Kinnevik Results Presentation Deck

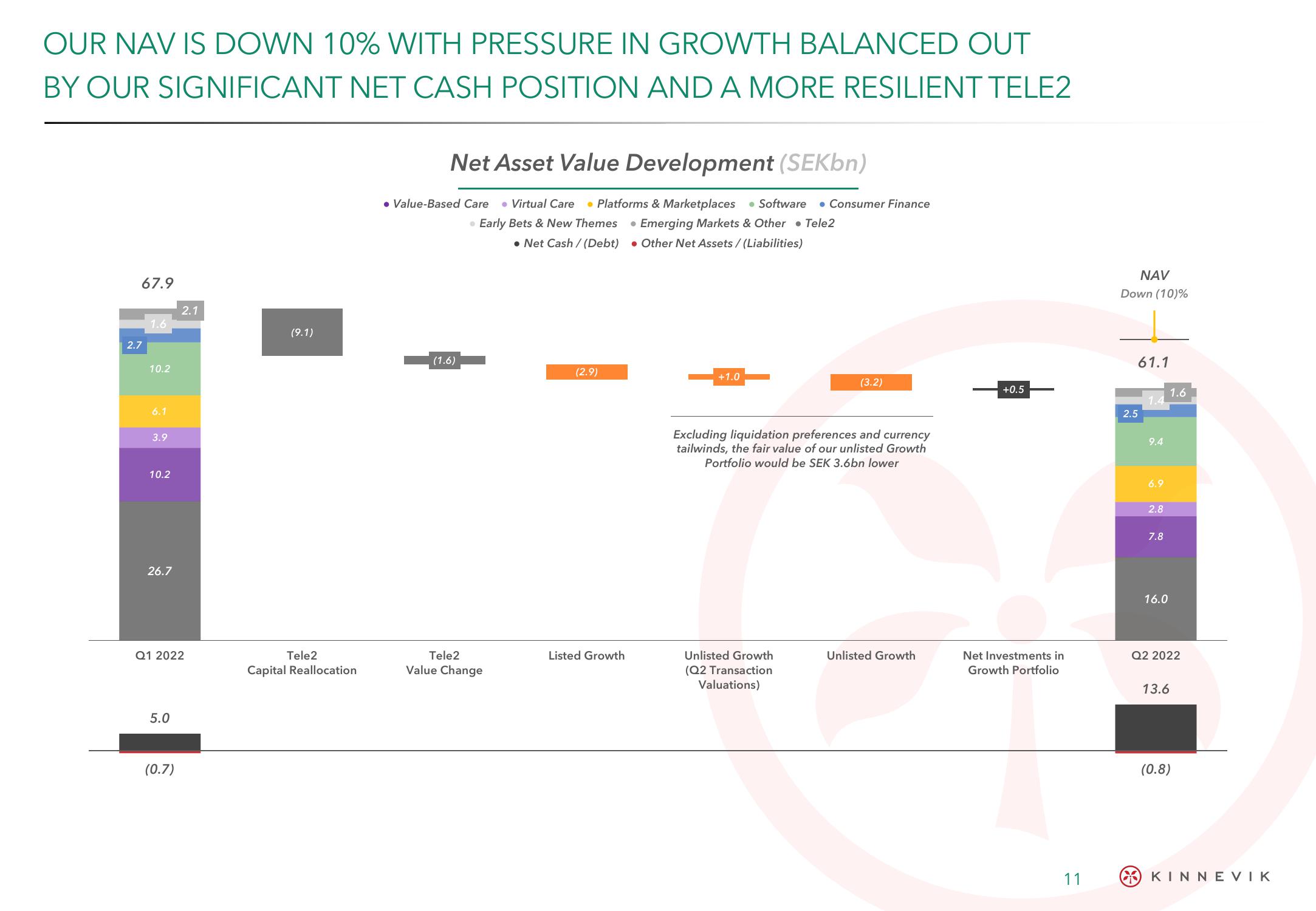

OUR NAV IS DOWN 10% WITH PRESSURE IN GROWTH BALANCED OUT

BY OUR SIGNIFICANT NET CASH POSITION AND A MORE RESILIENT TELE2

67.9

2.7

1.6

10.2

6.1

3.9

10.2

26.7

Q1 2022

5.0

2.1

(0.7)

(9.1)

Tele2

Capital Reallocation

Net Asset Value Development (SEKbn)

● Value-Based Care • Virtual Care • Platforms & Marketplaces • Software . Consumer Finance

• Early Bets & New Themes • Emerging Markets & Other Tele2

.Net Cash/(Debt) • Other Net Assets/(Liabilities)

(1.6)

Tele2

Value Change

(2.9)

Listed Growth

+1.0

(3.2)

Excluding liquidation preferences and currency

tailwinds, the fair value of our unlisted Growth

Portfolio would be SEK 3.6bn lower

Unlisted Growth

(Q2 Transaction

Valuations)

Unlisted Growth

+0.5

Net Investments in

Growth Portfolio

11

NAV

Down (10)%

61.1

2.5

1.4

9.4

6.9

2.8

7.8

16.0

1.6

Q2 2022

13.6

(0.8)

KINNEVIKView entire presentation