Main Street Capital Fixed Income Presentation Deck

Interest Rate Impact and Sensitivity

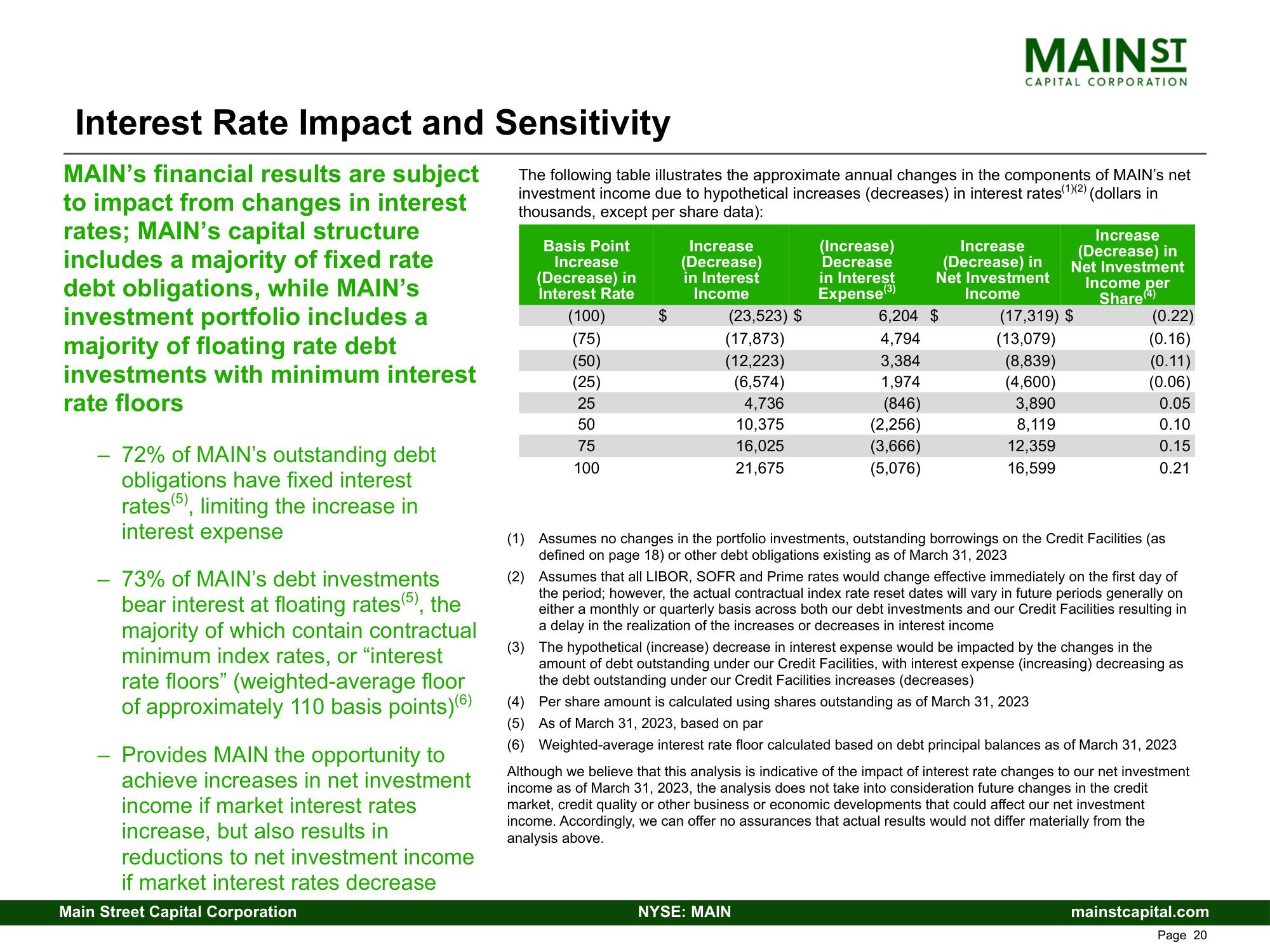

MAIN's financial results are subject

to impact from changes in interest

rates; MAIN's capital structure

includes a majority of fixed rate

debt obligations, while MAIN's

investment portfolio includes a

majority of floating rate debt

investments with minimum interest

rate floors

- 72% of MAIN's outstanding debt

obligations have fixed interest

rates(5), limiting the increase in

interest expense

- 73% of MAIN's debt investments

bear interest at floating rates(5), the

majority of which contain contractual

minimum index rates, or "interest

rate floors" (weighted-average floor

of approximately 110 basis points)(6)

- Provides MAIN the opportunity to

achieve increases in net investment

income if market interest rates

increase, but also results in

reductions to net investment income

if market interest rates decrease

Main Street Capital Corporation

Basis Point

Increase

(Decrease) in

Interes

The following table illustrates the approximate annual changes in the components of MAIN's net

investment income due to hypothetical increases (decreases) in interest rates(1)(2) (dollars in

thousands, except per share data):

(100)

(75)

(50)

(25)

25

50

75

100

$

Increase

(Decrease)

in Interest

come

(23,523) $

(17,873)

(12,223)

(6,574)

4,736

10,375

16,025

21,675

(Increase)

Decrease

in Interest

Expense (3)

MAIN ST

NYSE: MAIN

CAPITAL CORPORATION

6,204 $

4,794

3,384

1,974

(846)

(2,256)

(3,666)

(5,076)

Increase

(Decrease) in

Net Investment

Income

Increase

(Decrease) in

Net Investment

Income per

Share (4)

(17,319) $

(13,079)

(8,839)

(4,600)

3,890

8,119

12,359

16,599

(0.22)

(0.16)

(0.11)

(0.06)

0.05

0.10

0.15

0.21

(1) Assumes no changes in the portfolio investments, outstanding borrowings on the Credit Facilities (as

defined on page 18) or other debt obligations existing as March 31, 2023

(2)

Assumes that all LIBOR, SOFR and Prime rates would change effective immediately on the first day of

the period; however, the actual contractual index rate reset dates will vary in future periods generally on

either a monthly or quarterly basis across both our debt investments and our Credit Facilities resulting in

a delay in the realization of the increases or decreases in interest income

(3) The hypothetical (increase) decrease in interest expense would be impacted by the changes in the

amount of debt outstanding under our Credit Facilities, with interest expense (increasing) decreasing as

the debt outstanding under our Credit Facilities increases (decreases)

(4) Per share amount is calculated using shares outstanding as of March 31, 2023

(5) As of March 31, 2023, based on par

(6) Weighted-average interest rate floor calculated based on debt principal balances as of March 31, 2023

Although we believe that this analysis is indicative of the impact of interest rate changes to our net investment

income as of March 31, 2023, the analysis does not take into consideration future changes in the credit

market, credit quality or other business or economic developments that could affect our net investment

income. Accordingly, we can offer no assurances that actual results would not differ materially from the

analysis above.

mainstcapital.com

Page 20View entire presentation