Evercore Investment Banking Pitch Book

McMoRan Situation Analysis

Shareholder Name

Institutional

Wells Fargo & Co.

Omega Advisors, Inc.

Black Rock, Inc

The Vanguard Group, Inc.

DAY ROBERT ADDISON

Wilkinson O'Grady & Co., Inc. (New York)

State Street Corp.

Lord, Abbett & Co. LLC

Jokey Corp.

Chilton Investment Co. LLC

Other

Total Institutional

Insiders

Plains Exploration & Production Co.

James R. Moffett

Gerald J. Fond

Robert Addison Day

BM Rankin Jr.

Other

Total Insider

Retail

Total Shares Outstanding (Basic)

Float

Short Interest (% of Basic)

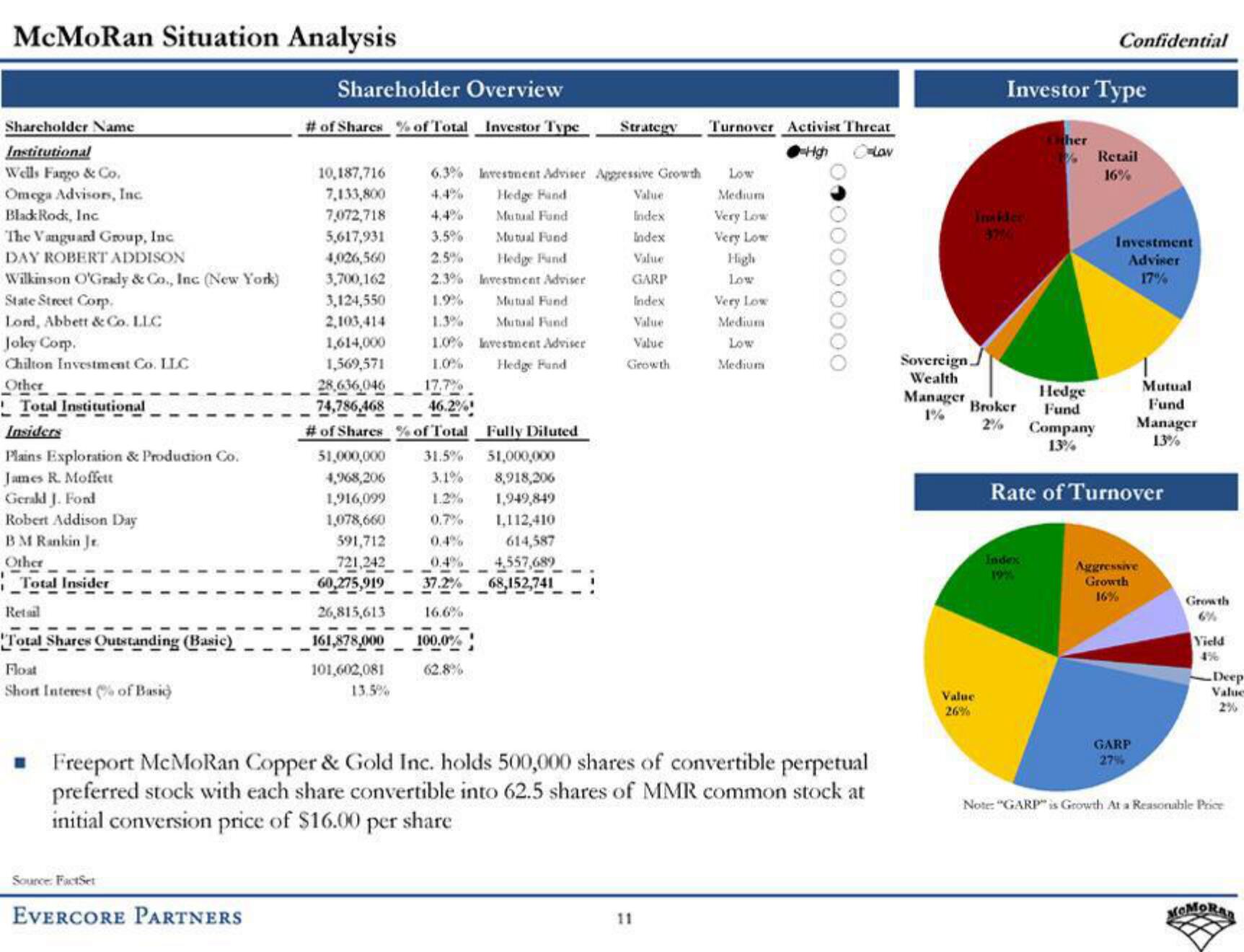

Shareholder Overview

# of Shares % of Total Investor Type

Source: FactSet

EVERCORE PARTNERS

10,187,716

7,133,800

7,072,718

5,617,931

4,026,560

3,700,162

3,124,550

2,103,414

1,614,000

1,569,571

28.636,046

74,786,468

1.0%

17.7%

46.2%

# of Shares % of Total

6.3% Investment Adviser Apgressive Growth

4.4%

Hedge Hand

4.4% Mutual Fund

3.5% Mutual Fund

2.5%

Hedge Fund

2.3% Investment Adviser

1.9%

Mutual Fund

1.3% Mutual Fund

1.0% Investment Adviser

Hedge Fund

Strategy Turnover Activist Threat

High

Lav

Fully Diluted

51,000,000

51,000,000

4,968,206

1,916,099

31.5%

3.1%

1.2%

8,918,206

1,949,849

1,078,660

0.7%

1,112,410

591,712

0.4%

614,587

721,242

0.4%

4,557,689

60,275,919 37.2% 68,152,741

26,815,613

16.6%

161,878,000 100.0%

101,602,081

13.5%

62.8%

Index

Index

Value

GARP

Index

Value

Value

Growth

Low

Medium

11

Very Low

Very Low

High

Low

Very Low

Medium

Low

Medium

■ Freeport McMoRan Copper & Gold Inc. holds 500,000 shares of convertible perpetual

preferred stock with each share convertible into 62.5 shares of MMR common stock at

initial conversion price of $16.00 per share

00000000

Sovereign

Wealth

Manager

1%

Insider

Investor Type

Value:

26%

Broker

2%

Confidential

Other

Index

19%

Retail

16%

Investment

Adviser

17%

Hedge

Fund

Company

13%

Rate of Turnover

Mutual

Fund

Manager

13%

Aggressive

Growth

16%

GARP

27%

Growth

6%

Yield

4%

Deep

Value

2%

Note: "GARP" is Growth At a Reasonable Price

MOMORARView entire presentation