SoftBank Results Presentation Deck

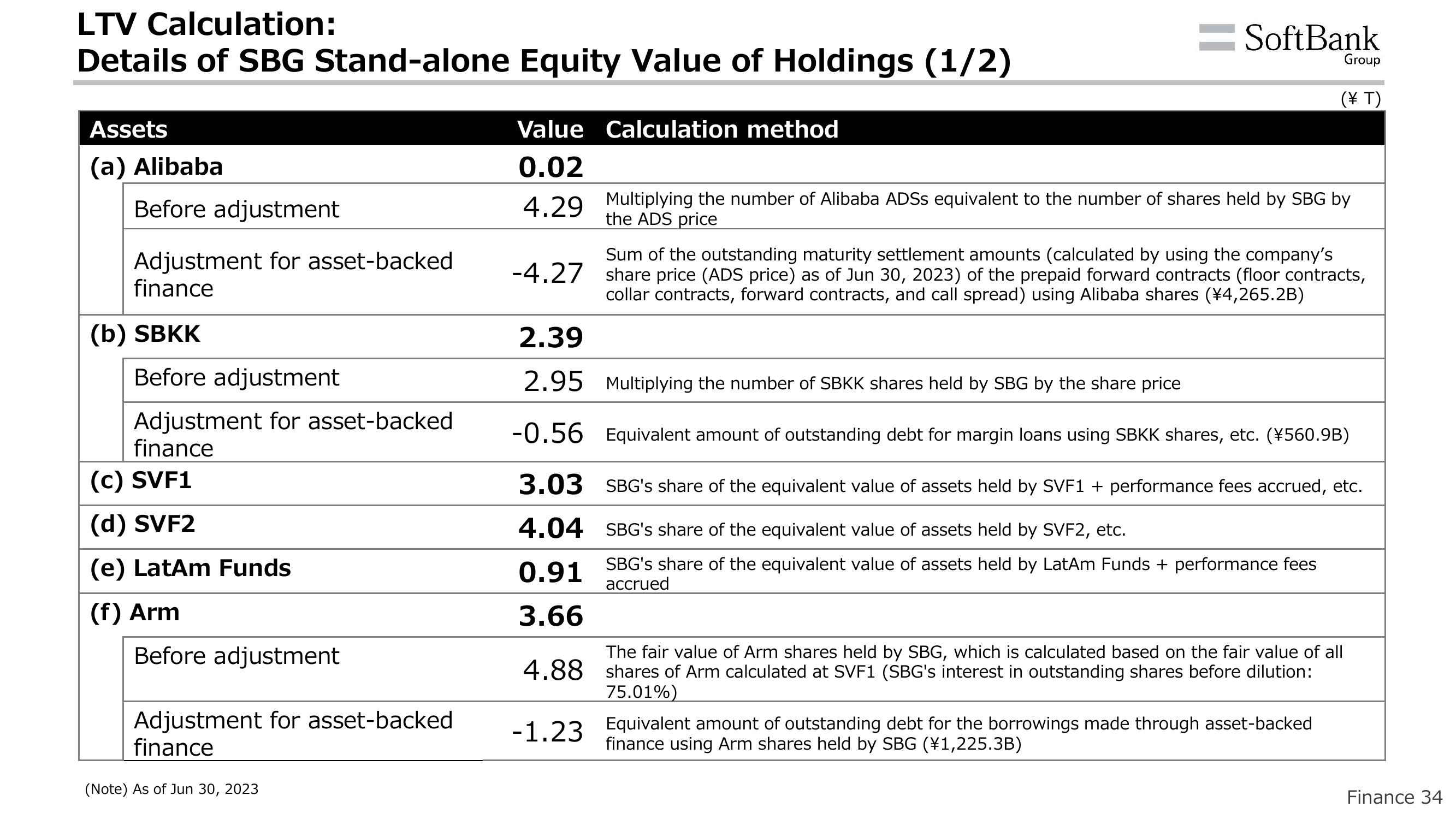

LTV Calculation:

Details of SBG Stand-alone Equity Value of Holdings (1/2)

Assets

(a) Alibaba

Before adjustment

Adjustment for asset-backed

finance

(b) SBKK

Before adjustment

Adjustment for asset-backed

finance

(c) SVF1

(d) SVF2

(e) LatAm Funds

(f) Arm

Before adjustment

Adjustment for asset-backed

finance

(Note) As of Jun 30, 2023

=SoftBank

Value Calculation method

0.02

4.29 Multiplying the number of Alibaba ADSS equivalent to the number of shares held by SBG by

the ADS price

2.39

2.95

-0.56

3.03

4.04

0.91

3.66

4.88

-1.23

Group

(\T)

Sum of the outstanding maturity settlement amounts (calculated by using the company's

-4.27 share price (ADS price) as of Jun 30, 2023) of the prepaid forward contracts (floor contracts,

collar contracts, forward contracts, and call spread) using Alibaba shares (¥4,265.2B)

Multiplying the number of SBKK shares held by SBG by the share price

Equivalent amount of outstanding debt for margin loans using SBKK shares, etc. (¥560.9B)

SBG's share of the equivalent value of assets held by SVF1+ performance fees accrued, etc.

SBG's share of the equivalent value of assets held by SVF2, etc.

SBG's share of the equivalent value of assets held by LatAm Funds + performance fees

accrued

The fair value of Arm shares held by SBG, which is calculated based on the fair value of all

shares of Arm calculated at SVF1 (SBG's interest in outstanding shares before dilution:

75.01%)

Equivalent amount of outstanding debt for the borrowings made through asset-backed

finance using Arm shares held by SBG (¥1,225.3B)

Finance 34View entire presentation