Pathward Financial Results Presentation Deck

WAREHOUSE FINANCE

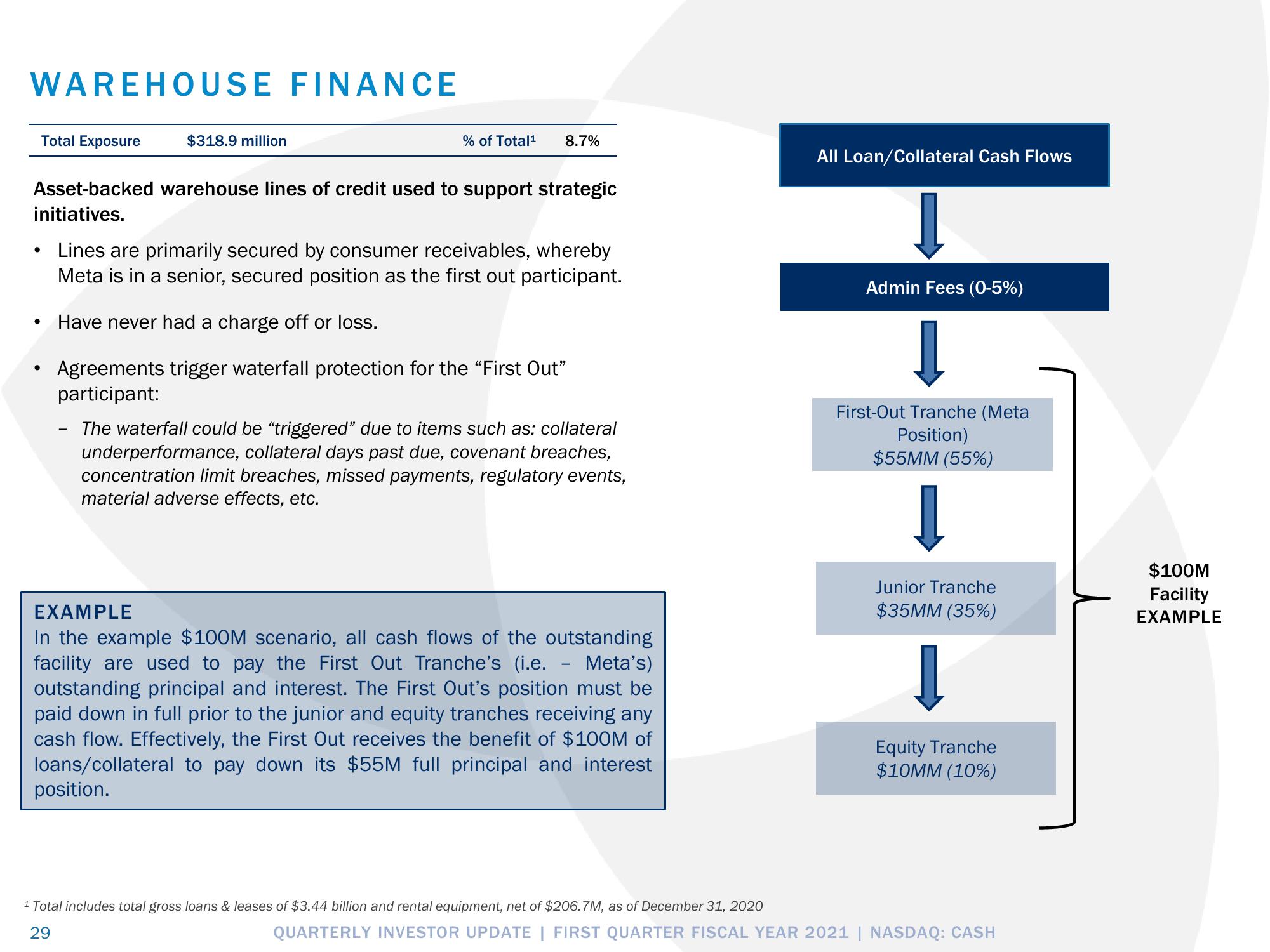

Total Exposure

●

$318.9 million

●

% of Total¹

Asset-backed warehouse lines of credit used to support strategic

initiatives.

8.7%

Lines are primarily secured by consumer receivables, whereby

Meta is in a senior, secured position as the first out participant.

Have never had a charge off or loss.

Agreements trigger waterfall protection for the "First Out"

participant:

The waterfall could be "triggered" due to items such as: collateral

underperformance, collateral days past due, covenant breaches,

concentration limit breaches, missed payments, regulatory events,

material adverse effects, etc.

EXAMPLE

Meta's)

In the example $100M scenario, all cash flows of the outstanding

facility are used to pay the First Out Tranche's (i.e.

outstanding principal and interest. The First Out's position must be

paid down in full prior to the junior and equity tranches receiving any

cash flow. Effectively, the First Out receives the benefit of $100M of

loans/collateral to pay down its $55M full principal and interest

position.

¹ Total includes total gross loans & leases of $3.44 billion and rental equipment, net of $206.7M, as of December 31, 2020

29

All Loan/Collateral Cash Flows

Admin Fees (0-5%)

First-Out Tranche (Meta

Position)

$55MM (55%)

Junior Tranche

$35MM (35%)

Equity Tranche

$10MM (10%)

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

$100M

Facility

EXAMPLEView entire presentation