Truist Financial Corp Results Presentation Deck

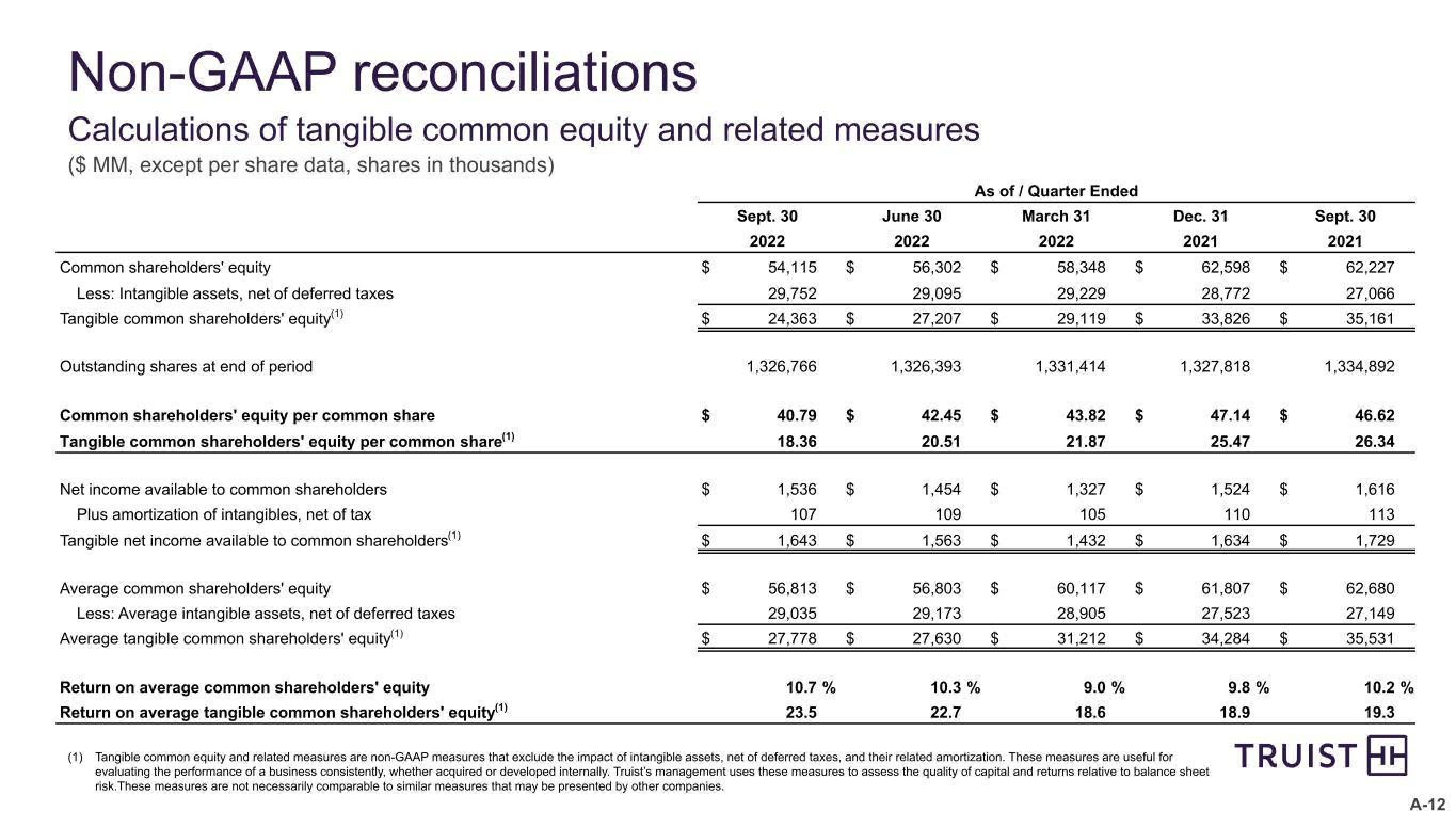

Non-GAAP reconciliations

Calculations of tangible common equity and related measures

($ MM, except per share data, shares in thousands)

Common shareholders' equity

Less: Intangible assets, net of deferred taxes

Tangible common shareholders' equity(¹)

Outstanding shares at end of period

Common shareholders' equity per common share

Tangible common shareholders' equity per common share(¹)

Net income available to common shareholders

Plus amortization of intangibles, net of tax

Tangible net income available to common shareholders(¹)

Average common shareholders' equity

Less: Average intangible assets, net of deferred taxes

Average tangible common shareholders' equity(¹)

Return on average common shareholders' equity

Return on average tangible common shareholders' equity(¹)

69

$

$

Sept. 30

2022

54,115

29,752

24,363

1,326,766

40.79

18.36

1,536

107

1,643

56,813

29,035

27,778

10.7 %

23.5

69

$

$

June 30

2022

56,302

29,095

27,207

1,326,393

42.45

20.51

1,454

109

1,563

56,803

29,173

27,630

As of/ Quarter Ended

March 31

2022

10.3 %

22.7

$

58,348

29,229

29,119

1,331,414

43.82 $

21.87

1,327 $

105

1,432

60,117

28,905

31,212

9.0 %

18.6

$

$

Dec. 31

2021

62,598

28,772

33,826

1,327,818

47.14

25.47

1,524

110

1,634

61,807

27,523

34,284

(1) Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization. These measures are useful for

evaluating the performance of a business consistently, whether acquired or developed internally. Truist's management uses these measures to assess the quality of capital and returns relative to balance sheet

risk. These measures are not necessarily comparable to similar measures that may be presented by other companies.

9.8 %

$

18.9

$

Sept. 30

2021

62,227

27,066

35,161

1,334,892

46.62

26.34

1,616

113

1,729

10.2 %

19.3

TRUIST HH

62,680

27,149

35,531

A-12View entire presentation