LanzaTech SPAC Presentation Deck

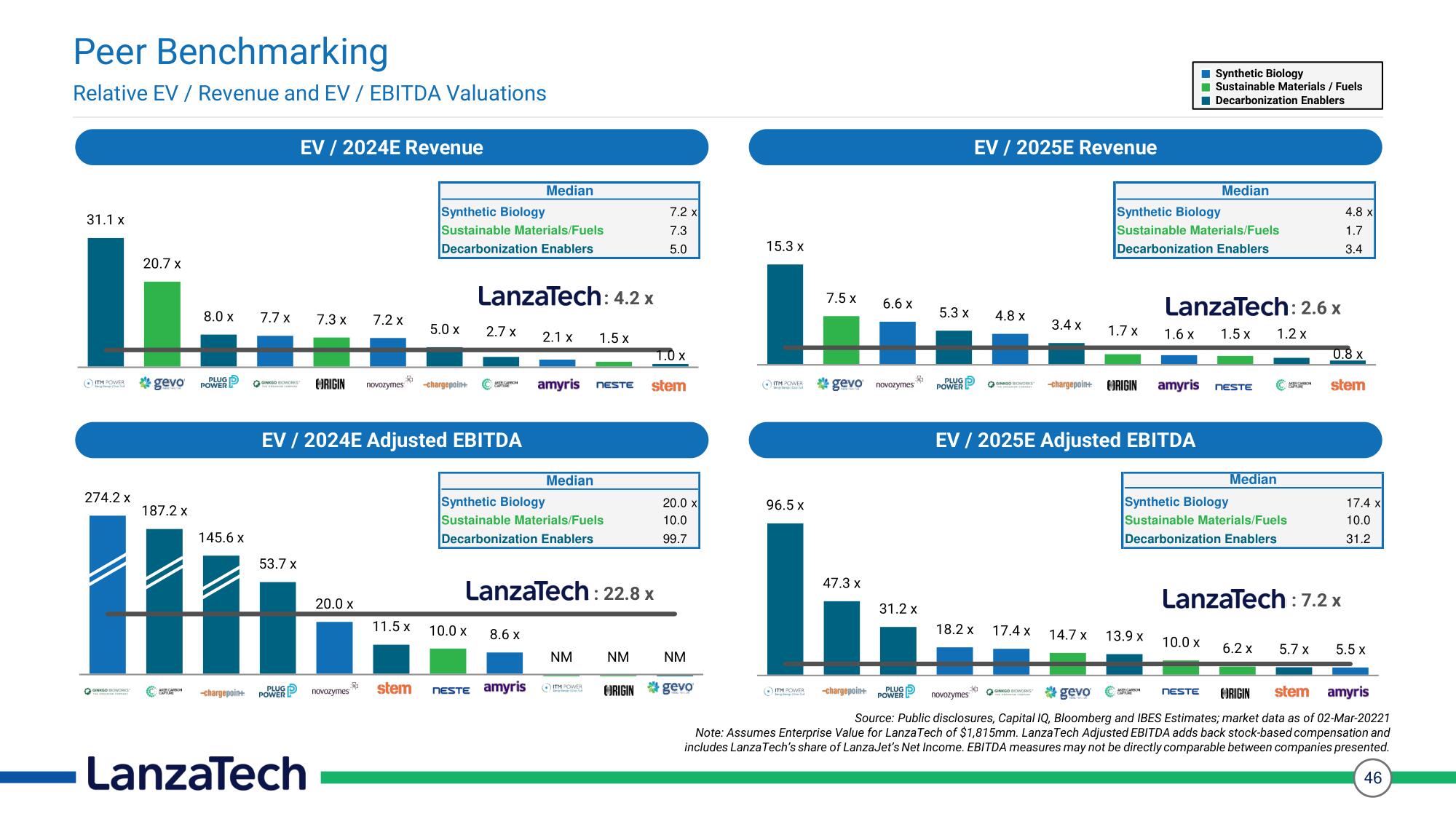

Peer Benchmarking

Relative EV / Revenue and EV / EBITDA Valuations

31.1 x

274.2 x

20.7 x

ITM POWER *gevo POWER

GINKGO BIOWORKS

8.0 x

ARTA CARBON

7.7 x

187.2 x

145.6 x

53.7 x

Hi

-chargepoin+

EV / 2024E Revenue

ONGO BOWORKS ORIGIN

POWER

7.3 x

LanzaTech

20.0 x

novozymes

7.2 X

$

$

EV / 2024E Adjusted EBITDA

novozymes -chargepoin+

11.5 x

Synthetic Biology

Sustainable Materials/Fuels

Decarbonization Enablers

5.0 X

stem

LanzaTech: 4.2 x

2.7 X

10.0 X

Median

8.6 x

2.1 X

NESTE amyris

Synthetic Biology

Sustainable Materials/Fuels

Decarbonization Enablers

Median

LanzaTech: 2

1.0 x

amyris NESTE stem

1.5 x

NM

(ITH POR

: 22.8 x

7.2 x

7.3

5.0

NM

20.0 x

10.0

99.7

NM

ORIGIN gevo

15.3 x

ITM POWER

96.5 x

7.5 x

() ITM POWER

47.3 x

||

gevo novozymes

6.6 x

-chargepoin+

R

31.2 x

PLUG

POWER

5.3 x

PLUG 5

POWER

EV / 2025E Revenue

18.2 x

4.8 x

novozymes

GINKGO BIOWORKS

17.4 x

3.4 x

* GINKGO BIOWORKS

EV / 2025E Adjusted EBITDA

1.7 x

14.7 x

Synthetic Biology

Sustainable Materials/Fuels

Decarbonization Enablers

-chargepoin+ RIGIN amyris

1.6 x

LanzaTech: 2.6 x

1.5 x

1.2 x

13.9 x

Synthetic Biology

Sustainable Materials / Fuels

Decarbonization Enablers

Median

NESTE

Synthetic Biology

Sustainable Materials/Fuels

Decarbonization Enablers

Median

NESTE

10.0 X 6.2 X

LanzaTech:7

: 7.2 x

5.7 x

gevo

ORIGIN

stem amyris

Source: Public disclosures, Capital IQ, Bloomberg and IBES Estimates; market data as of 02-Mar-20221

Note: Assumes Enterprise Value for LanzaTech of $1,815mm. LanzaTech Adjusted EBITDA adds back stock-based compensation and

includes LanzaTech's share of LanzaJet's Net Income. EBITDA measures may not be directly comparable between companies presented.

46

4.8 x

1.7

3.4

0.8 x

stem

17.4 x

10.0

31.2

5.5 xView entire presentation