First Merchants Investor Presentation Deck

Loan Portfolio Insights (continued)

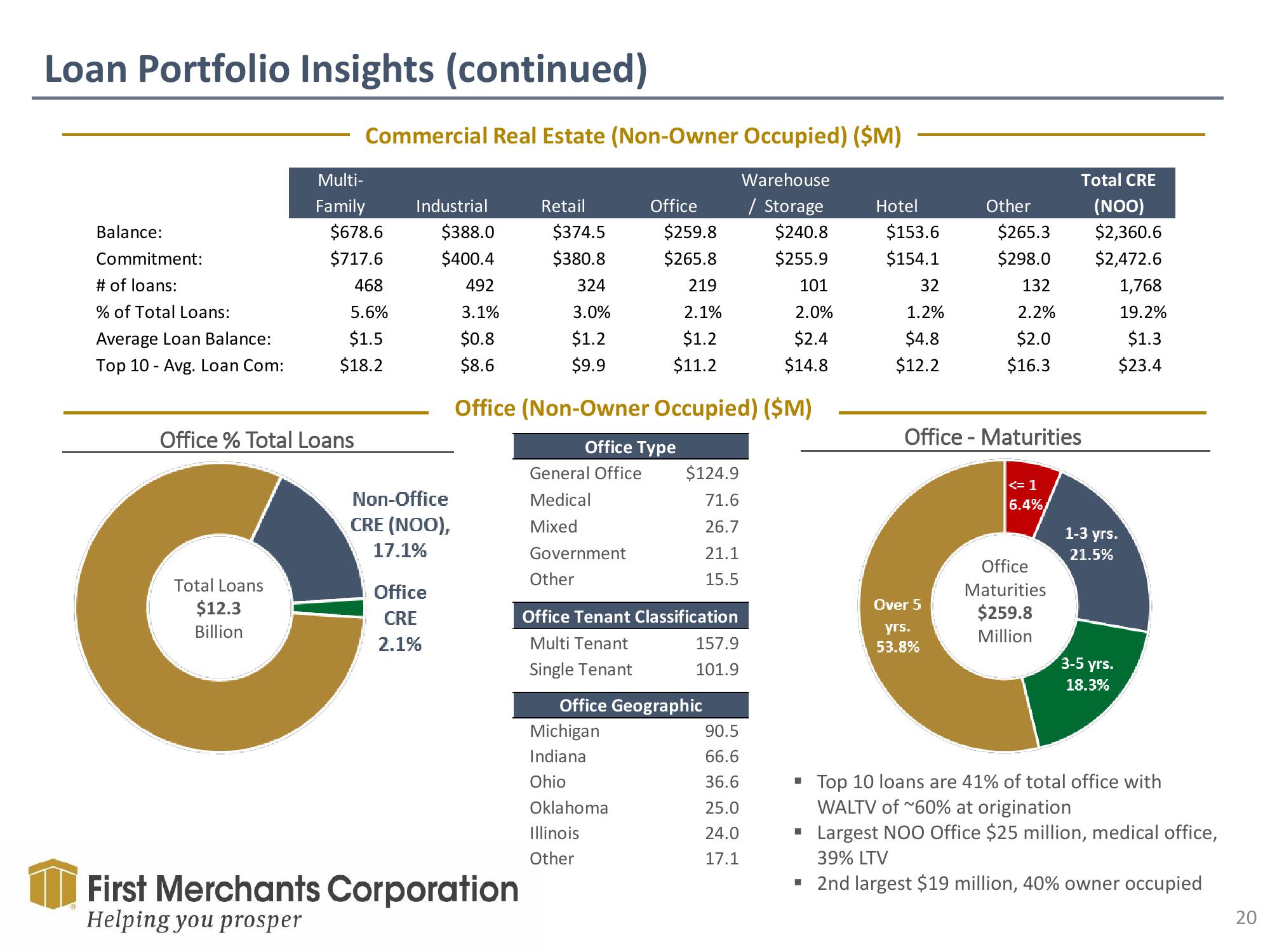

Balance:

Commitment:

# of loans:

% of Total Loans:

Average Loan Balance:

Top 10 Avg. Loan Com:

Total Loans

$12.3

Billion

Commercial Real Estate (Non-Owner Occupied) ($M)

Multi-

Family

Office % Total Loans

$678.6

$717.6

468

5.6%

$1.5

$18.2

Industrial

$388.0

$374.5

$259.8

$400.4

$380.8

$265.8

492

324

219

3.1%

3.0%

2.1%

$0.8

$1.2

$1.2

$8.6

$9.9

$11.2

Office (Non-Owner Occupied) ($M)

Office Type

Non-Office

CRE (NOO),

17.1%

Office

CRE

2.1%

First Merchants Corporation

Helping you prosper

Retail

Office

General Office

Medical

Mixed

Government

Other

Office Tenant Classification

Multi Tenant

Single Tenant

Michigan

Indiana

Ohio

$124.9

71.6

26.7

21.1

15.5

Oklahoma

Illinois

Other

Office Geographic

157.9

101.9

Warehouse

/ Storage

$240.8

$255.9

101

2.0%

$2.4

$14.8

90.5

66.6

36.6

25.0

24.0

17.1

Hotel

$153.6

$154.1

32

1.2%

$4.8

$12.2

Other

Over 5

yrs.

53.8%

$265.3

$298.0

132

2.2%

$2.0

$16.3

Office - Maturities

<= 1

6.4%

Total CRE

(NOO)

$2,360.6

$2,472.6

Office

Maturities

$259.8

Million

1,768

19.2%

$1.3

$23.4

1-3 yrs.

21.5%

3-5 yrs.

18.3%

▪ Top 10 loans are 41% of total office with

WALTV of ~60% at origination

Largest NOO Office $25 million, medical office,

39% LTV

▪ 2nd largest $19 million, 40% owner occupied

20View entire presentation