Melrose Mergers and Acquisitions Presentation Deck

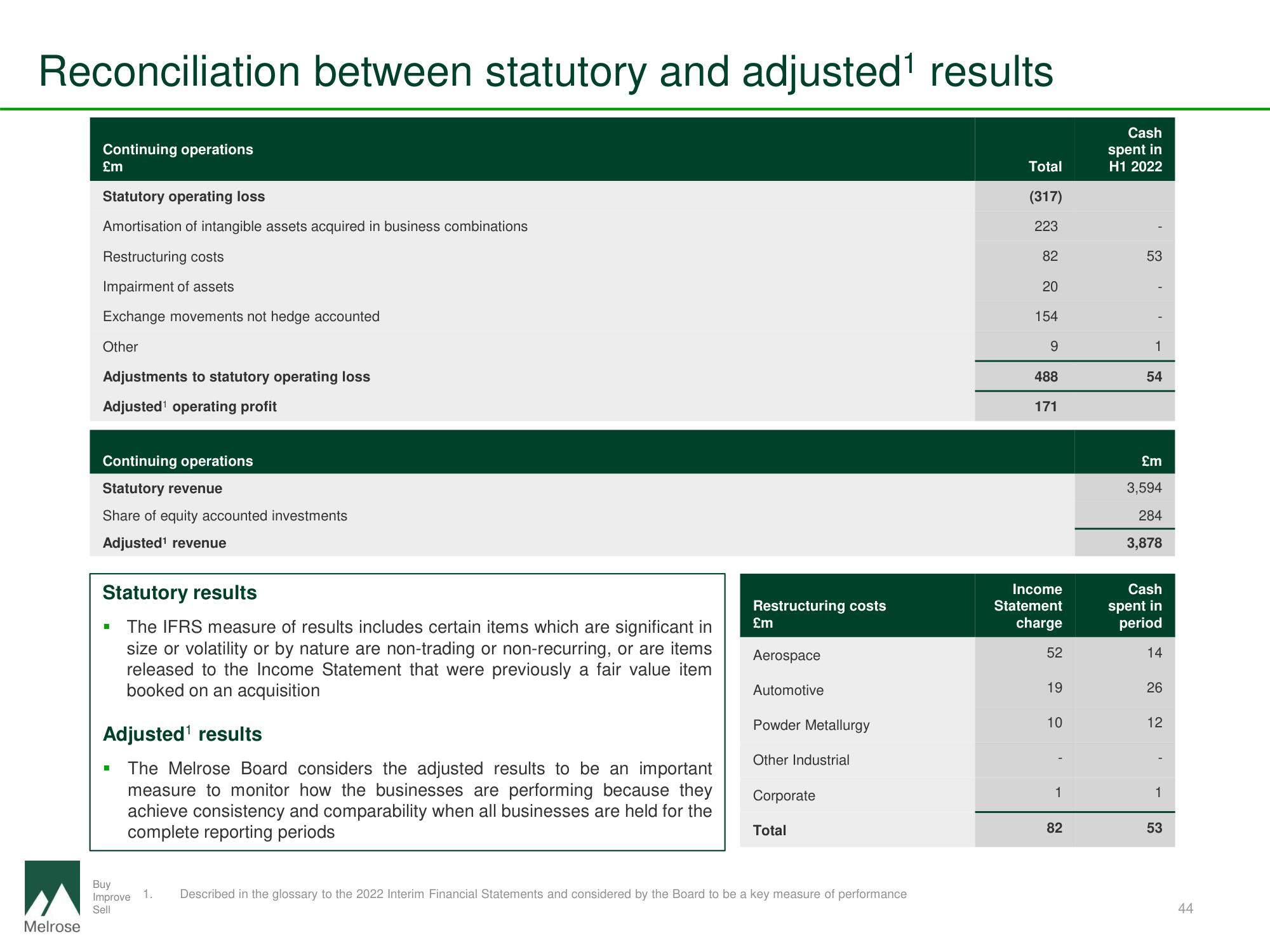

Reconciliation between statutory and adjusted¹ results

Melrose

Continuing operations

£m

Statutory operating loss

Amortisation of intangible assets acquired in business combinations

Restructuring costs

Impairment of assets

Exchange movements not hedge accounted

Other

Adjustments to statutory operating loss

Adjusted¹ operating profit

Continuing operations

Statutory revenue

Share of equity accounted investments

Adjusted¹ revenue

Statutory results

▪ The IFRS measure of results includes certain items which are significant in

size or volatility or by nature are non-trading or non-recurring, or are items

released to the Income Statement that were previously a fair value item

booked on an acquisition

Adjusted¹ results

The Melrose Board considers the adjusted results to be an important

measure to monitor how the businesses are performing because they

achieve consistency and comparability when all businesses are held for the

complete reporting periods

I

Buy

Improve

Sell

1.

Restructuring costs

£m

Aerospace

Automotive

Powder Metallurgy

Other Industrial

Corporate

Total

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

Total

(317)

223

82

20

154

9

488

171

Income

Statement

charge

52

19

10

1

82

Cash

spent in

H1 2022

53

1

54

£m

3,594

284

3,878

Cash

spent in

period

14

26

12

1

53

44View entire presentation