Sixth Street Lending Partners, Inc. Presentation to State of Connecticut

SIXTH STREET EXECUTIVE SUMMARY

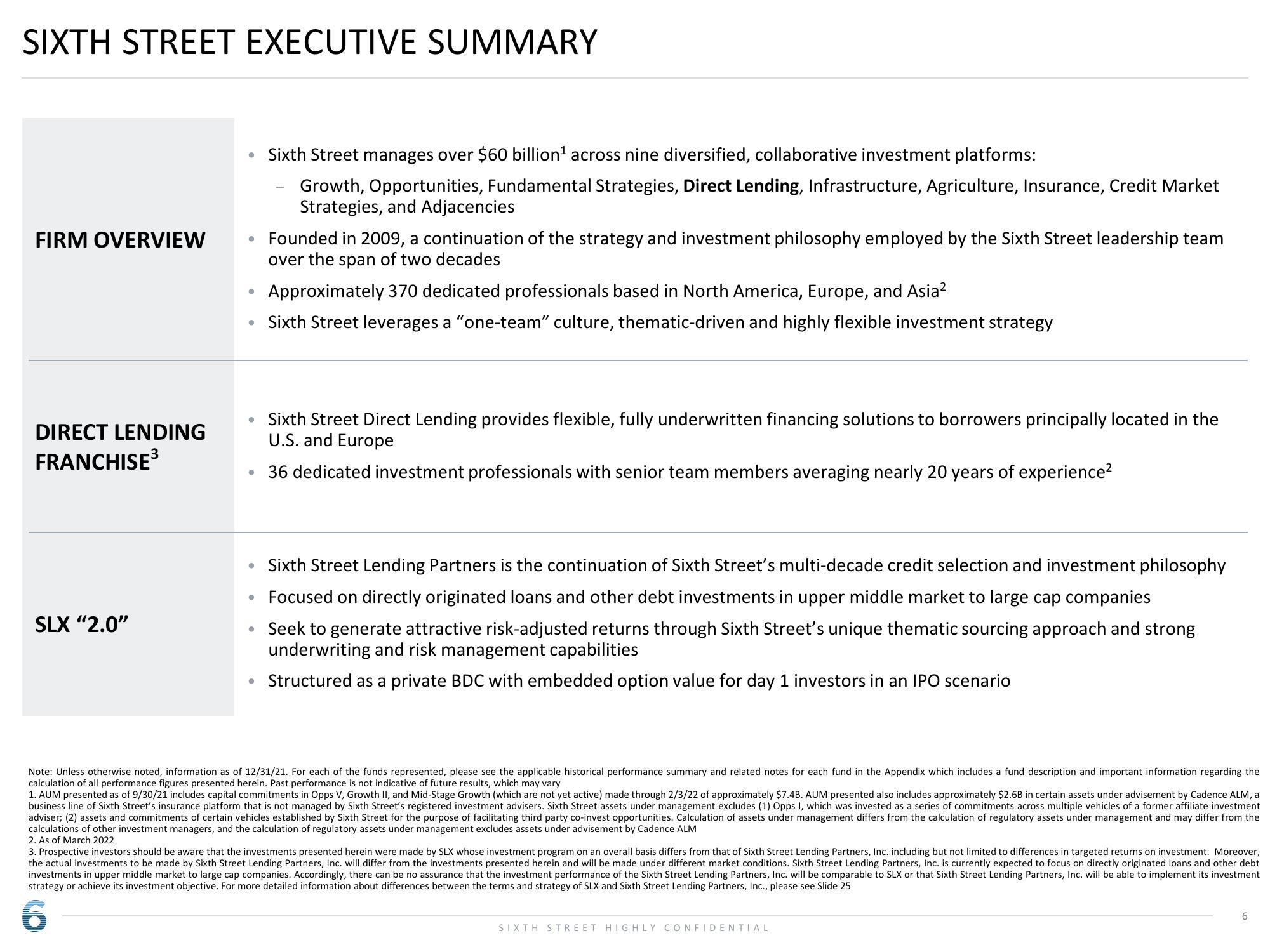

FIRM OVERVIEW

DIRECT LENDING

FRANCHISE³

SLX "2.0"

●

●

●

●

●

●

Sixth Street manages over $60 billion¹ across nine diversified, collaborative investment platforms:

Growth, Opportunities, Fundamental Strategies, Direct Lending, Infrastructure, Agriculture, Insurance, Credit Market

Strategies, and Adjacencies

●

Founded in 2009, a continuation of the strategy and investment philosophy employed by the Sixth Street leadership team

over the span of two decades

Approximately 370 dedicated professionals based in North America, Europe, and Asia²

Sixth Street leverages a "one-team" culture, thematic-driven and highly flexible investment strategy

Sixth Street Lending Partners is the continuation of Sixth Street's multi-decade credit selection and investment philosophy

Focused on directly originated loans and other debt investments in upper middle market to large cap companies

• Seek to generate attractive risk-adjusted returns through Sixth Street's unique thematic sourcing approach and strong

underwriting and risk management capabilities

Structured as a private BDC with embedded option value for day 1 investors in an IPO scenario

Sixth Street Direct Lending provides flexible, fully underwritten financing solutions to borrowers principally located in the

U.S. and Europe

36 dedicated investment professionals with senior team members averaging nearly 20 years of experience²

Note: Unless otherwise noted, information as of 12/31/21. For each of the funds represented, please see the applicable historical performance summary and related notes for each fund in the Appendix which includes a fund description and important information regarding the

calculation of all performance figures presented herein. Past performance is not indicative of future results, which may vary

1. AUM presented as of 9/30/21 includes capital commitments in Opps V, Growth II, and Mid-Stage Growth (which are not yet active) made through 2/3/22 of approximately $7.4B. AUM presented also includes approximately $2.6B in certain assets under advisement by Cadence ALM, a

business line of Sixth Street's insurance platform that is not managed by Sixth Street's registered investment advisers. Sixth Street assets under management excludes (1) Opps I, which was invested as a series of commitments across multiple vehicles of a former affiliate investment

adviser; (2) assets and commitments of certain vehicles established by Sixth Street for the purpose of facilitating third party co-invest opportunities. Calculation of assets under management differs from the calculation of regulatory assets under management and may differ from the

calculations of other investment managers, and the calculation of regulatory assets under management excludes assets under advisement by Cadence ALM

2. As of March 2022

3. Prospective investors should be aware that the investments presented herein were made by SLX whose investment program on an overall basis differs from that of Sixth Street Lending Partners, Inc. including but not limited to differences in targeted returns on investment. Moreover,

the actual investments to be made by Sixth Street Lending Partners, Inc. will differ from the investments presented herein and will be made under different market conditions. Sixth Street Lending Partners, Inc. is currently expected to focus on directly originated loans and other debt

investments in upper middle market to large cap companies. Accordingly, there can be no assurance that the investment performance of the Sixth Street Lending Partners, Inc. will be comparable to SLX or that Sixth Street Lending Partners, Inc. will be able to implement its investment

strategy or achieve its investment objective. For more detailed information about differences between the terms and strategy of SLX and Sixth Street Lending Partners, Inc., please see Slide 25

SIXTH STREET HIGHLY CONFIDENTIAL

6View entire presentation