Trian Partners Activist Presentation Deck

Management Has Received Generous Bonuses Despite Poor Results

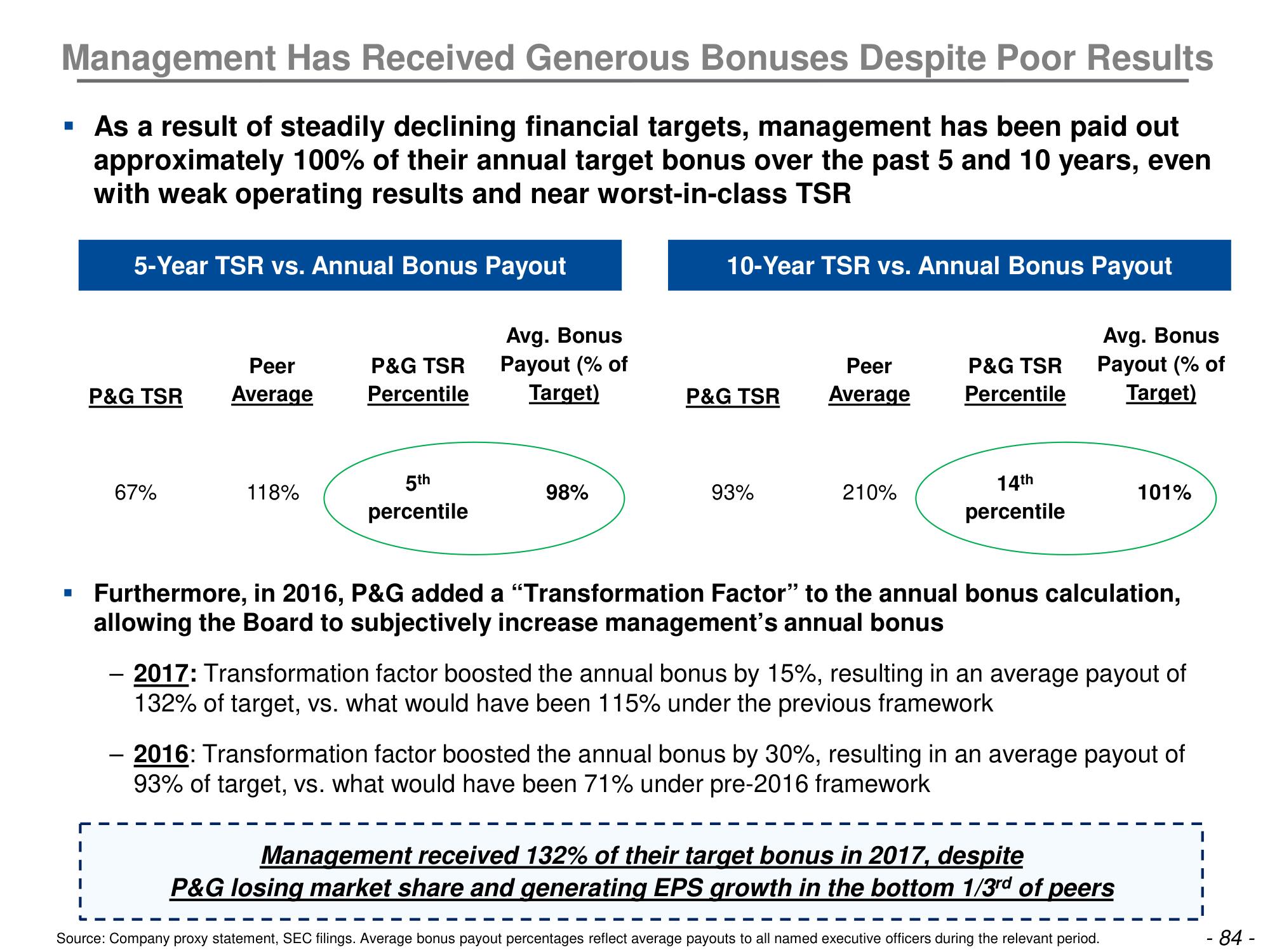

▪ As a result of steadily declining financial targets, management has been paid out

approximately 100% of their annual target bonus over the past 5 and 10 years, even

with weak operating results and near worst-in-class TSR

■

5-Year TSR vs. Annual Bonus Payout

P&G TSR

67%

Peer

Average

118%

P&G TSR

Percentile

5th

percentile

Avg. Bonus

Payout (% of

Target)

98%

10-Year TSR vs. Annual Bonus Payout

P&G TSR

93%

Peer

Average

210%

P&G TSR

Percentile

14th

percentile

Avg. Bonus

Payout (% of

Target)

Furthermore, in 2016, P&G added a "Transformation Factor" to the annual bonus calculation,

allowing the Board to subjectively increase management's annual bonus

101%

- 2017: Transformation factor boosted the annual bonus by 15%, resulting in an average payout of

132% of target, vs. what would have been 115% under the previous framework

- 2016: Transformation factor boosted the annual bonus by 30%, resulting in an average payout of

93% of target, vs. what would have been 71% under pre-2016 framework

Management received 132% of their target bonus in 2017, despite

P&G losing market share and generating EPS growth in the bottom 1/3rd of peers

Source: Company proxy statement, SEC filings. Average bonus payout percentages reflect average payouts to all named executive officers during the relevant period.

- 84 -View entire presentation