IGI SPAC Presentation Deck

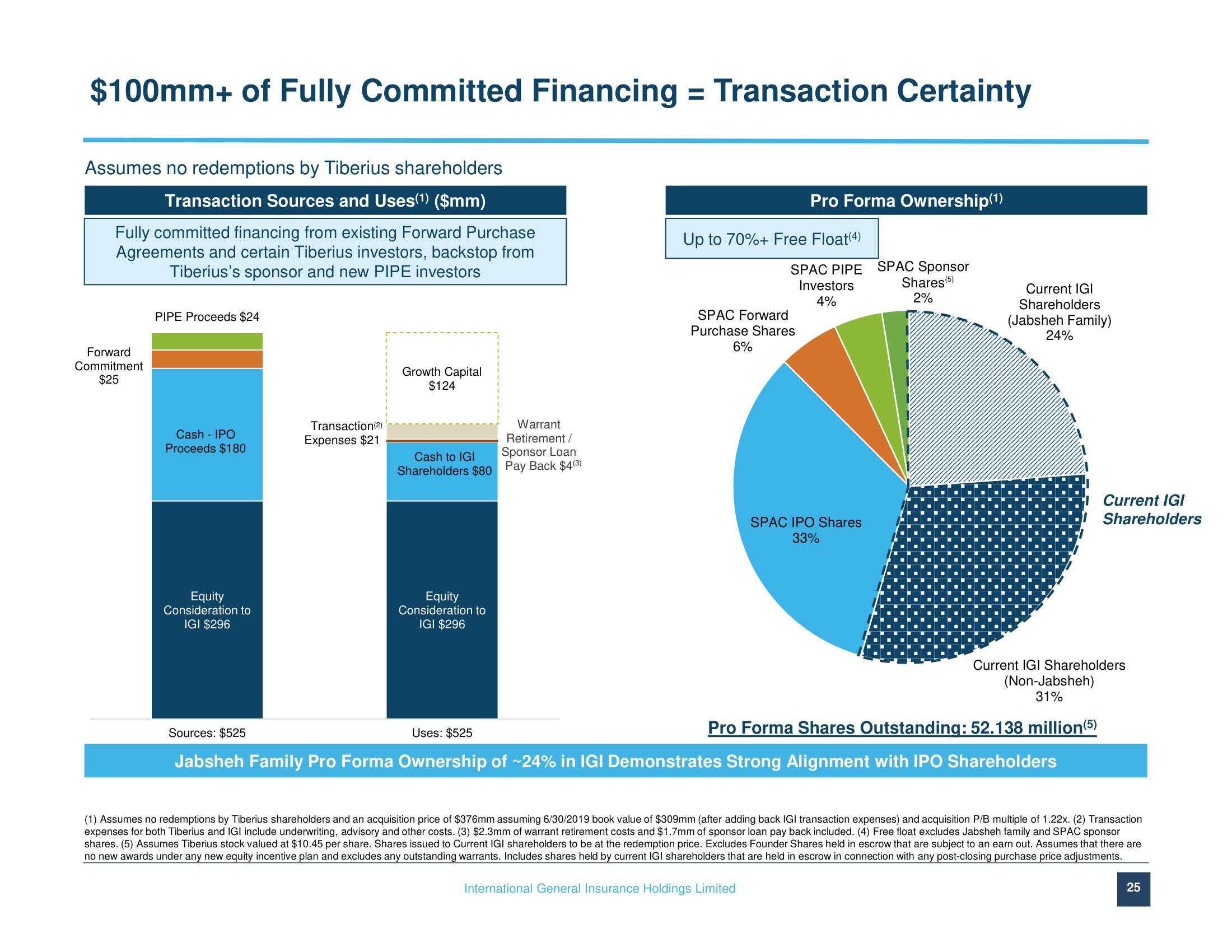

$100mm+ of Fully Committed Financing = Transaction Certainty

Assumes no redemptions by Tiberius shareholders

Transaction Sources and Uses(¹) ($mm)

Fully committed financing from existing Forward Purchase

Agreements and certain Tiberius investors, backstop from

Tiberius's sponsor and new PIPE investors

Forward

Commitment

$25

PIPE Proceeds $24

Cash-IPO

Proceeds $180

Equity

Consideration to

IGI $296

Transaction (2)

Expenses $21

Sources: $525

Growth Capital

$124

Cash to IGI

Shareholders $80

Equity

Consideration to

IGI $296

Warrant

Retirement/

Sponsor Loan

Pay Back $4(3)

Uses: $525

Pro Forma Ownership(¹)

Up to 70%+ Free Float(4)

SPAC PIPE SPAC Sponsor

Investors

Shares (5)

2%

4%

SPAC Forward

Purchase Shares

6%

SPAC IPO Shares

33%

Current IGI

Shareholders

(Jabsheh Family)

24%

Current IGI Shareholders

(Non-Jabsheh)

31%

Pro Forma Shares Outstanding: 52.138 million (5)

Jabsheh Family Pro Forma Ownership of ~24% in IGI Demonstrates Strong Alignment with IPO Shareholders

Current IGI

Shareholders

(1) Assumes no redemptions by Tiberius shareholders and an acquisition price of $376mm assuming 6/30/2019 book value of $309mm (after adding back IGI transaction expenses) and acquisition P/B multiple of 1.22x. (2) Transaction

expenses for both Tiberius and IGI include underwriting, advisory and other costs. (3) $2.3mm of warrant retirement costs and $1.7mm of sponsor loan pay back included. (4) Free float excludes Jabsheh family and SPAC sponsor

shares. (5) Assumes Tiberius stock valued at $10.45 per share. Shares issued to Current IGI shareholders to be at the redemption price. Excludes Founder Shares held in escrow that are subject to an earn out. Assumes that there are

no new awards under any new equity incentive plan and excludes any outstanding warrants. Includes shares held by current IGI shareholders that are held in escrow in connection with any post-closing purchase price adjustments.

International General Insurance Holdings Limited

25View entire presentation