Fourth Quarter & FY2023 Financial Update

Adj. CASM + Net Interest (SLA 1,000)²

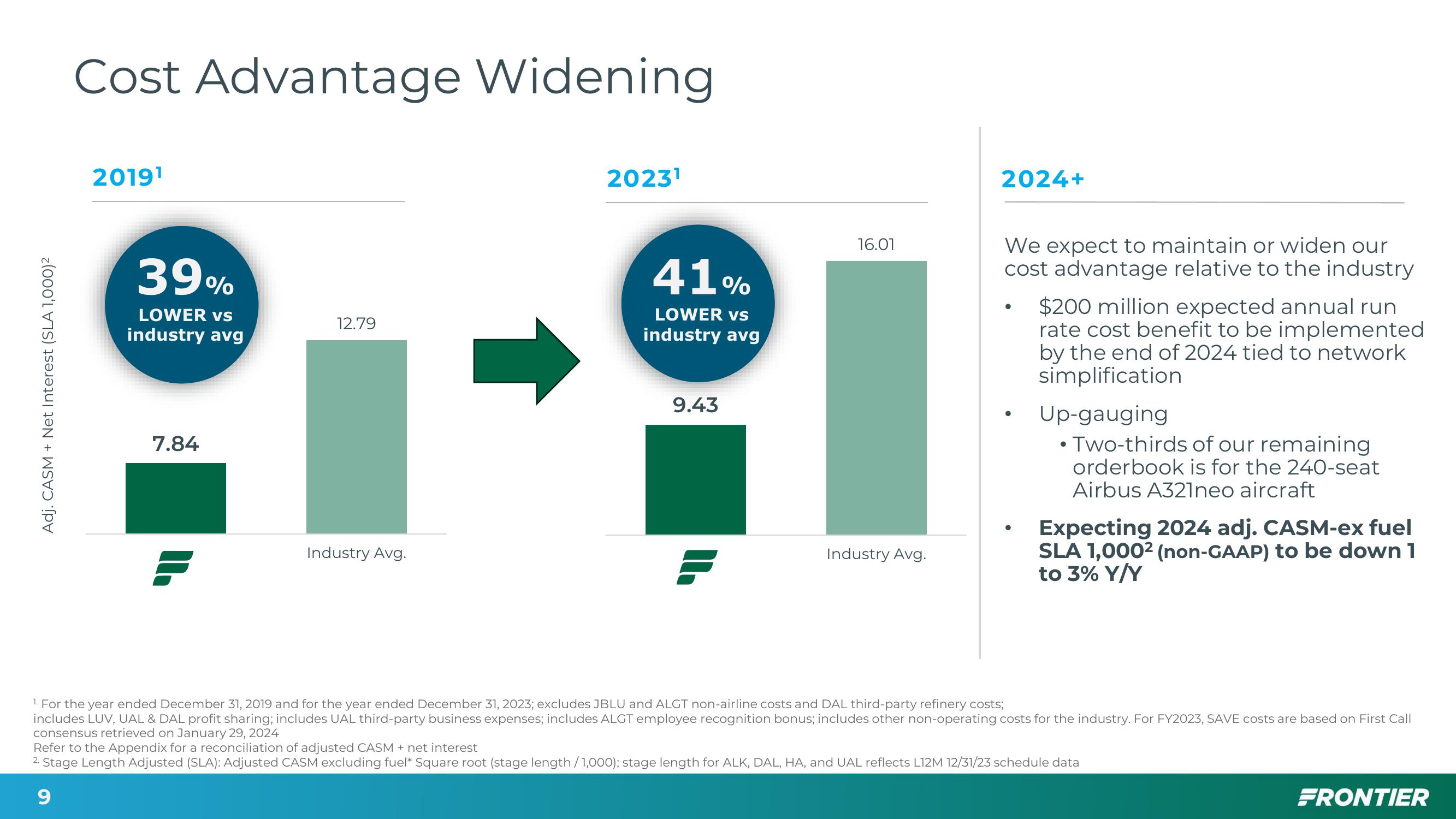

Cost Advantage Widening

2019¹

39%

LOWER vs

industry avg

7.84

12.79

Industry Avg.

2023¹

41%

LOWER vs

industry avg

9.43

P

16.01

Industry Avg.

2024+

We expect to maintain or widen our

cost advantage relative to the industry

●

●

$200 million expected annual run

rate cost benefit to be implemented

by the end of 2024 tied to network

simplification

Up-gauging

• Two-thirds of our remaining

orderbook is for the 240-seat

Airbus A321neo aircraft

Expecting 2024 adj. CASM-ex fuel

SLA 1,000² (non-GAAP) to be down 1

to 3% Y/Y

1. For the year ended December 31, 2019 and for the year ended December 31, 2023; excludes JBLU and ALGT non-airline costs and DAL third-party refinery costs;

includes LUV, UAL & DAL profit sharing; includes UAL third-party business expenses; includes ALGT employee recognition bonus; includes other non-operating costs for the industry. For FY2023, SAVE costs are based on First Call

consensus retrieved on January 29, 2024

Refer to the Appendix for a reconciliation of adjusted CASM + net interest

2. Stage Length Adjusted (SLA): Adjusted CASM excluding fuel* Square root (stage length/1,000); stage length for ALK, DAL, HA, and UAL reflects L12M 12/31/23 schedule data

9

FRONTIERView entire presentation