Zegna Results Presentation Deck

FY 2022 NET FINANCIAL INDEBTEDNESS /

(CASH SURPLUS)

●

●

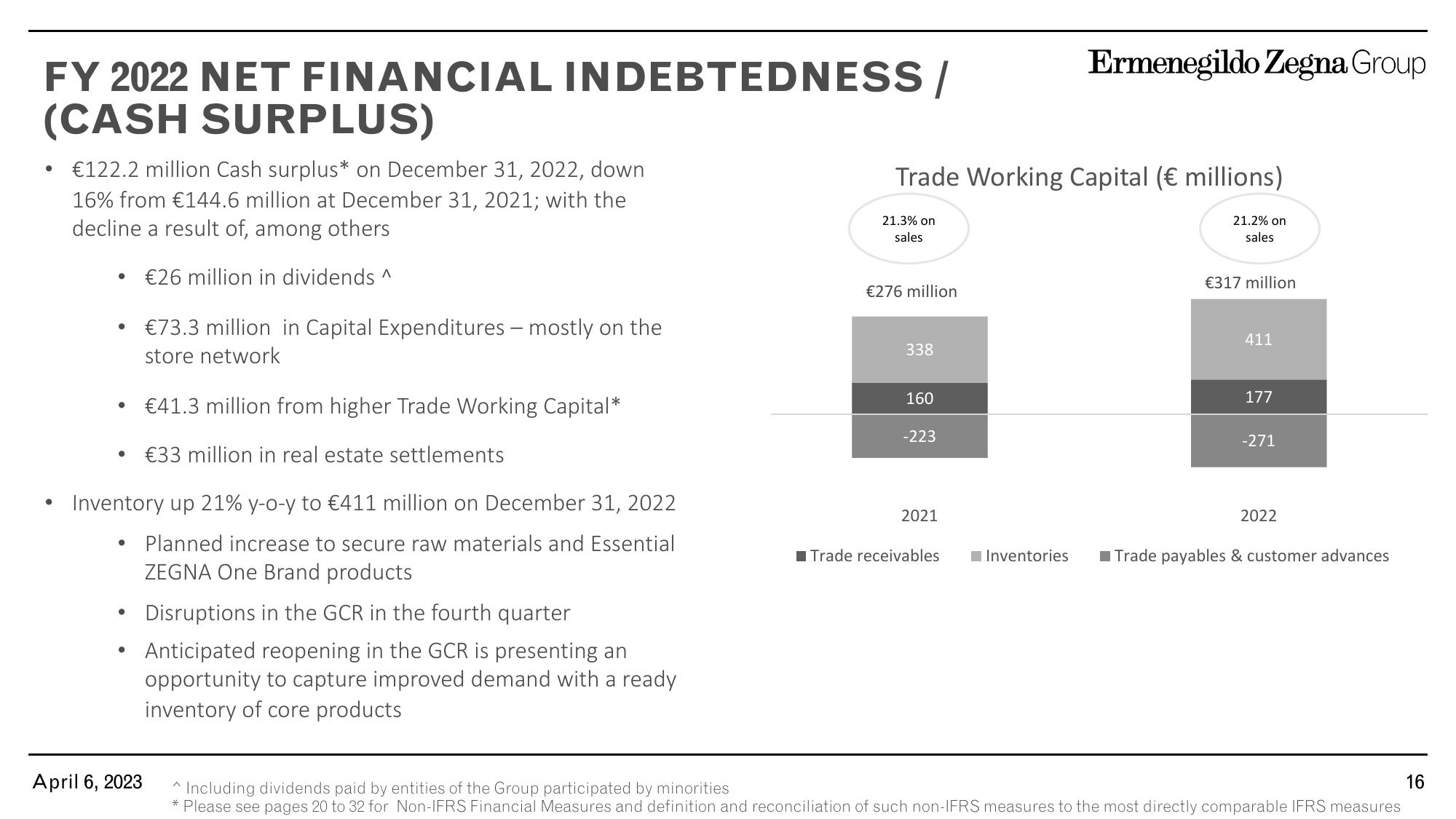

€122.2 million Cash surplus* on December 31, 2022, down

16% from €144.6 million at December 31, 2021; with the

decline a result of, among others

€26 million in dividends ^

€73.3 million in Capital Expenditures - mostly on the

store network

€41.3 million from higher Trade Working Capital*

€33 million in real estate settlements

Inventory up 21% y-o-y to € 411 million on December 31, 2022

Planned increase to secure raw materials and Essential

ZEGNA One Brand products

●

●

●

●

April 6, 2023

Disruptions in the GCR in the fourth quarter

Anticipated reopening in the GCR is presenting an

opportunity to capture improved demand with a ready

inventory of core products

Trade Working Capital (€ millions)

21.3% on

sales

€276 million

338

160

-223

2021

Ermenegildo Zegna Group

■Trade receivables

21.2% on

sales.

€317 million

411

177

-271

2022

Inventories ■Trade payables & customer advances

^ Including dividends paid by entities of the Group participated by minorities

Please see pages 20 to 32 for Non-IFRS Financial Measures and definition and reconciliation of such non-IFRS measures to the most directly comparable IFRS measures

16View entire presentation