Deutsche Bank Results Presentation Deck

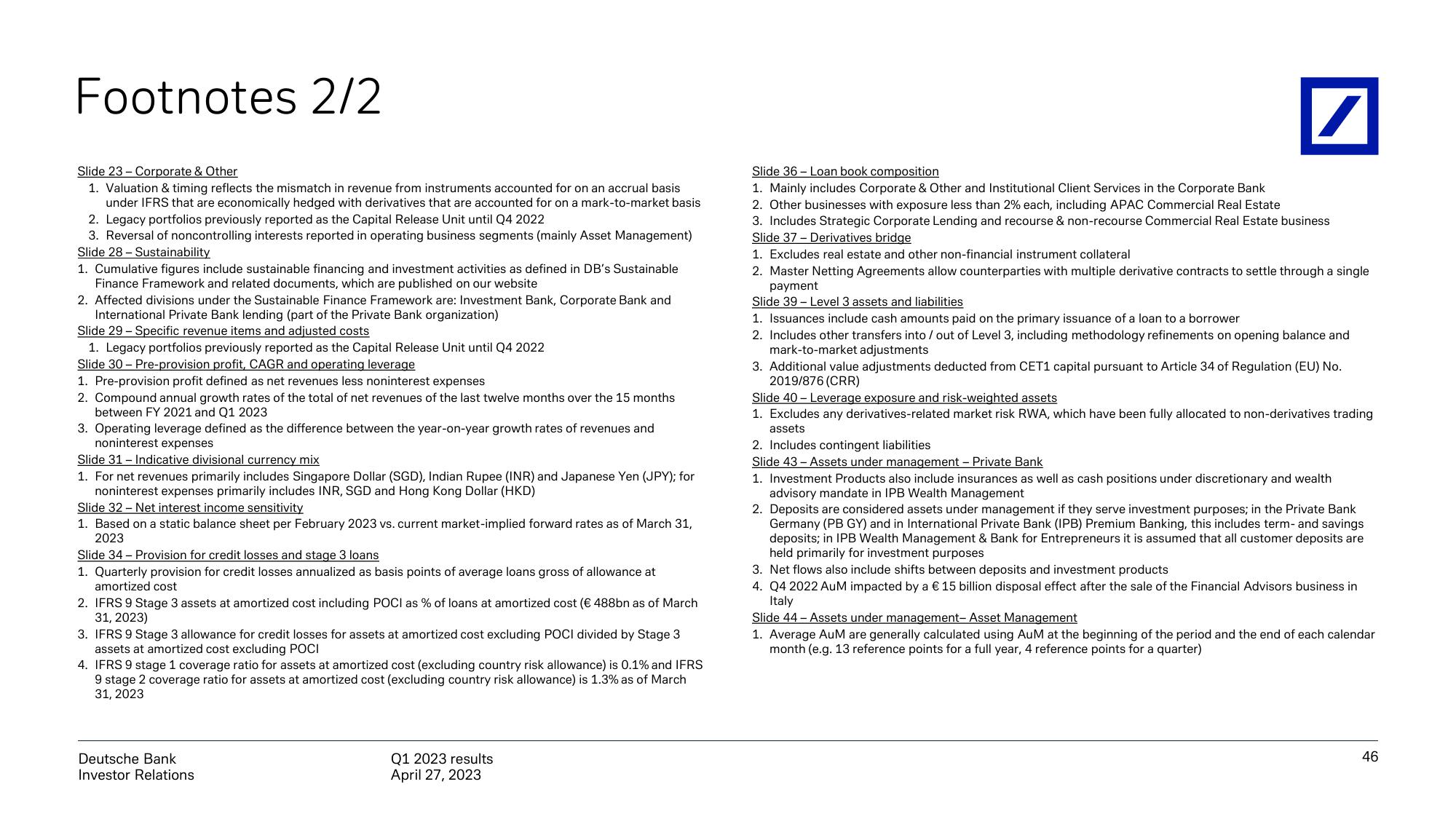

Footnotes 2/2

Slide 23- Corporate & Other

1. Valuation & timing reflects the mismatch in revenue from instruments accounted for on an accrual basis

under IFRS that are economically hedged with derivatives that are accounted for on a mark-to-market basis

