Tudor, Pickering, Holt & Co Investment Banking

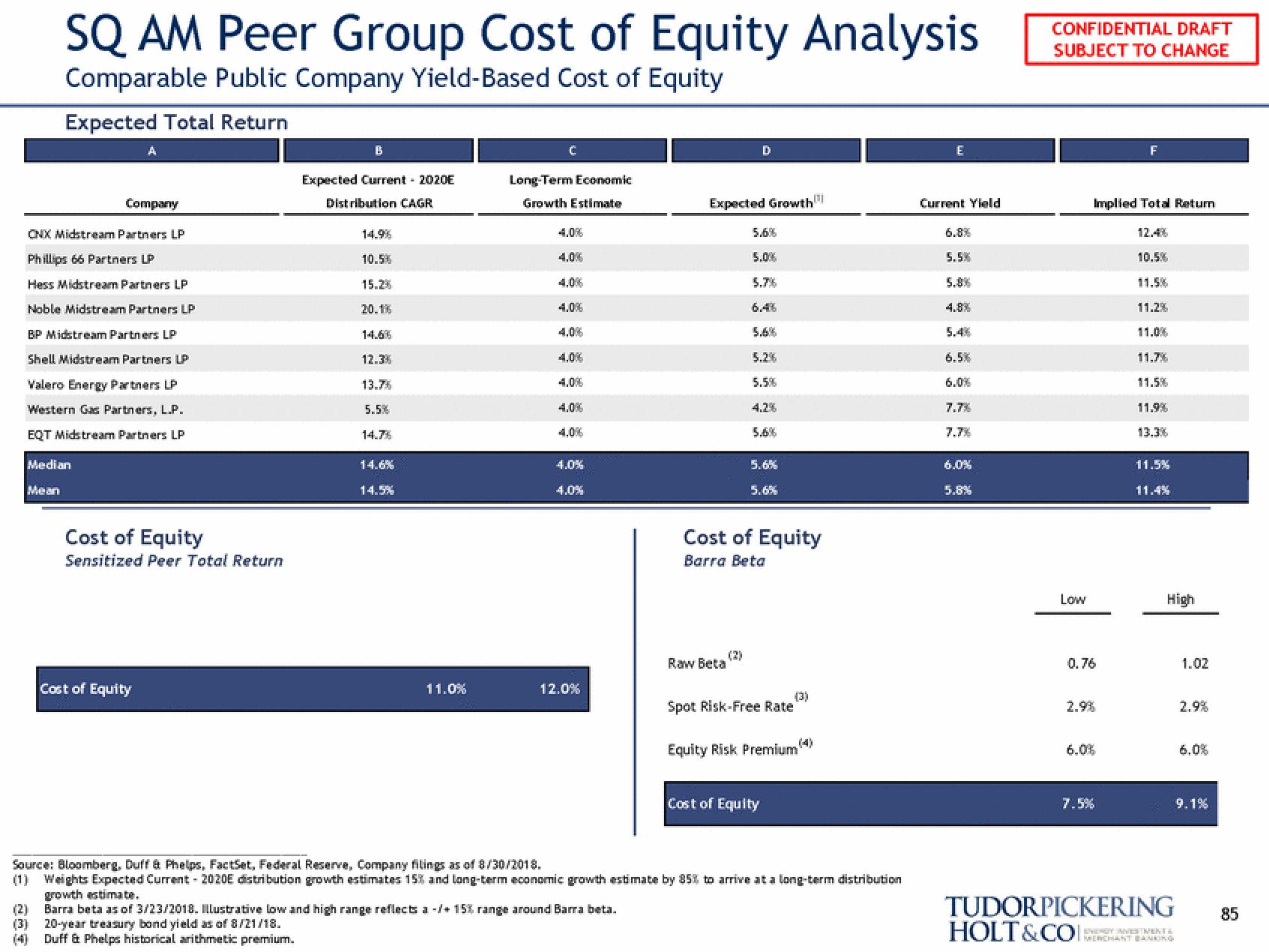

SQ AM Peer Group Cost of Equity Analysis

Comparable Public Company Yield-Based Cost of Equity

Expected Total Return

Company

CNX Midstream Partners LP

Phillips 66 Partners LP

Hess Midstream Partners LP

Noble Midstream Partners LP

BP Midstream Partners LP

Shell Midstream Partners LP

Valero Energy Partners LP

Western Gas Partners, L.P.

EQT Midstream Partners LP

Median

Mean

Cost of Equity

Sensitized Peer Total Return

Cost of Equity

B

Expected Current - 2020E

Distribution CAGR

14.96

10.5%

15.2%

20.1%

12.3%

13.7%

5.5%

14.7%

14.6%

14.5%

11.0%

Long-Term Economic

Growth Estimate

4.0%

4.0%

4.0%

4.0%

4.0%

4.0%

12.0%

Expected Growth

Raw Beta

D

(2)

5.6%

5.0%

5.7%

5.2%

5.5%

5.6%

Cost of Equity

Barra Beta

5.6%

5.6%

(3)

Spot Risk-Free Rate

Cost of Equity

Equity Risk Premium

Source: Bloomberg, Duff & Phelps, FactSet, Federal Reserve, Company filings as of 8/30/2018.

(1) Weights Expected Current - 2020E distribution growth estimates 15% and long-term economic growth estimate by 85% to arrive at a long-term distribution

growth estimate.

(2)

Barra beta as of 3/23/2018. Illustrative low and high range reflects a -/+ 15% range around Barra beta.

(3) 20-year treasury bond yield as of 8/21/18.

Duff & Phelps historical arithmetic premium.

E

Current Yield

5.5%

5.8%

4.8%

5.4%

6.5%

6.0%

7.7%

7.7%

6.0%

5.8%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

Low

Implied Total Return

0.76

6.0%

7.5%

12.4%

10.5%

11.5%

11.2%

11.0%

11.7%

11.5%

11.9%

13.3%

11.5%

11.4%

High

TUDORPICKERING

HOLT&COI:

ENERGY INVESTIMENT

MERCHANT BANKING

1.02

2.9%

6.0%

9.1%

85View entire presentation