Matson Investor Presentation Deck

15

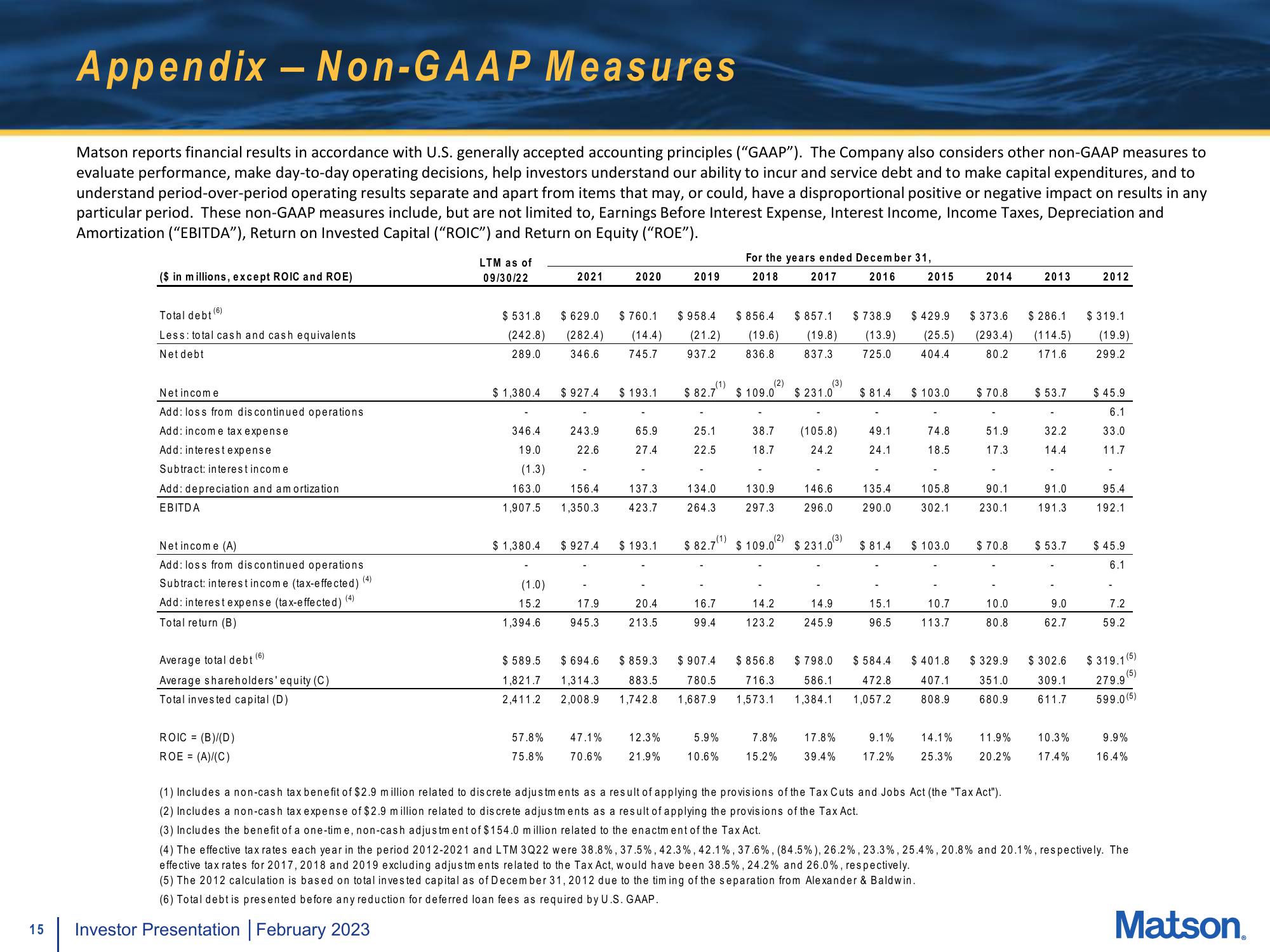

Appendix -Non-GAAP Measures

Matson reports financial results in accordance with U.S. generally accepted accounting principles ("GAAP"). The Company also considers other non-GAAP measures to

evaluate performance, make day-to-day operating decisions, help investors understand our ability to incur and service debt and to make capital expenditures, and to

understand period-over-period operating results separate and apart from items that may, or could, have a disproportional positive or negative impact on results in any

particular period. These non-GAAP measures include, but are not limited to, Earnings Before Interest Expense, Interest Income, Income Taxes, Depreciation and

Amortization ("EBITDA"), Return on Invested Capital ("ROIC") and Return on Equity ("ROE").