2. Legacy portfolios previously reported as the Capital Release Unit until Q4 2022

3. Reversal of noncontrolling interests reported in operating business segments (mainly Asset Management)

Slide 28 Sustainability

1. Cumulative figures include sustainable financing and investment activities as defined in DB's Sustainable

Finance Framework and related documents, which are published on our website

2. Affected divisions under the Sustainable Finance Framework are: Investment Bank, Corporate Bank and

International Private Bank lending (part of the Private Bank organization)

Slide 29 - Specific revenue items and adjusted costs

1. Legacy portfolios previously reported as the Capital Release Unit until Q4 2022

Slide 30 Pre-provision profit, CAGR and operating leverage

1. Pre-provision profit defined as net revenues less noninterest expenses

2. Compound annual growth rates of the total of net revenues of the last twelve months over the 15 months

between FY 2021 and Q1 2023

3. Operating leverage defined as the difference between the year-on-year growth rates of revenues and

noninterest expenses

Slide 31 Indicative divisional currency mix

1. For net revenues primarily includes Singapore Dollar (SGD), Indian Rupee (INR) and Japanese Yen (JPY); for

noninterest expenses primarily includes INR, SGD and Hong Kong Dollar (HKD)

Slide 32 Net interest income sensitivity

1. Based on a static balance sheet per February 2023 vs. current market-implied forward rates as of March 31,

2023

Slide 34 - Provision for credit losses and stage 3 loans

1. Quarterly provision for credit losses annualized as basis points of average loans gross of allowance at

amortized cost

2. IFRS 9 Stage 3 assets at amortized cost including POCI as % of loans at amortized cost (€ 488bn as of March

31, 2023)

3. IFRS 9 Stage 3 allowance for credit losses for assets at amortized cost excluding POCI divided by Stage 3

assets at amortized cost excluding POCI

4. IFRS 9 stage 1 coverage ratio for assets at amortized cost (excluding country risk allowance) is 0.1% and IFRS

9 stage 2 coverage ratio for assets at amortized cost (excluding country risk allowance) is 1.3% as of March

31, 2023

Deutsche Bank

Investor Relations

Q1 2023 results

April 27, 2023

Slide 36 Loan book composition

1. Mainly includes Corporate & Other and Institutional Client Services in the Corporate Bank

2. Other businesses with exposure less than 2% each, including APAC Commercial Real Estate

3. Includes Strategic Corporate Lending and recourse & non-recourse Commercial Real Estate business

Slide 37 Derivatives bridge

1. Excludes real estate and other non-financial instrument collateral

2. Master Netting Agreements allow counterparties with multiple derivative contracts to settle through a single

payment

Slide 39 Level 3 assets and liabilities

1. Issuances include cash amounts paid on the primary issuance of a loan to a borrower

2. Includes other transfers into / out of Level 3, including methodology refinements on opening balance and

mark-to-market adjustments

3. Additional value adjustments deducted from CET1 capital pursuant to Article 34 of Regulation (EU) No.

2019/876 (CRR)

Slide 40- Leverage exposure and risk-weighted assets

1. Excludes any derivatives-related market risk RWA, which have been fully allocated to non-derivatives trading

assets

2. Includes contingent liabilities

Slide 43 - Assets under management - Private Bank

1. Investment Products also include insurances as well as cash positions under discretionary and wealth

advisory mandate in IPB Wealth Management

2. Deposits are considered assets under management if they serve investment purposes; in the Private Bank

Germany (PB GY) and in International Private Bank (IPB) Premium Banking, this includes term- and savings

deposits; in IPB Wealth Management & Bank for Entrepreneurs it is assumed that all customer deposits are

held primarily for investment purposes

3. Net flows also include shifts between deposits and investment products

4. Q4 2022 AuM impacted by a € 15 billion disposal effect after the sale of the Financial Advisors business in

Italy

Slide 44 - Assets under management- Asset Management

1. Average AuM are generally calculated using AuM at the beginning of the period and the end of each calendar

month (e.g. 13 reference points for a full year, 4 reference points for a quarter)

46View entire presentation