J.P.Morgan ESG Presentation Deck

E

New Sector Targets

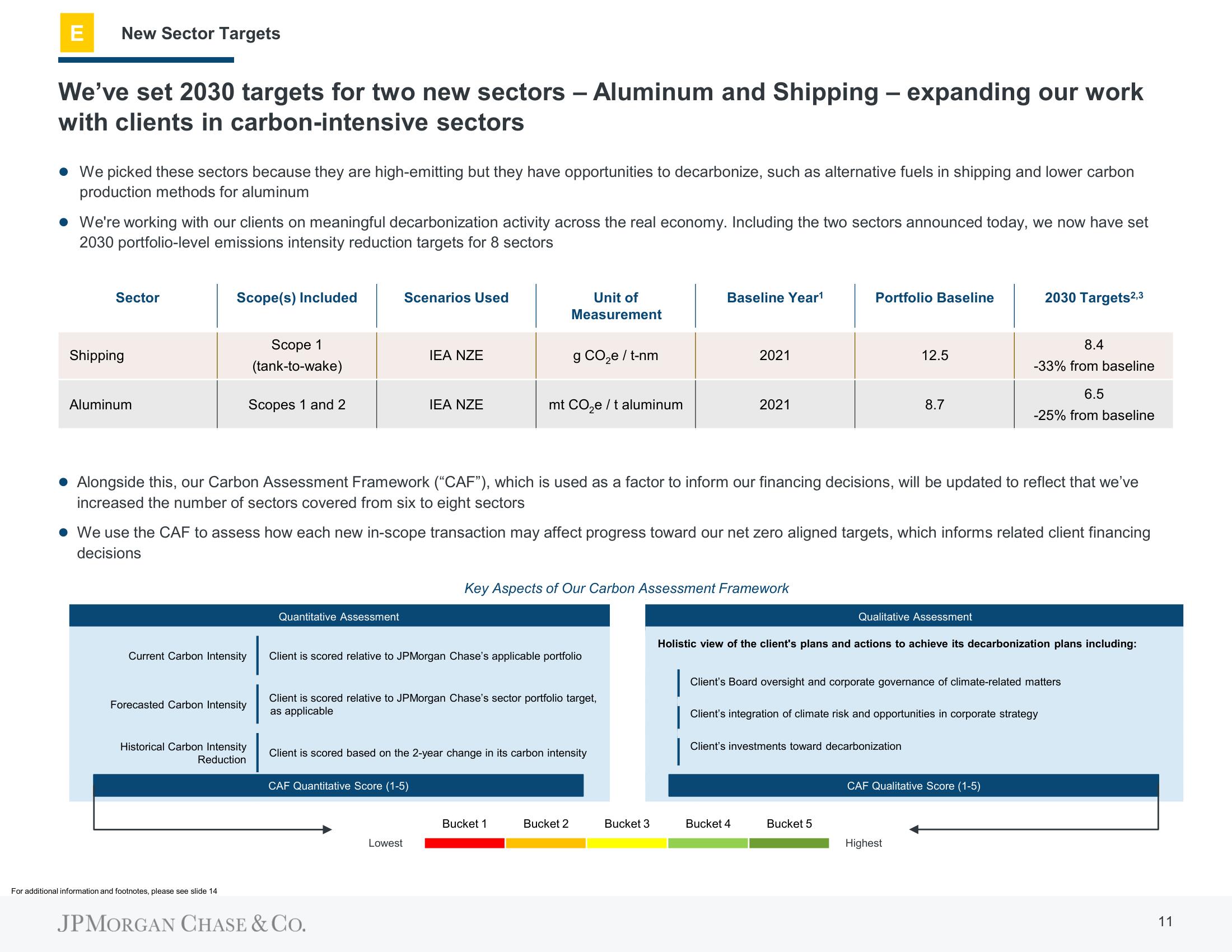

We've set 2030 targets for two new sectors - Aluminum and Shipping - expanding our work

with clients in carbon-intensive sectors

. We picked these sectors because they are high-emitting but they have opportunities to decarbonize, such as alternative fuels in shipping and lower carbon

production methods for aluminum

• We're working with our clients on meaningful decarbonization activity across the real economy. Including the two sectors announced today, we now have set

2030 portfolio-level emissions intensity reduction targets for 8 sectors

Sector

Shipping

Aluminum

Scope(s) Included

Scope 1

(tank-to-wake)

Scopes 1 and 2

Current Carbon Intensity

Forecasted Carbon Intensity

Historical Carbon Intensity

Reduction

For additional information and footnotes, please see slide 14

Quantitative Assessment

Scenarios Used

IEA NZE

IEA NZE

CAF Quantitative Score (1-5)

JPMORGAN CHASE & CO.

Lowest

Unit of

Measurement

g CO₂e / t-nm

mt CO₂e / t aluminum

Alongside this, our Carbon Assessment Framework ("CAF"), which is used as a factor to inform our financing decisions, will be updated to reflect that we've

increased the number of sectors covered from six to eight sectors

Client is scored relative to JPMorgan Chase's applicable portfolio

• We use the CAF to assess how each new in-scope transaction may affect progress toward our net zero aligned targets, which informs related client financing

decisions

Client is scored relative to JPMorgan Chase's sector portfolio target,

as applicable

Client is scored based on the 2-year change in its carbon intensity

Bucket 1

Key Aspects of Our Carbon Assessment Framework

Bucket 2

Baseline Year¹

2021

Bucket 3

2021

Portfolio Baseline

Bucket 4

12.5

8.7

Client's investments toward decarbonization

Bucket 5

Qualitative Assessment

Holistic view of the client's plans and actions to achieve its decarbonization plans including:

2030 Targets2,3

Client's Board oversight and corporate governance of climate-related matters

Client's integration of climate risk and opportunities in corporate strategy

8.4

-33% from baseline

6.5

-25% from baseline

Highest

CAF Qualitative Score (1-5)

11View entire presentation