J.P.Morgan Results Presentation Deck

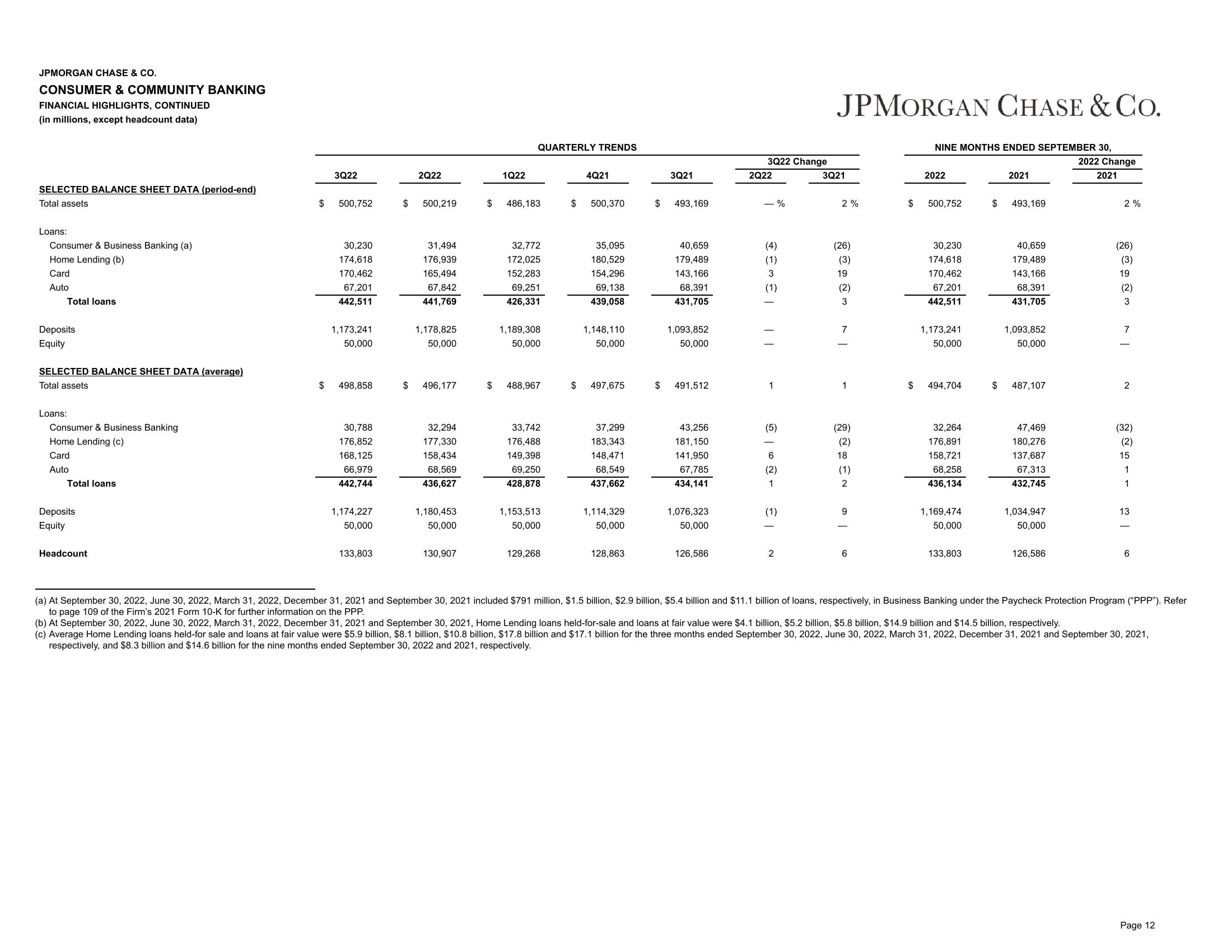

JPMORGAN CHASE & CO.

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except headcount data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Consumer & Business Banking (a)

Home Lending (b)

Card

Auto

Total loans

Deposits

Equity

SELECTED BALANCE SHEET DATA (average)

Total assets

Loans:

Consumer & Business Banking

Home Lending (c)

Card

Auto

Total loans

Deposits

Equity

Headcount

3Q22

$ 500,752

30,230

174,618

170,462

67,201

442,511

1,173,241

50,000

$ 498,858

30,788

176,852

168,125

66,979

442,744

1,174,227

50,000

133,803

$

2Q22

500,219

31,494

176,939

165,494

67,842

441,769

1,178,825

50,000

$ 496,177

32,294

177,330

158,434

68,569

436,627

1,180,453

50,000

130,907

1Q22

QUARTERLY TRENDS

$ 486,183

32,772

172,025

152,283

69,251

426,331

1,189,308

50,000

$ 488,967

33,742

176,488

149,398

69,250

428,878

1,153,513

50,000

129,268

4Q21

$ 500,370

35,095

180,529

154,296

69,138

439,058

1,148,110

50,000

$ 497,675

37,299

183,343

148,471

68,549

437,662

1,114,329

50,000

128,863

$

$

3Q21

493,169

40,659

179,489

143,166

68,391

431,705

1,093,852

50,000

491,512

43,256

181,150

141,950

67,785

434,141

1,076,323

50,000

126,586

3Q22 Change

2Q22

- %

(4)

3

(1)

1

IT

1

(5)

6

(2)

1

(1)

1

2

JPMORGAN CHASE & Co.

3Q21

2%

(26)

(3)

19

(2)

3

7

1

(29)

(2)

18

(1)

2

9

6

$

$

NINE MONTHS ENDED SEPTEMBER 30,

2022

500,752

30,230

174,618

170,462

67,201

442,511

1,173,241

50,000

494,704

32,264

176,891

158,721

68,258

436,134

1,169,474

50,000

133,803

2021

$ 493,169

$

40,659

179,489

143,166

68,391

431,705

1,093,852

50,000

487,107

47,469

180,276

137,687

67,313

432,745

1,034,947

50,000

126,586

2022 Change

2021

2%

(26)

(3)

19

(2)

3

7

2

(32)

(2)

15

1

1

13

6

(a) At September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021 included $791 million, $1.5 billion, $2.9 billion, $5.4 billion and $11.1 billion of loans, respectively, in Business Banking under the Paycheck Protection Program ("PPP"). Refer

to page 109 of the Firm's 2021 Form 10-K for further information on the PPP.

(b) At September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, Home Lending loans held-for-sale and loans at fair value were $4.1 billion, $5.2 billion, $5.8 billion, $14.9 billion and $14.5 billion, respectively.

(c) Average Home Lending loans held-for sale and loans at fair value were $5.9 billion, $8.1 billion, $10.8 billion, $17.8 billion and $17.1 billion for the three months ended September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021,

respectively, and $8.3 billion and $14.6 billion for the nine months ended September 30, 2022 and 2021, respectively.

Page 12View entire presentation