Zegna SPAC Presentation Deck

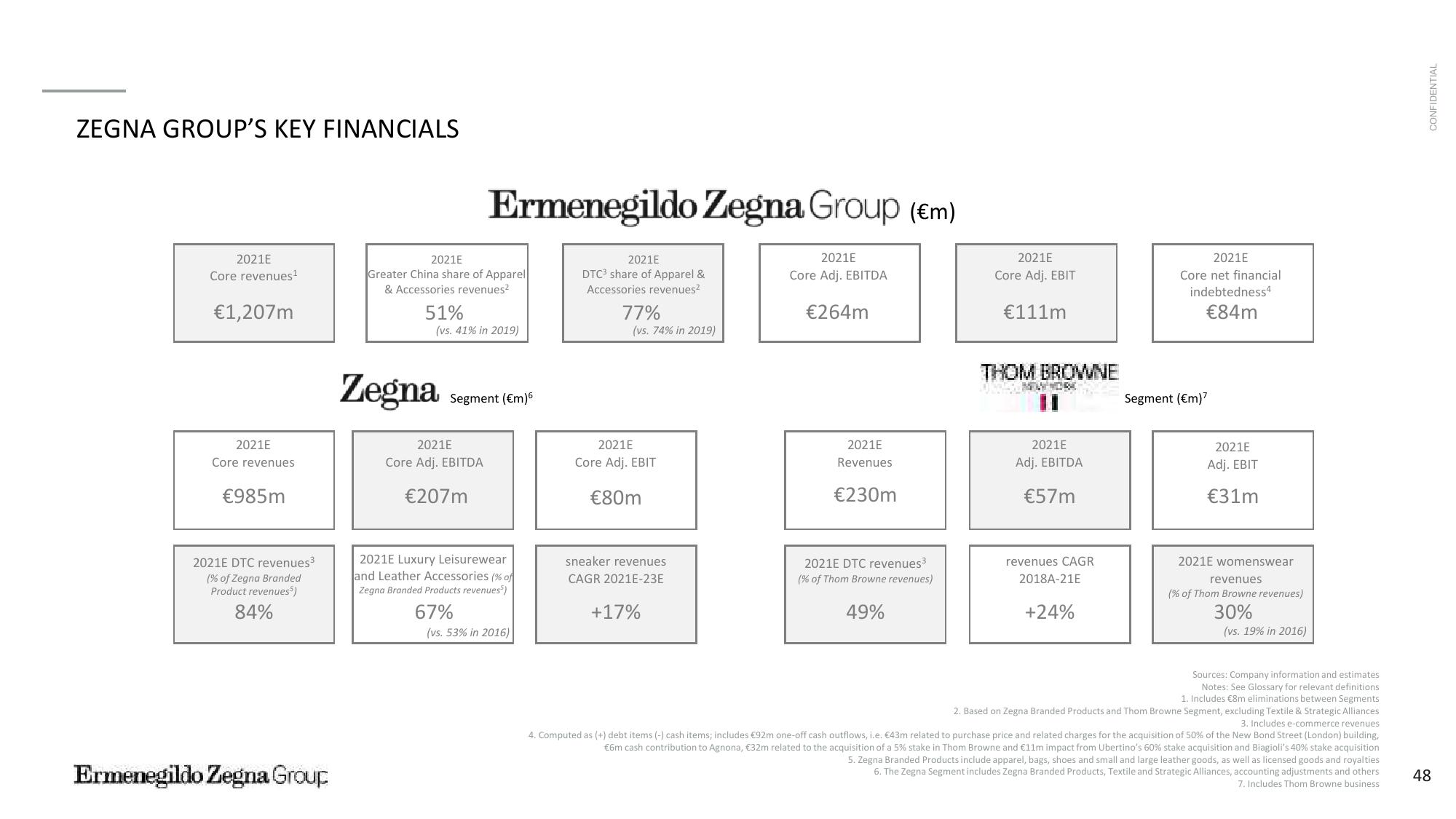

ZEGNA GROUP'S KEY FINANCIALS

2021E

Core revenues¹

€1,207m

2021E

Core revenues

€985m

2021E DTC revenues³

(% of Zegna Branded

Product revenues)

84%

Ermenegildo Zegna Group

2021E

Greater China share of Apparel

& Accessories revenues²

51%

Ermenegildo Zegna Group (em)

(vs. 41% in 2019)

Zegna

Segment (€m)6

2021E

Core Adj. EBITDA

€207m

2021E Luxury Leisurewear

and Leather Accessories (% of

Zegna Branded Products revenues)

67%

(vs. 53% in 2016)

2021E

DTC3 share of Apparel &

Accessories revenues²

77%

(vs. 74% in 2019)

2021E

Core Adj. EBIT

€80m

sneaker revenues

CAGR 2021E-23E

+17%

2021E

Core Adj. EBITDA

€264m

2021E

Revenues

€230m

2021E DTC revenues³

(% of Thom Browne revenues)

49%

2021E

Core Adj. EBIT

€111m

THOM BROWNE

2021E

Adj. EBITDA

€57m

revenues CAGR

2018A-21E

+24%

2021E

Core net financial

indebtedness4

€84m

Segment (€m)7

2021E

Adj. EBIT

€31m

2021E womenswear

revenues

(% of Thom Browne revenues)

30%

(vs. 19% in 2016)

Sources: Company information and estimates

Notes: See Glossary for relevant definitions.

Includes €8m eliminations between Segments

1.

2. Based on Zegna Branded Products and Thom Browne Segment, excluding Textile & Strategic Alliances.

3. Includes e-commerce revenues

4. Computed as (+) debt items (-) cash items; includes €92m one-off cash outflows, i.e. €43m related to purchase price and related charges for the acquisition of 50% of the New Bond Street (London) building,

€6m cash contribution to Agnona, €32m related to the acquisition of a 5% stake in Thom Browne and €11m impact from Ubertino's 60% stake acquisition and Biagioli's 40% stake acquisition

5. Zegna Branded Products include apparel, bags, shoes and small and large leather goods, as well as licensed goods and royalties

6. The Zegna Segment includes Zegna Branded Products, Textile and Strategic Alliances, accounting adjustments and others.

7. Includes Thom Browne business

CONFIDENTIAL

48View entire presentation