Apollo Global Management Investor Day Presentation Deck

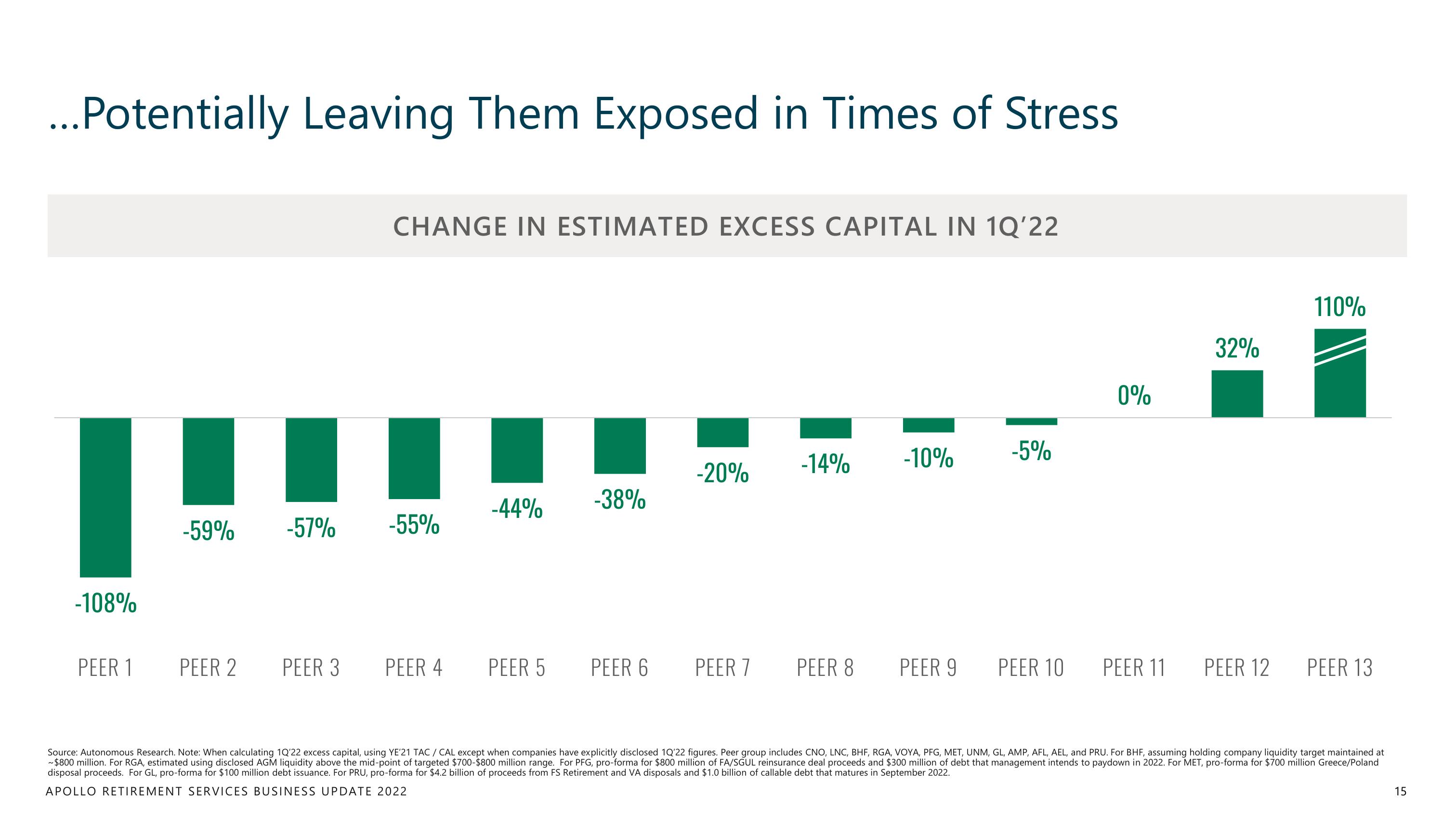

...Potentially Leaving Them Exposed in Times of Stress

-108%

PEER 1

-59%

PEER 2

-57%

PEER 3

CHANGE IN ESTIMATED EXCESS CAPITAL IN 1Q'22

-55%

PEER 4

-44%

PEER 5

-38%

PEER 6

-20%

PEER 7

-14% -10%

PEER 8

PEER 9

-5%

PEER 10

0%

PEER 11

32%

PEER 12

110%

PEER 13

Source: Autonomous Research. Note: When calculating 1Q'22 excess capital, using YE'21 TAC / CAL except when companies have explicitly disclosed 1Q'22 figures. Peer group includes CNO, LNC, BHF, RGA, VOYA, PFG, MET, UNM, GL, AMP, AFL, AEL, and PRU. For BHF, assuming holding company liquidity target maintained at

~$800 million. For RGA, estimated using disclosed AGM liquidity above the mid-point of targeted $700-$800 million range. For PFG, pro-forma for $800 million of FA/SGUL reinsurance deal proceeds and $300 million of debt that management intends to paydown in 2022. For MET, pro-forma for $700 million Greece/Poland

disposal proceeds. For GL, pro-forma for $100 million debt issuance. For PRU, pro-forma for $4.2 billion of proceeds from FS Retirement and VA disposals and $1.0 billion of callable debt that matures in September 2022.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

15View entire presentation