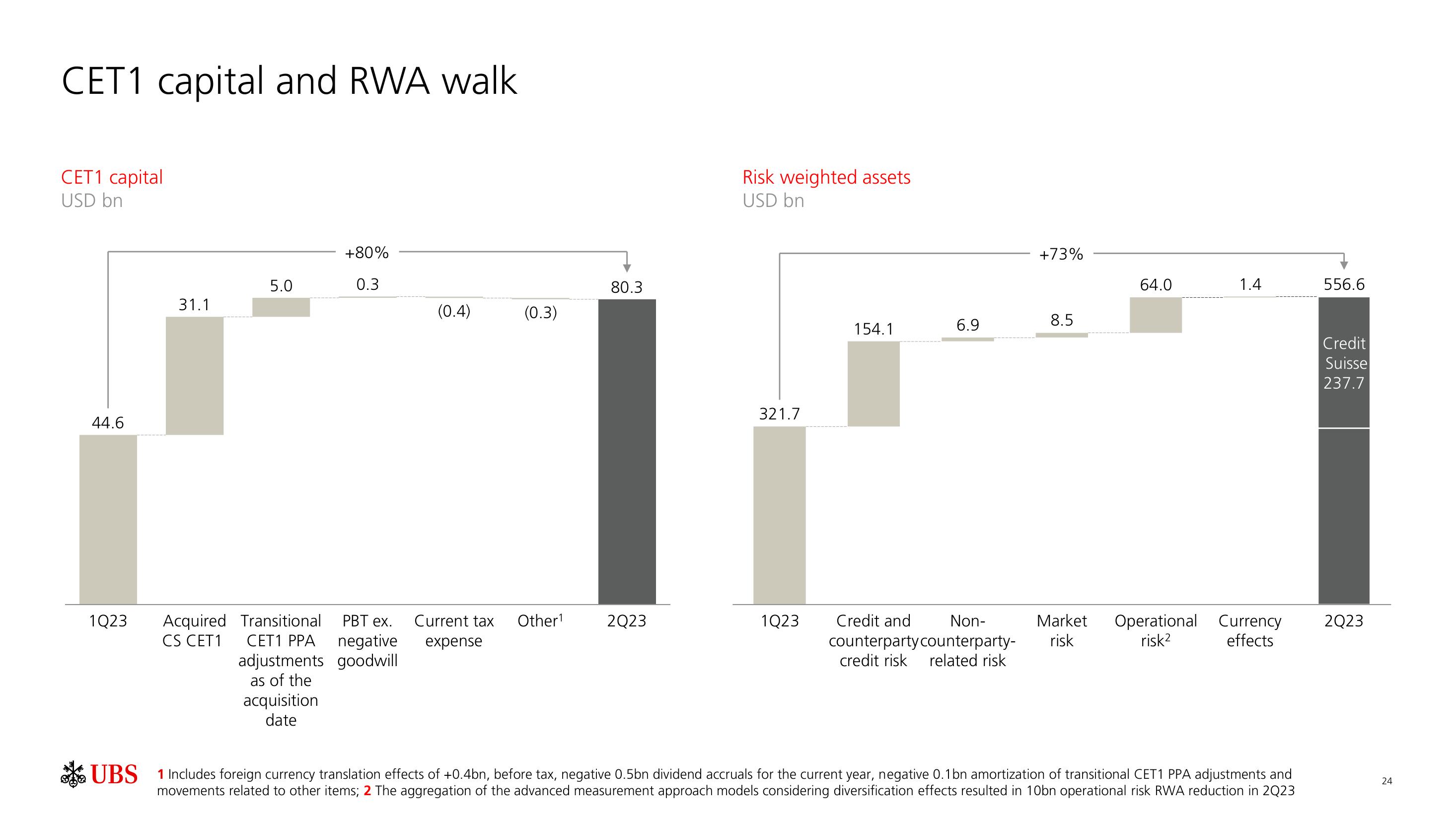

CET1 capital and RWA walk

CET1 capital

USD bn

44.6

1Q23

31.1

Acquired

CS CET1

5.0

+80%

0.3

acquisition

date

Transitional

CET1 PPA negative

adjustments goodwill

as of the

(0.4)

(0.3)

PBT ex. Current tax Other¹

expense

80.3

2Q23

Risk weighted assets

USD bn

321.7

1Q23

154.1

6.9

+73%

8.5

64.0

Credit and Non-

counterparty counterparty- risk

credit risk related risk

1.4

Market Operational Currency

risk²

effects

UBS 1 Includes foreign currency translation effects of +0.4bn, before tax, negative 0.5bn dividend accruals for the current year, negative 0.1bn amortization of transitional CET1 PPA adjustments and

movements related to other items; 2 The aggregation of the advanced measurement approach models considering diversification effects resulted in 10bn operational risk RWA reduction in 2Q23

556.6

Credit

Suisse

237.7

2Q23

24View entire presentation