Bank of America Investment Banking Pitch Book

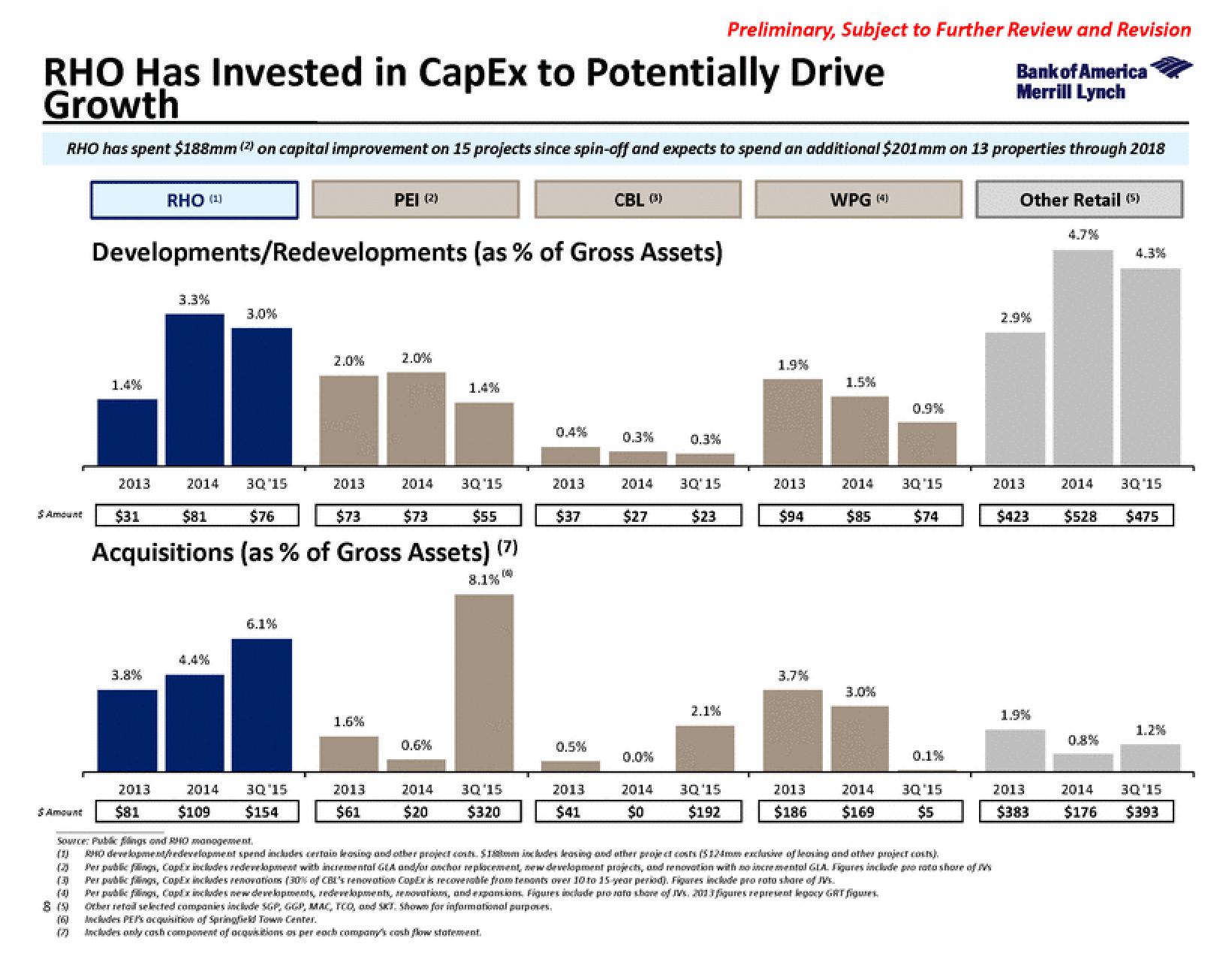

RHO Has Invested in CapEx to Potentially Drive

Growth

RHO has spent $188mm (2) on capital improvement on 15 projects since spin-off and expects to spend an additional $201mm on 13 properties through 2018

$ Amount

$Amount

8888888

(3)

8 (9)

1.4%

2013

Developments/Redevelopments (as % of Gross Assets)

RHO (¹)

$31

3.8%

3.3%

$81

3.0%

2014 3Q'15

$76

$55

Acquisitions (as % of Gross Assets) (7)

(4)

4.4%

6.1%

2013

$73

2013

2014

3Q'15

$81 $109 $154

PEI (2)

1.6%

2013

$61

2.0%

2014 3Q'15

$73

1.4%

0.6%

2014

$20

8.1%

3Q'15

$320

2013

$37

0.5%

CBL (5)

2013

$41

0.3%

2014

$27

0.0%

0.3%

3Q'15

$23

2.1%

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

2014 30'15

$0

$192

1.9%

2013

$94

3.7%

2013

$186

WPG (4)

1.5%

2014

$85

3.0%

2014

$169

0.9%

3Q'15

$74

Source: Public fings and RHO management.

(0) RHO development/redevelopment spend includes certain leasing and other project cost $1m includes leasing and other project costs (5124mm exclusive of leasing and other project costs).

Per public fing, CopEx includes redevelopment with incremental GA and/or anchor replacement, new development project, and renovation with no incremental GLA. Figures include pro roto shore of m

Per public fings, CopEx includes renovations (30% of CBL's renovation CopEr is recoverable from tenonts over 10 to 15 year period). Figures include pro roto share of s

Per public, Copfx includes new developments, redevelopments, renovations, and expansions Figures include pro rato shove of Vs. 2013 figures represent legacy GRT figures

Orber retail selected companies include SGP, GGP, MAC, TOO, and SKT. Shown for informational purposes.

Includes PEP's acquisition of Springfield Town Center.

Includes only cash component of acquisitions as per each company's cash flow statement.

0.1%

3Q'15

$5

Other Retail (5)

2013

1.9%

$423 $528

2013

4.7%

$383

2014 3Q'15

4.3%

0.8%

$475

1.2%

2014

30 15

$176 $393View entire presentation