Investor Presentation

·

At FPL, we remain focused on identifying smart capital

investments to further improve our outstanding customer

value proposition

FPL's Areas of Focus

Unyielding commitment to low bills,

high reliability and excellent

customer service

• Focus on efficiency and best-in-

class cost performance

•

Reduced non-fuel O&M cost per

megawatt by ~8.6% in 2022

Invest capital in ways that benefit

customers

- Plan to deploy more than $10 B of solar

through 2025(2) and expect to double

solar additions in the next TYSP (3)

compared to the previous filing

- T&D investments of ~$14 - 16 B

through 2025 to support customer

growth and grid hardening programs

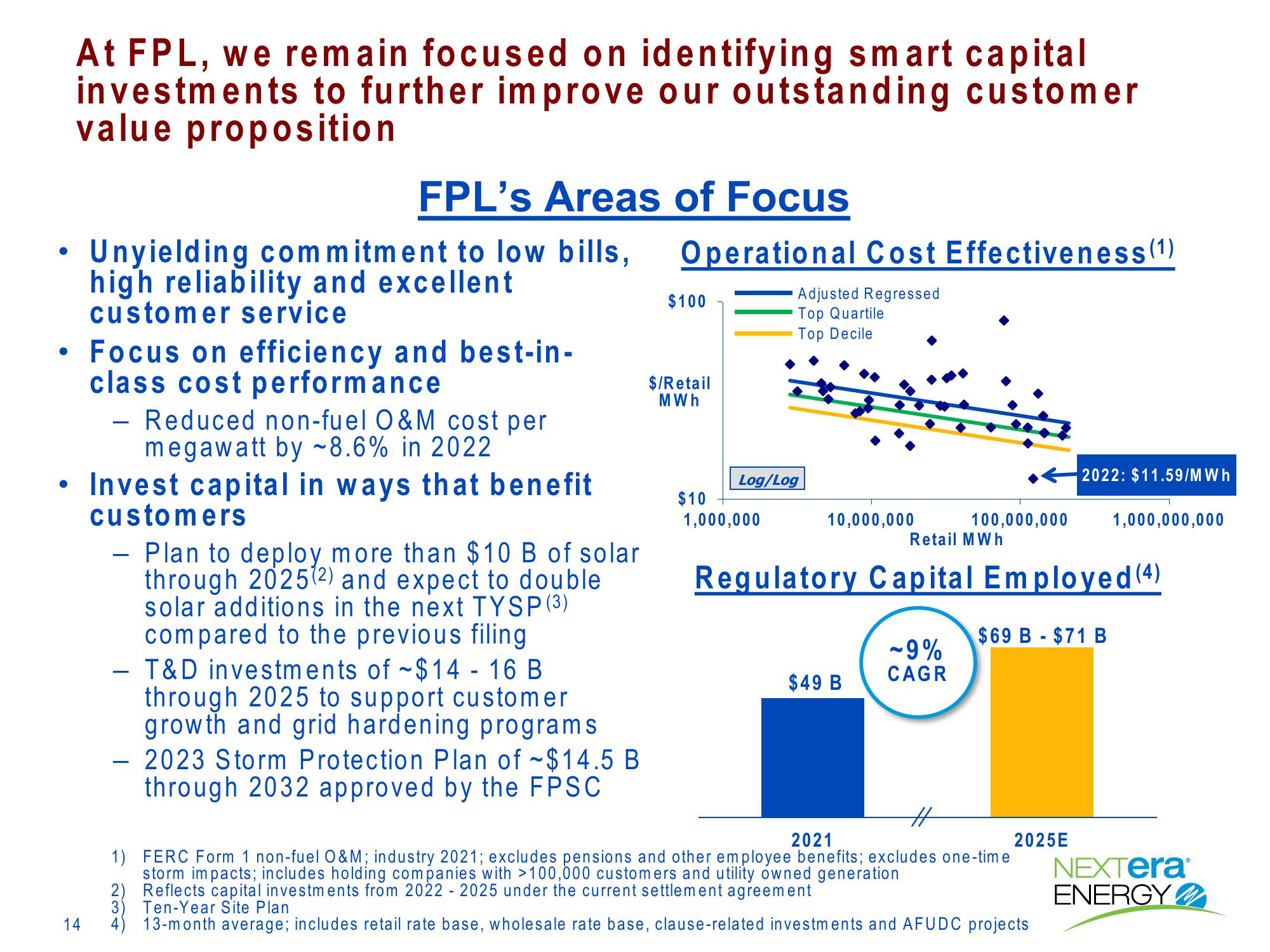

Operational Cost Effectiveness (1)

$100

$/Retail

MWh

Adjusted Regressed

Top Quartile

Top Decile

Log/Log

2022: $11.59/MWh

$10

1,000,000

10,000,000

100,000,000

1,000,000,000

Retail MWh

Regulatory Capital Employed (4)

$69 B $71 B

-9%

CAGR

$49 B

- 2023 Storm Protection Plan of ~$14.5 B

through 2032 approved by the FPSC

#

2021

2025E

1) FERC Form 1 non-fuel O&M; industry 2021; excludes pensions and other employee benefits; excludes one-time

storm impacts; includes holding companies with >100,000 customers and utility owned generation

3)

-

2) Reflects capital investments from 2022 2025 under the current settlement agreement

Ten-Year Site Plan

NEXTera®

ENERGY

14

13-month average; includes retail rate base, wholesale rate base, clause-related investments and AFUDC projectsView entire presentation