Allwyn Investor Update

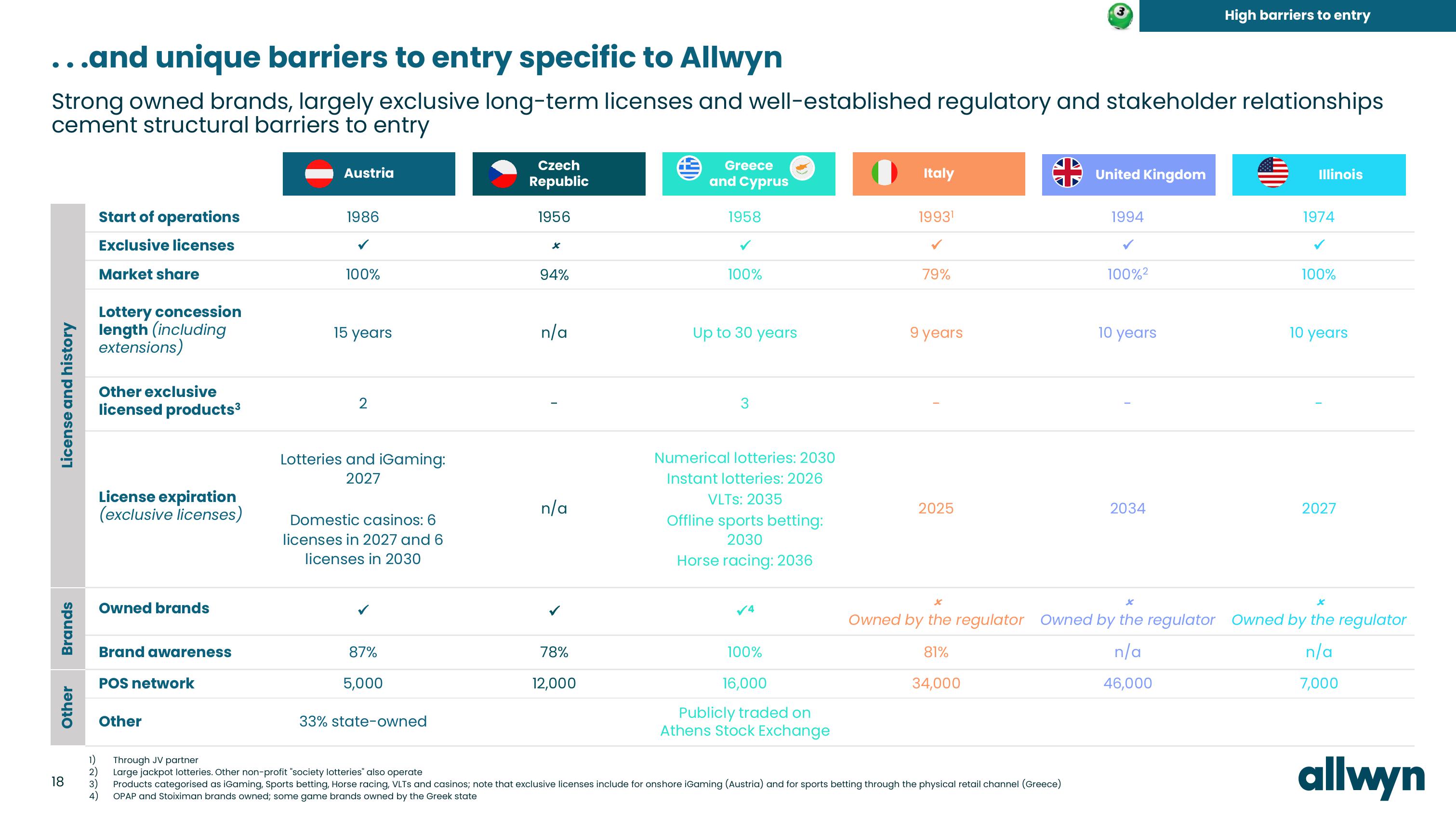

...and unique barriers to entry specific to Allwyn

Strong owned brands, largely exclusive long-term licenses and well-established regulatory and stakeholder relationships

cement structural barriers to entry

License and history

Brands

Other

18

Start of operations

Exclusive licenses

Market share

Lottery concession

length (including

extensions)

Other exclusive

licensed products³

License expiration

(exclusive licenses)

Owned brands

Brand awareness

POS network

Other

Austria

1986

100%

15 years

2

Lotteries and iGaming:

2027

Domestic casinos: 6

licenses in 2027 and 6

licenses in 2030

87%

5,000

33% state-owned

Czech

Republic

1956

94%

n/a

I

n/a

78%

12,000

Greece

and Cyprus

1958

100%

Up to 30 years

3

Numerical lotteries: 2030

Instant lotteries: 2026

VLTS: 2035

Offline sports betting:

2030

Horse racing: 2036

✓4

100%

16,000

Publicly traded on

Athens Stock Exchange

Italy

1993¹

79%

9 years

2025

United Kingdom

1) Through JV partner

2)

Large jackpot lotteries. Other non-profit "society lotteries" also operate

3)

Products categorised as iGaming, Sports betting, Horse racing, VLTS and casinos; note that exclusive licenses include for onshore iGaming (Austria) and for sports betting through the physical retail channel (Greece)

OPAP and Stoiximan brands owned; some game brands owned by the Greek state

4)

1994

100%²

10 years

]

High barriers to entry

2034

Illinois

1974

100%

10 years

2027

Owned by the regulator Owned by the regulator Owned by the regulator

81%

n/a

n/a

7,000

34,000

46,000

allwynView entire presentation