Bausch+Lomb Results Presentation Deck

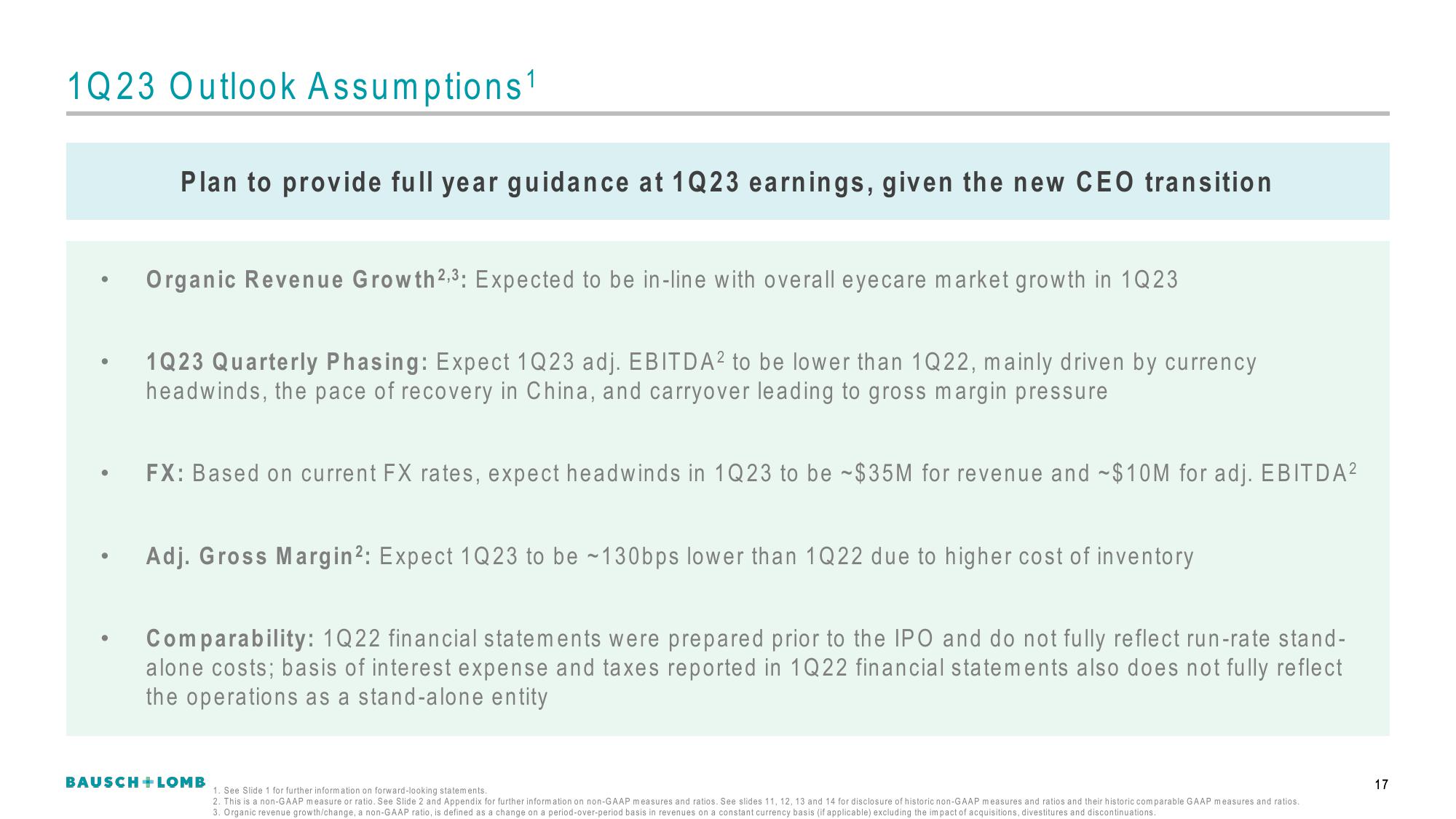

1Q23 Outlook Assumptions¹

Plan to provide full year guidance at 1Q23 earnings, given the new CEO transition

Organic Revenue Growth 2,³: Expected to be in-line with overall eyecare market growth in 1Q23

1Q23 Quarterly Phasing: Expect 1Q23 adj. EBITDA² to be lower than 1Q22, mainly driven by currency

headwinds, the pace of recovery in China, and carryover leading to gross margin pressure

FX: Based on current FX rates, expect headwinds in 1Q23 to be ~$35M for revenue and ~$10M for adj. EBITDA²

Adj. Gross Margin²: Expect 1Q23 to be ~130bps lower than 1Q22 due to higher cost of inventory

Comparability: 1Q22 financial statements were prepared prior to the IPO and do not fully reflect run-rate stand-

alone costs; basis of interest expense and taxes reported in 1Q22 financial statements also does not fully reflect

the operations as a stand-alone entity

BAUSCH + LOMB

1. See Slide 1 for further information on forward-looking statements.

2. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios. See slides 11, 12, 13 and 14 for disclosure of historic non-GAAP measures and ratios and their historic comparable GAAP measures and ratios.

3. Organic revenue growth/change, a non-GAAP ratio, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

17View entire presentation