Nikola Results Presentation Deck

NIKOLA.

PAGE/13

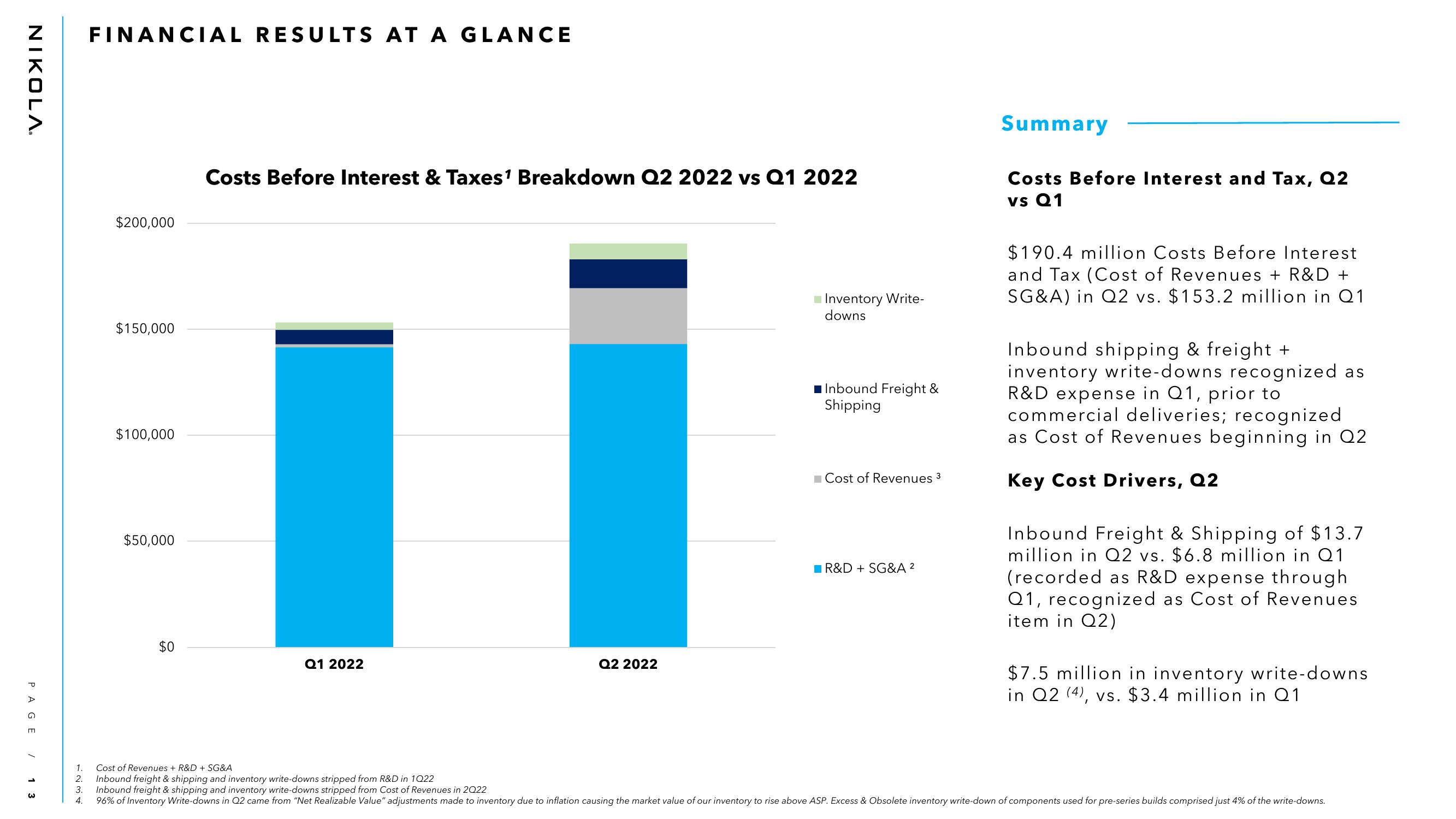

FINANCIAL RESULTS AT A GLANCE

$200,000

$150,000

$100,000

$50,000

$0

Costs Before Interest & Taxes¹ Breakdown Q2 2022 vs Q1 2022

Q1 2022

Q2 2022

Inventory Write-

downs

Inbound Freight &

Shipping

Cost of Revenues 3

R&D + SG&A ²

Summary

Costs Before Interest and Tax, Q2

vs Q1

$190.4 million Costs Before Interest

and Tax (Cost of Revenues + R&D +

SG&A) in Q2 vs. $153.2 million in Q1

Inbound shipping & freight +

inventory write-downs recognized as

R&D expense in Q1, prior to

commercial deliveries; recognized

as Cost of Revenues beginning in Q2

Key Cost Drivers, Q2

Inbound Freight & Shipping of $13.7

million in Q2 vs. $6.8 million in Q1

(recorded as R&D expense through

Q1, recognized as Cost of Revenues

item in Q2)

$7.5 million in inventory write-downs

in Q2 (4), vs. $3.4 million in Q1

1. Cost of Revenues + R&D + SG&A

2. Inbound freight & shipping and inventory write-downs stripped from R&D in 1Q22

3. Inbound freight & shipping and inventory write-downs stripped from Cost of Revenues in 2Q22

4. 96% of Inventory Write-downs in Q2 came from "Net Realizable Value" adjustments made to inventory due to inflation causing the market value of our inventory to rise above ASP. Excess & Obsolete inventory write-down of components used for pre-series builds comprised just 4% of the write-downs.View entire presentation