Pershing Square Activist Presentation Deck

C. McOpCo Financial Analysis

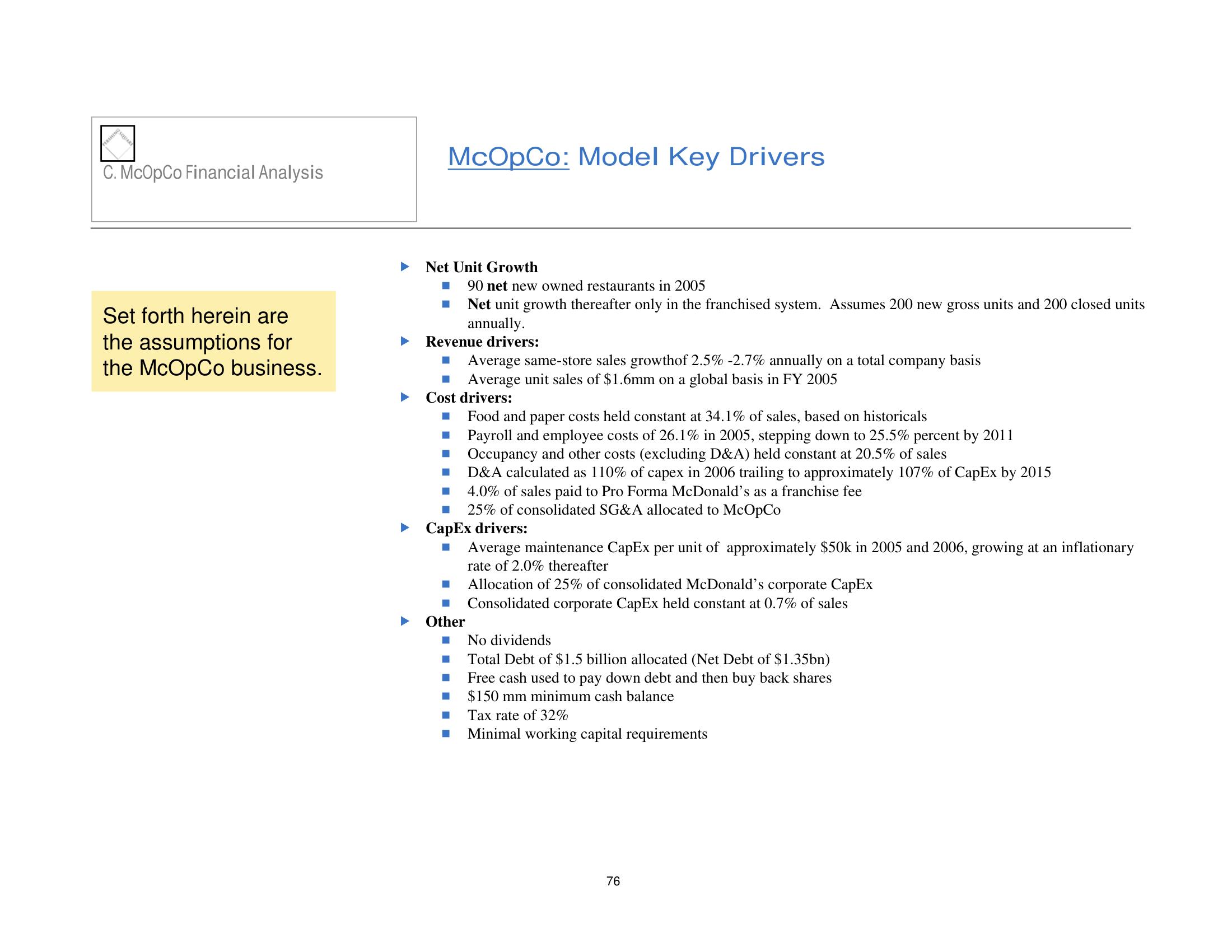

Set forth herein are

the assumptions for

the McOpCo business.

McOpCo: Model Key Drivers

Net Unit Growth

■ 90 net new owned restaurants in 2005

Net unit growth thereafter only in the franchised system. Assumes 200 new gross units and 200 closed units

annually.

Revenue drivers:

Average same-store sales growthof 2.5% -2.7% annually on a total company basis

Average unit sales of $1.6mm on a global basis in FY 2005

Cost drivers:

Food and paper costs held constant at 34.1% of sales, based on historicals

Payroll and employee costs of 26.1% in 2005, stepping down to 25.5% percent by 2011

Occupancy and other costs (excluding D&A) held constant at 20.5% of sales

D&A calculated as 110% of capex in 2006 trailing to approximately 107% of CapEx by 2015

■

■

■

■

I

CapEx drivers:

4.0% of sales paid to Pro Forma McDonald's as a franchise fee

25% of consolidated SG&A allocated to McOpCo

Average maintenance CapEx per unit of approximately $50k in 2005 and 2006, growing at an inflationary

rate of 2.0% thereafter

■ Allocation of 25% of consolidated McDonald's corporate CapEx

■ Consolidated corporate CapEx held constant at 0.7% of sales

Other

I

■

No dividends

Total Debt of $1.5 billion allocated (Net Debt of $1.35bn)

Free cash used to pay down debt and then buy back shares

$150 mm minimum cash balance

Tax rate of 32%

Minimal working capital requirements

76View entire presentation