Pershing Square Activist Presentation Deck

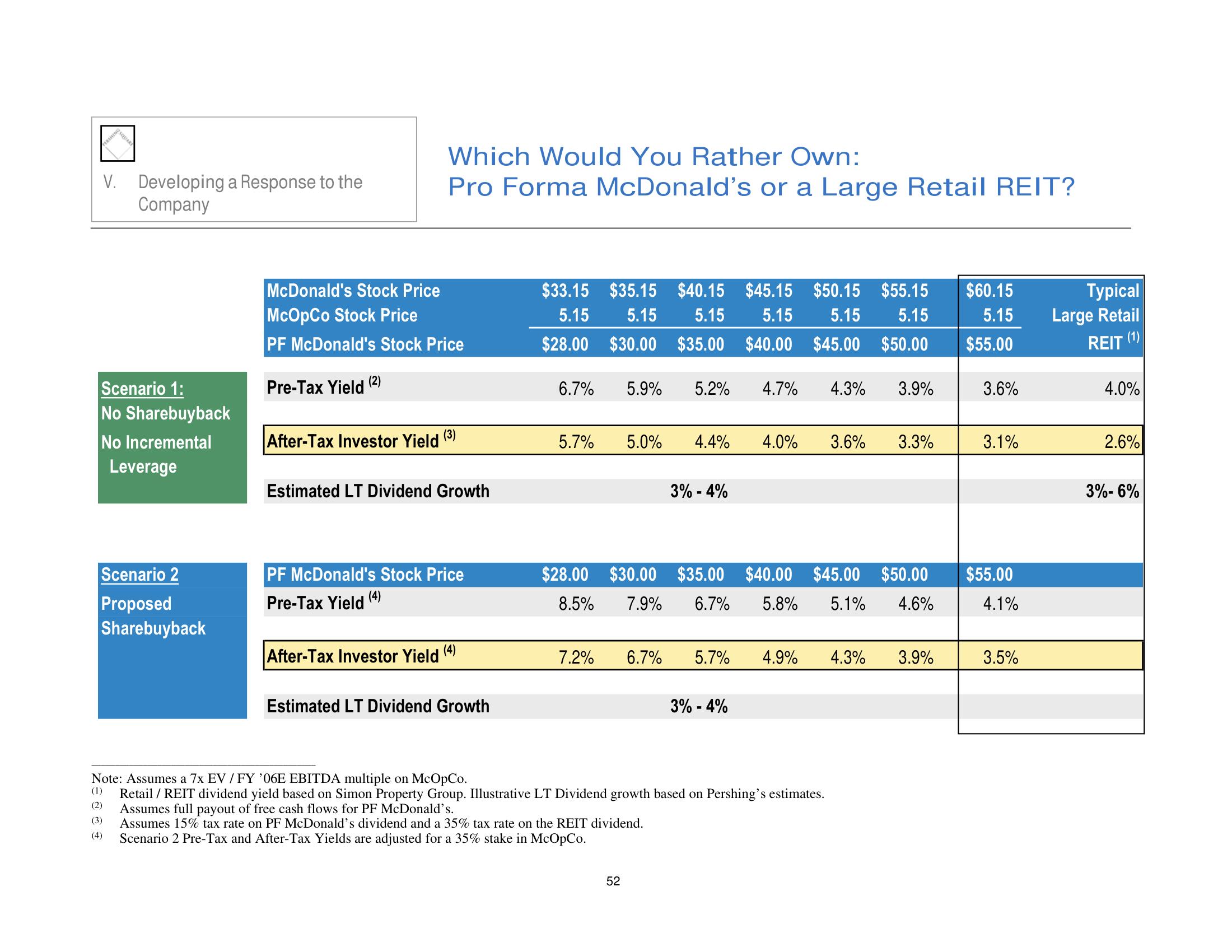

V. Developing a Response to the

Company

Scenario 1:

No Sharebuyback

No Incremental

Leverage

Scenario 2

Proposed

Sharebuyback

McDonald's Stock Price

McOpCo Stock Price

PF McDonald's Stock Price

Pre-Tax Yield

Which Would You Rather Own:

Pro Forma McDonald's or a Large Retail REIT?

(2)

After-Tax Investor Yield (3)

Estimated LT Dividend Growth

PF McDonald's Stock Price

Pre-Tax Yield (4)

After-Tax Investor Yield (4)

Estimated LT Dividend Growth

$33.15

$35.15 $40.15 $45.15 $50.15 $55.15 $60.15

5.15 5.15 5.15 5.15 5.15 5.15

5.15

$28.00 $30.00 $35.00 $40.00 $45.00 $50.00

$55.00

6.7% 5.9% 5.2% 4.7% 4.3%

5.7% 5.0% 4.4% 4.0% 3.6% 3.3%

7.2%

3% -4%

$28.00 $30.00 $35.00 $40.00 $45.00 $50.00

8.5% 7.9% 6.7% 5.8% 5.1% 4.6%

52

3.9%

6.7% 5.7% 4.9% 4.3% 3.9%

3% -4%

Note: Assumes a 7x EV/FY '06E EBITDA multiple on McOpCo.

(1) Retail / REIT dividend yield based on Simon Property Group. Illustrative LT Dividend growth based on Pershing's estimates.

Assumes full payout of free cash flows for PF McDonald's.

(2)

(3)

Assumes 15% tax rate on PF McDonald's dividend and a 35% tax rate on the REIT dividend.

(4)

Scenario 2 Pre-Tax and After-Tax Yields are adjusted for a 35% stake in McOpCo.

3.6%

3.1%

$55.00

4.1%

3.5%

Typical

Large Retail

REIT

(1)

4.0%

2.6%

3%- 6%View entire presentation