($ in millions, except ROIC and ROE)

(6)

Total debt

Less: total cash and cash equivalents

Net debt.

Net income

Add: loss from discontinued operations

Add: income tax expense

Add: interestexpense

Subtract: interest income

Add: depreciation and amortization

EBITDA

Net income (A)

Add: loss from discontinued operations

Subtract: interest income (tax-effected)

Add: interest expense (tax-effected)

Total return (B)

Average total debt

+ (6)

Average shareholders' equity (C)

Total invested capital (D)

ROIC = (B)/(D)

ROE = (A)/(C)

(4)

(4)

LTM as of

09/30/22

Investor Presentation | February 2023

$531.8 $ 629.0

(242.8) (282.4)

289.0 346.6

$ 1,380.4

346.4

19.0

(1.3)

163.0

1,907.5

$ 1,380.4

(1.0)

15.2

1,394.6

2021

57.8%

75.8%

$927.4

243.9

22.6

156.4

1,350.3

17.9

945.3

2020

$ 760.1

(14.4)

745.7

47.1%

70.6%

$ 193.1

65.9

27.4

$927.4 $ 193.1

137.3

423.7

20.4

213.5

2019

12.3%

21.9%

$958.4 $856.4

(21.2) (19.6)

937.2 836.8

25.1

22.5

(1)

$ 82.7 $ 109.0

134.0

264.3

For the years ended December 31,

2018 2017

2016

16.7

99.4

(2)

5.9%

10.6%

38.7

18.7

130.9

297.3

14.2

123.2

$857.1 $ 738.9 $ 429.9

(19.8) (13.9) (25.5)

837.3 725.0 404.4

(3)

$ 82.7¹) $109.02) $231.0(3)

7.8%

15.2%

$231.0

(105.8)

24.2

146.6

296.0

14.9

245.9

$81.4

17.8%

39.4%

49.1

24.1

135.4

290.0

$81.4

2015

15.1

96.5

$ 589.5 $694.6 $859.3 $907.4 $856.8 $798.0 $584.4 $401.8

1,821.7 1,314.3 883.5 780.5 716.3 586.1 472.8 407.1

2,411.2 2,008.9 1,742.8 1,687.9 1,573.1 1,384.1 1,057.2 808.9

$ 103.0

74.8

18.5

105.8

302.1

$103.0

10.7

113.7

2014

$ 373.6

(293.4)

80.2

$70.8

51.9

17.3

90.1

230.1

$70.8

10.0

80.8

$329.9

351.0

680.9

9.1%

14.1%

11.9%

17.2% 25.3% 20.2%

2013

$286.1 $319.1

(114.5) (19.9)

171.6 299.2

$53.7

32.2

14.4

91.0

191.3

$53.7

9.0

62.7

$302.6

309.1

611.7

2012

10.3%

17.4%

$45.9

6.1

33.0

11.7

95.4

192.1

$45.9

6.1

7.2

59.2

$319.1 (5)

(5)

279.9

599.0 (5)

9.9%

16.4%

(1) Includes a non-cash tax benefit of $2.9 million related to discrete adjustments as a result of applying the provisions of the Tax Cuts and Jobs Act (the "Tax Act").

(2) Includes a non-cash tax expense of $2.9 million related to discrete adjustments as a result of applying the provisions of the Tax Act.

(3) Includes the benefit of a one-time, non-cash adjustment of $154.0 million related to the enactment of the Tax Act.

(4) The effective tax rates each year in the period 2012-2021 and LTM 3Q22 were 38.8%, 37.5%, 42.3%, 42.1%, 37.6%, (84.5%), 26.2%, 23.3%, 25.4%, 20.8% and 20.1%, respectively. The

effective tax rates for 2017, 2018 and 2019 excluding adjustments related to the Tax Act, would have been 38.5%, 24.2% and 26.0%, respectively.

(5) The 2012 calculation is based on total invested capital as of December 31, 2012 due to the timing of the separation from Alexander & Baldwin.

(6) Total debt is presented before any reduction for deferred loan fees as required by U.S. GAAP.

Matson.View entire presentation