Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

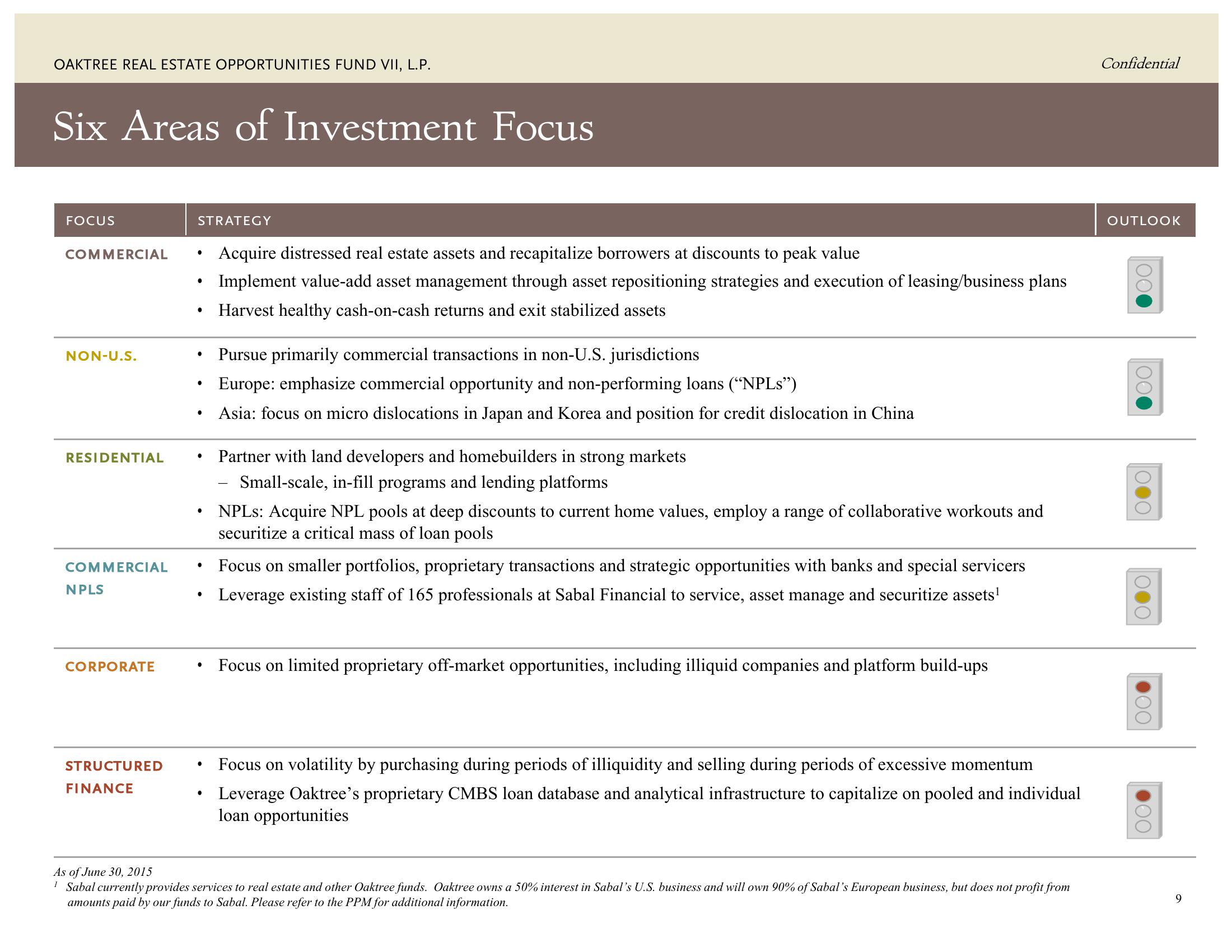

Six Areas of Investment Focus

FOCUS

COMMERCIAL

NON-U.S.

RESIDENTIAL

COMMERCIAL

NPLS

CORPORATE

STRUCTURED

FINANCE

STRATEGY

●

●

●

●

●

●

●

●

●

Acquire distressed real estate assets and recapitalize borrowers at discounts to peak value

Implement value-add asset management through asset repositioning strategies and execution of leasing/business plans

Harvest healthy cash-on-cash returns and exit stabilized assets

Pursue primarily commercial transactions in non-U.S. jurisdictions

Europe: emphasize commercial opportunity and non-performing loans ("NPLs")

Asia: focus on micro dislocations in Japan and Korea and position for credit dislocation in China

Partner with land developers and homebuilders in strong markets

Small-scale, in-fill programs and lending platforms

NPLs: Acquire NPL pools at deep discounts to current home values, employ a range of collaborative workouts and

securitize a critical mass of loan pools

Focus on smaller portfolios, proprietary transactions and strategic opportunities with banks and special servicers

Leverage existing staff of 165 professionals at Sabal Financial to service, asset manage and securitize assets¹

Focus on limited proprietary off-market opportunities, including illiquid companies and platform build-ups

Focus on volatility by purchasing during periods of illiquidity and selling during periods of excessive momentum

Leverage Oaktree's proprietary CMBS loan database and analytical infrastructure to capitalize on pooled and individual

loan opportunities

As of June 30, 2015

1 Sabal currently provides services to real estate and other Oaktree funds. Oaktree owns a 50% interest in Sabal's U.S. business and will own 90% of Sabal's European business, but does not profit from

amounts paid by our funds to Sabal. Please refer to the PPM for additional information.

Confidential

OUTLOOK

00

OO

OOO

1000

00

OO

9View entire presentation