The Urgent Need for Change and The Superior Path Forward

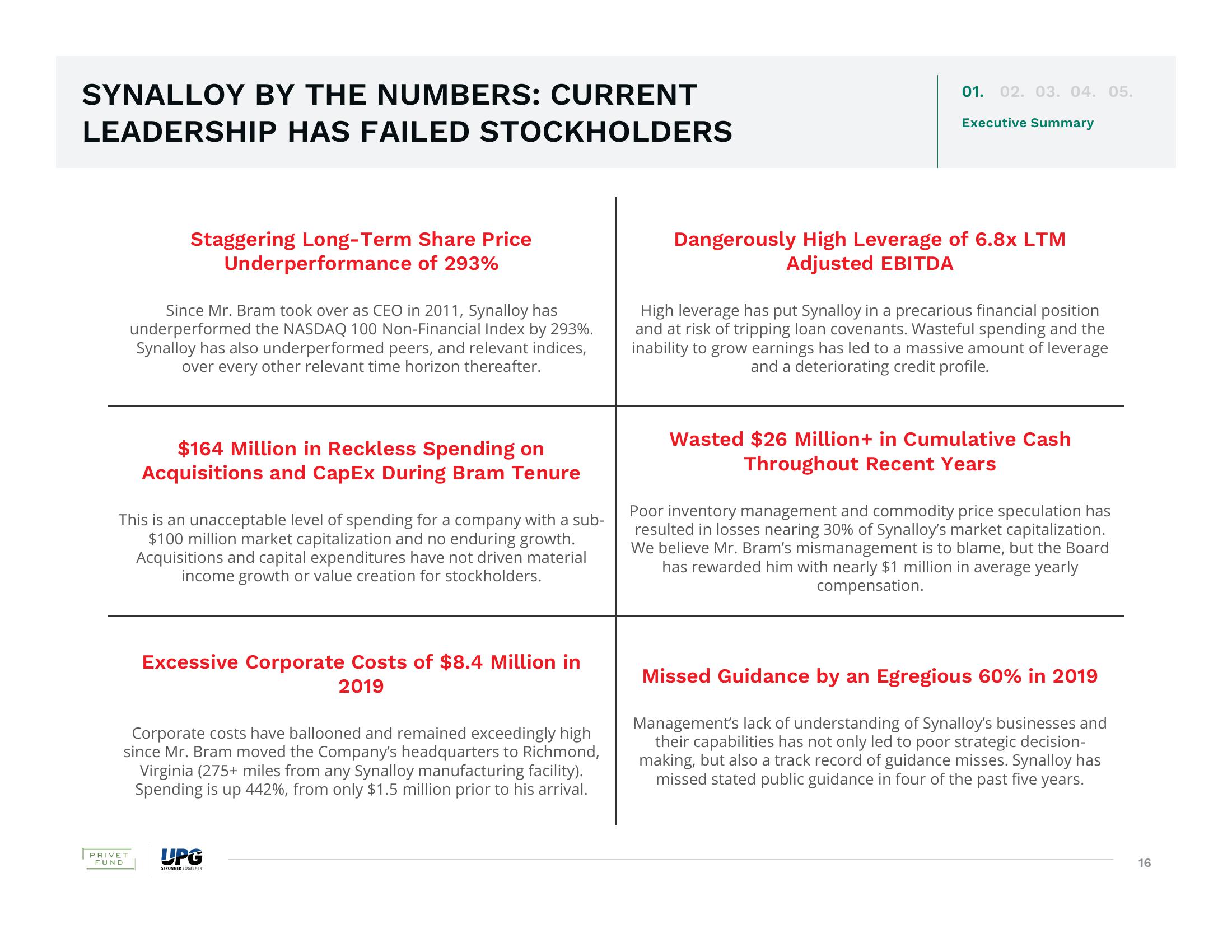

SYNALLOY BY THE NUMBERS: CURRENT

LEADERSHIP HAS FAILED STOCKHOLDERS

Staggering Long-Term Share Price

Underperformance of 293%

Since Mr. Bram took over as CEO in 2011, Synalloy has

underperformed the NASDAQ 100 Non-Financial Index by 293%.

Synalloy has also underperformed peers, and relevant indices,

over every other relevant time horizon thereafter.

PRIVET

FUND

$164 Million in Reckless Spending on

Acquisitions and CapEx During Bram Tenure

This is an unacceptable level of spending for a company with a sub-

$100 million market capitalization and no enduring growth.

Acquisitions and capital expenditures have not driven material

income growth or value creation for stockholders.

Excessive Corporate Costs of $8.4 Million in

2019

Corporate costs have ballooned and remained exceedingly high

since Mr. Bram moved the Company's headquarters to Richmond,

Virginia (275+ miles from any Synalloy manufacturing facility).

Spending is up 442%, from only $1.5 million prior to his arrival.

UPG

STRONGER TOGETHER

01.

02. 03. 04. 05.

Executive Summary

Dangerously High Leverage of 6.8x LTM

Adjusted EBITDA

High leverage has put Synalloy in a precarious financial position

and at risk of tripping loan covenants. Wasteful spending and the

inability to grow earnings has led to a massive amount of leverage

and a deteriorating credit profile.

Wasted $26 Million+ in Cumulative Cash

Throughout Recent Years

Poor inventory management and commodity price speculation has

resulted in losses nearing 30% of Synalloy's market capitalization.

We believe Mr. Bram's mismanagement is to blame, but the Board

has rewarded him with nearly $1 million in average yearly

compensation.

Missed Guidance by an Egregious 60% in 2019

Management's lack of understanding of Synalloy's businesses and

their capabilities has not only led to poor strategic decision-

making, but also a track record of guidance misses. Synalloy has

missed stated public guidance in four of the past five years.

16View entire presentation