Grove SPAC Presentation Deck

Notes:

I.

2.

MASON ∞

5.

7.

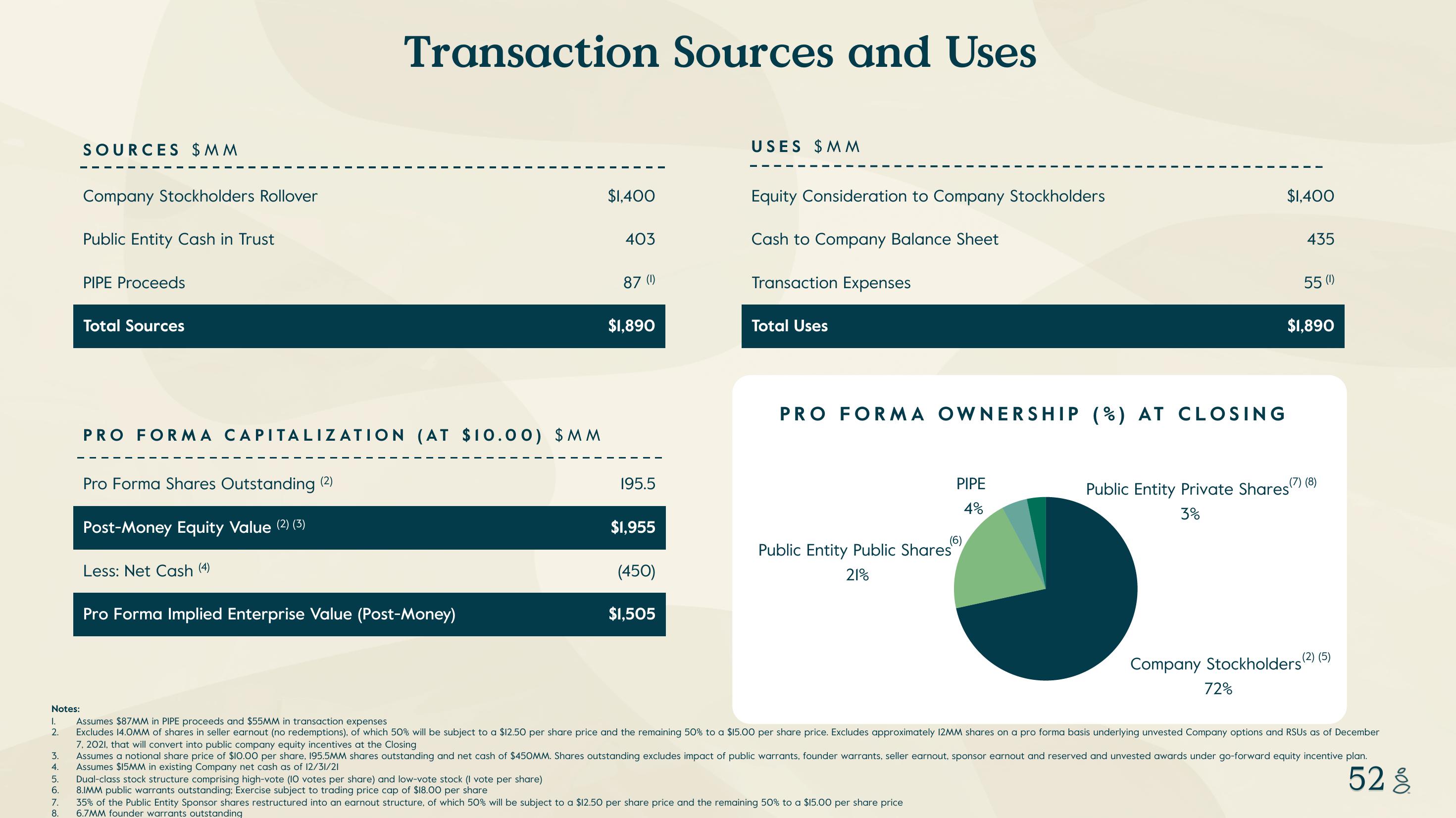

SOURCES $MM

8.

Company Stockholders Rollover

Public Entity Cash in Trust

PIPE Proceeds

Total Sources

Transaction Sources and Uses

PRO FORMA CAPITALIZATION (AT $10.00) $MM

Pro Forma Shares Outstanding (2)

Post-Money Equity Value (2) (3)

Less: Net Cash (4)

Pro Forma Implied Enterprise Value (Post-Money)

$1,400

403

87 (1)

$1,890

195.5

$1,955

(450)

$1,505

USES $MM

Equity Consideration to Company Stockholders

Cash to Company Balance Sheet

Transaction Expenses

Total Uses

PRO FORMA OWNERSHIP (%) AT CLOSING

PIPE

4%

(6)

Public Entity Public Shares

21%

35% of the Public Entity Sponsor shares restructured into an earnout structure, of which 50% will be subject to a $12.50 per share price and the remaining 50% to a $15.00 per share price

6.7MM founder warrants outstanding

$1,400

435

72%

Assumes $87MM in PIPE proceeds and $55MM in transaction expenses

Excludes 14.0MM of shares in seller earnout (no redemptions), of which 50% will be subject to a $12.50 per share price and the remaining 50% to a $15.00 per share price. Excludes approximately 12MM shares on a pro forma basis underlying unvested Company options and RSUS as of December

7, 2021, that will convert into public company equity incentives at the Closing

3. Assumes a notional share price of $10.00 per share, 195.5MM shares outstanding and net cash of $450MM. Shares outstanding excludes impact of public warrants, founder warrants, seller earnout, sponsor earnout and reserved and unvested awards under go-forward equity incentive plan.

4. Assumes $15MM in existing Company net cash as of 12/31/21

52 8

Dual-class stock structure comprising high-vote (10 votes per share) and low-vote stock (1 vote per share)

6. 8.IMM public warrants outstanding; Exercise subject to trading price cap of $18.00 per share

55 (1)

$1,890

Public Entity Private Shares(7) (8)

3%

Company Stockholders (2) (5)View entire presentation