LegalZoom.com Investor Presentation Deck

Lz

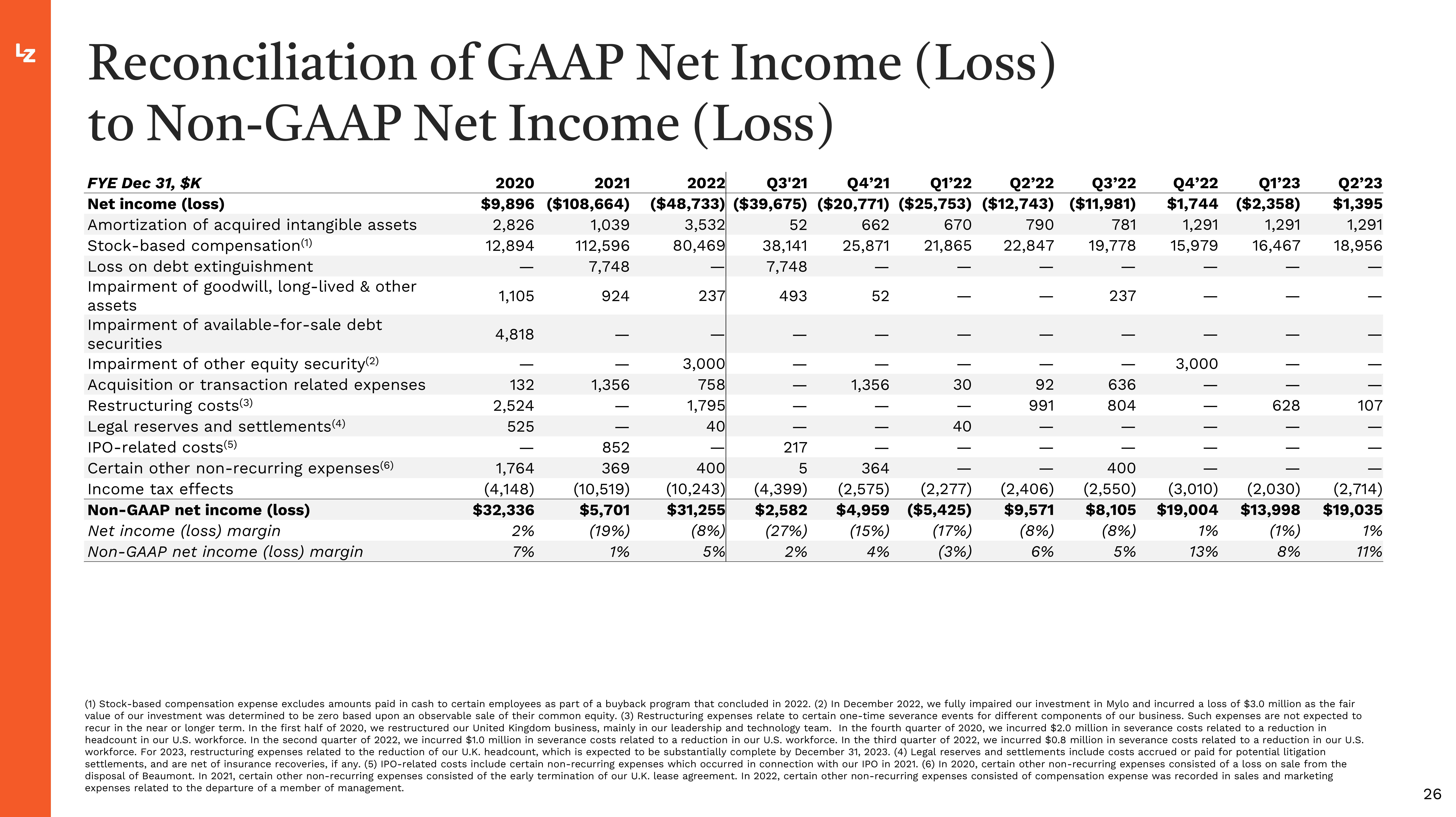

Reconciliation of GAAP Net Income (Loss)

to Non-GAAP Net Income (Loss)

FYE Dec 31, $K

Net income (loss)

Amortization of acquired intangible assets

Stock-based compensation (¹)

Loss on debt extinguishment

Impairment of goodwill, long-lived & other

assets

Impairment of available-for-sale debt

securities

Impairment of other equity security (2)

Acquisition or transaction related expenses

Restructuring costs (³)

Legal reserves and settlements (4)

IPO-related costs(5)

Certain other non-recurring expenses(6)

Income tax effects

Non-GAAP net income (loss)

Net income (loss) margin

Non-GAAP net income (loss) margin

2020

2022 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22

$9,896 ($108,664) ($48,733) ($39,675) ($20,771) ($25,753) ($12,743) ($11,981)

2,826

52

662

670

790

12,894

38,141 25,871 21,865 22,847

7,748

3,532

80,469

493

1,105

4,818

132

2,524

525

1,764

(4,148)

$32,336

2%

7%

2021

1,039

112,596

7,748

924

1,356

852

369

(10,519)

$5,701

(19%)

1%

237

3,000

758

1,795

40

| | |

52

I

| | |

1,356

I

|

181811

30

40

T

T

92

991

217

364

400

5

(10,243) (4,399) (2,575) (2,277) (2,406)

$31,255 $2,582 $4,959 ($5,425) $9,571

(8%) (27%) (15%) (17%) (8%)

5%

2%

4% (3%)

6%

Q1'23 Q2'23

$1,744 ($2,358) $1,395

781 1,291 1,291 1,291

19,778 15,979 16,467 18,956

237

I

636

804

T

I

3,000

81111

I

T

628

I

T

T

(1) Stock-based compensation expense excludes amounts paid in cash to certain employees as part of a buyback program that concluded in 2022. (2) In December 2022, we fully impaired our investment in Mylo and incurred a loss of $3.0 million as the fair

value of our investment was determined to be zero based upon an observable sale of their common equity. (3) Restructuring expenses relate to certain one-time severance events for different components of our business. Such expenses are not expected to

recur in the near or longer term. In the first half of 2020, we restructured our United Kingdom business, mainly in our leadership and technology team. In the fourth quarter of 2020, we incurred $2.0 million in severance costs related to a reduction in

headcount in our U.S. workforce. In the second quarter of 2022, we incurred $1.0 million in severance costs related to a reduction in our U.S. workforce. the third quarter of 2022, we incurred $0.8 million in severance costs related to a reduction in our U.S.

workforce. For 2023, restructuring expenses related to the reduction of our U.K. headcount, which is expected to be substantially complete by December 31, 2023. (4) Legal reserves and settlements include costs accrued or paid for potential litigation

settlements, and are net of insurance recoveries, if any. (5) IPO-related costs include certain non-recurring expenses which occurred in connection with our IPO in 2021. (6) In 2020, certain other non-recurring expenses consisted of a loss on sale from the

disposal of Beaumont. In 2021, certain other non-recurring expenses consisted of the early termination of our U.K. lease agreement. In 2022, certain other non-recurring expenses consisted of compensation expense was recorded in sales and marketing

expenses related to the departure of a member of management.

T

107

400

(2,550) (3,010) (2,030) (2,714)

$8,105 $19,004 $13,998 $19,035

(8%)

1%

(1%)

1%

13%

8%

5%

11%

26View entire presentation