Owens&Minor Investor Conference Presentation Deck

5 Strong Cash Flow Profile Provides Ability to Significantly Reduce Debt

Financial Strength Drivers

17

●

●

●

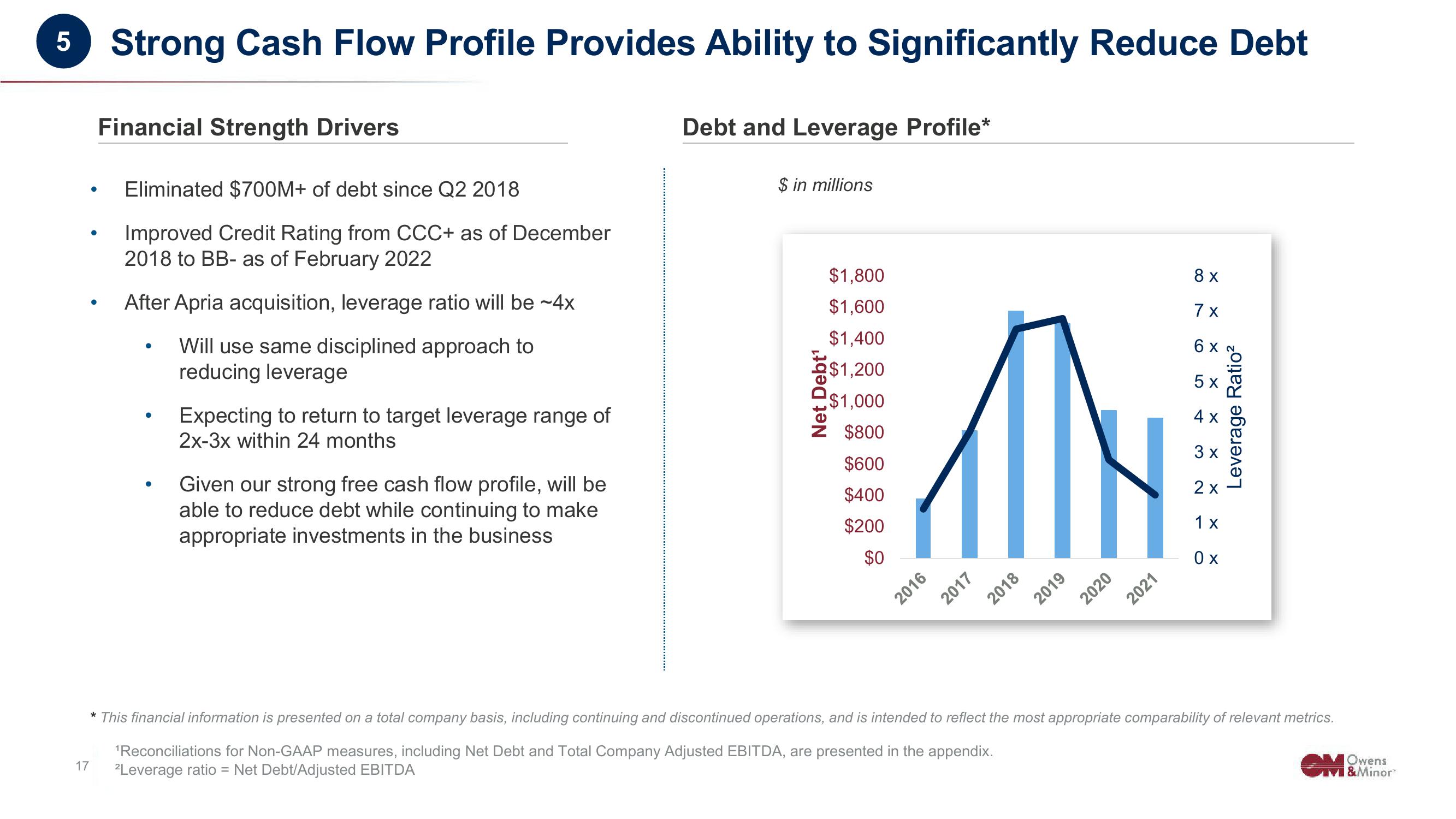

Eliminated $700M+ of debt since Q2 2018

Improved Credit Rating from CCC+ as of December

2018 to BB- as of February 2022

After Apria acquisition, leverage ratio will be ~4x

Will use same disciplined approach to

reducing leverage

●

Expecting to return to target leverage range of

2x-3x within 24 months

Given our strong free cash flow profile, will be

able to reduce debt while continuing to make

appropriate investments in the business

Debt and Leverage Profile*

$ in millions

Net Debt¹

$1,800

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

2016

2017

2018

2019

2020

2021

8 x

7x

6x N

5x

4 x

3 x

2x

1 x

Ox

Leverage Ratio²

*This financial information is presented on a total company basis, including continuing and discontinued operations, and is intended to reflect the most appropriate comparability of relevant metrics.

¹Reconciliations for Non-GAAP measures, including Net Debt and Total Company Adjusted EBITDA, are presented in the appendix.

²Leverage ratio = Net Debt/Adjusted EBITDA

Owens

VI & MinorView entire presentation