Evercore Investment Banking Pitch Book

Confidential - Preliminary and Subject to Change

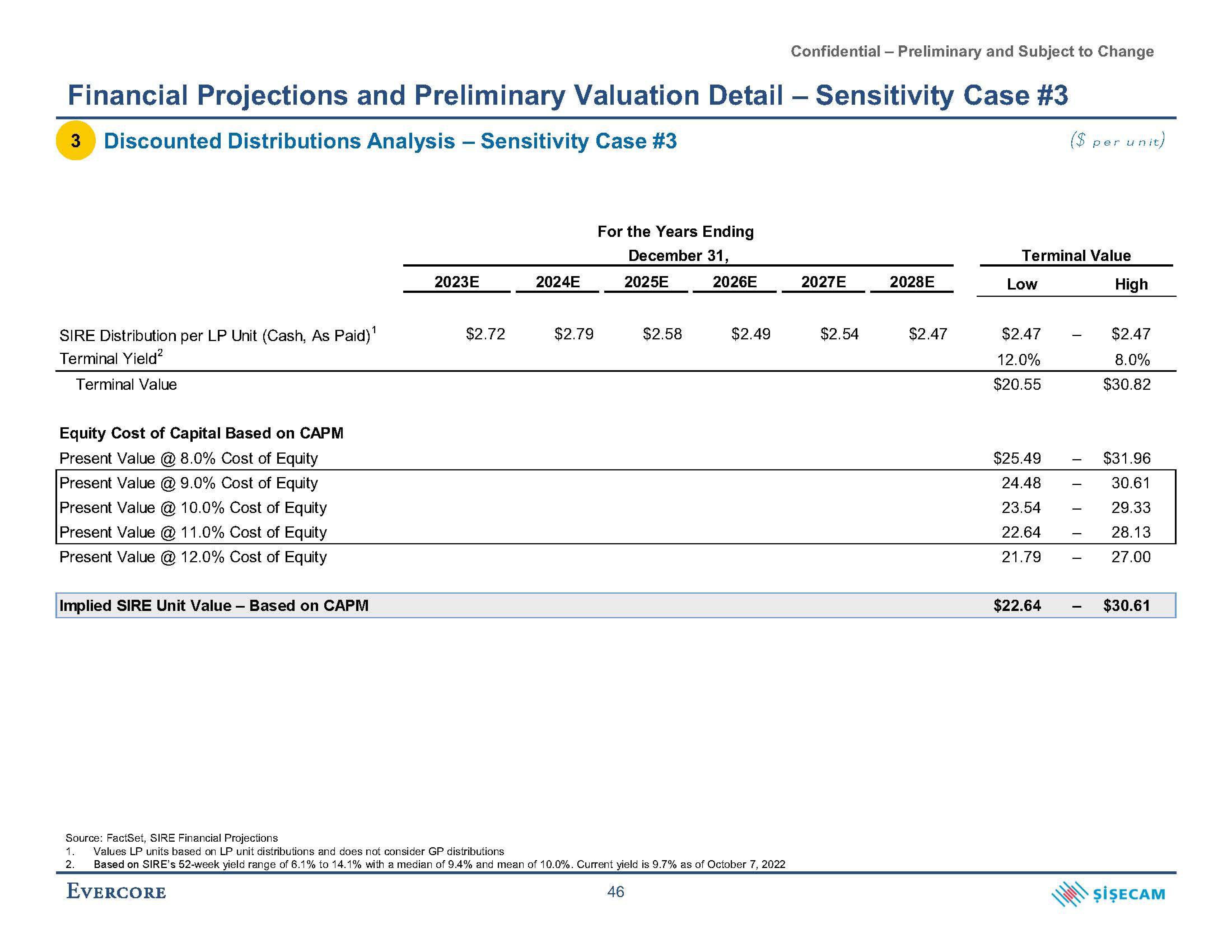

Financial Projections and Preliminary Valuation Detail - Sensitivity Case #3

3 Discounted Distributions Analysis - Sensitivity Case #3

SIRE Distribution per LP Unit (Cash, As Paid)¹

Terminal Yield²

Terminal Value

Equity Cost of Capital Based on CAPM

Present Value @ 8.0% Cost of Equity

Present Value @ 9.0% Cost of Equity

Present Value @ 10.0% Cost of Equity

Present Value @ 11.0% Cost of Equity

Present Value @ 12.0% Cost of Equity

Implied SIRE Unit Value - Based on CAPM

2023E

$2.72

2024E

$2.79

For the Years Ending

December 31,

2025E

2026E

$2.58

$2.49

Source: FactSet, SIRE Financial Projections

1. Values LP units based on LP unit distributions and does not consider GP distributions

2.

Based on SIRE's 52-week yield range of 6.1% to 14.1% with a median of 9.4% and mean of 10.0%. Current yield is 9.7% as of October 7, 2022

EVERCORE

46

2027E

$2.54

2028E

$2.47

Terminal Value

Low

$2.47

12.0%

$20.55

$25.49

24.48

23.54

22.64

21.79

$22.64

-

-

per unit)

-

High

$2.47

8.0%

$30.82

$31.96

30.61

29.33

28.13

27.00

$30.61

ŞİŞECAMView entire presentation