Antero Midstream Partners Mergers and Acquisitions Presentation Deck

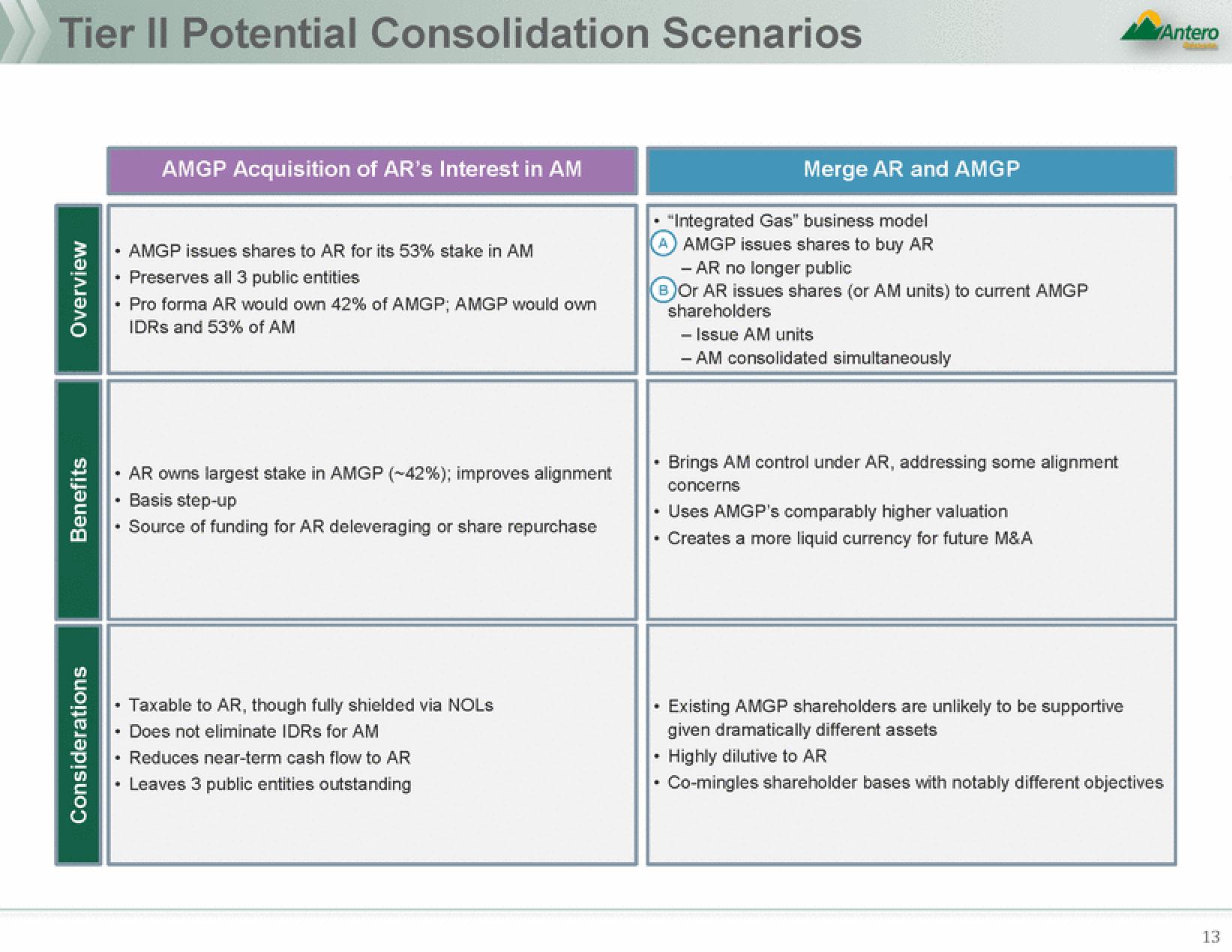

Tier II Potential Consolidation Scenarios

Overview

Benefits

Considerations

+

.

.

+

*

"

→

+

+

W

AMGP Acquisition of AR's Interest in AM

AMGP issues shares to AR for its 53% stake in AM

Preserves all 3 public entities

Pro forma AR would own 42% of AMGP; AMGP would own

IDRS and 53% of AM

AR owns largest stake in AMGP (-42%); improves alignment

Basis step-up

Source of funding for AR deleveraging or share repurchase

Taxable to AR, though fully shielded via NOLS

Does not eliminate IDRs for AM

Reduces near-term cash flow to AR

Leaves 3 public entities outstanding

"Integrated Gas" business model

A) AMGP issues shares to buy AR

- AR no longer public

B)Or AR issues shares (or AM units) to current AMGP

shareholders

- Issue AM units

AM consolidated simultaneously

■

Merge AR and AMGP

·

Uses AMGP's comparably higher valuation

• Creates a more liquid currency for future M&A

■

.

Brings AM control under AR, addressing some alignment

concerns

Antero

Existing AMGP shareholders are unlikely to be supportive

given dramatically different assets

Highly dilutive to AR

Co-mingles shareholder bases with notably different objectives

13View entire presentation