Melrose Mergers and Acquisitions Presentation Deck

Foreign exchange forward looking

Melrose

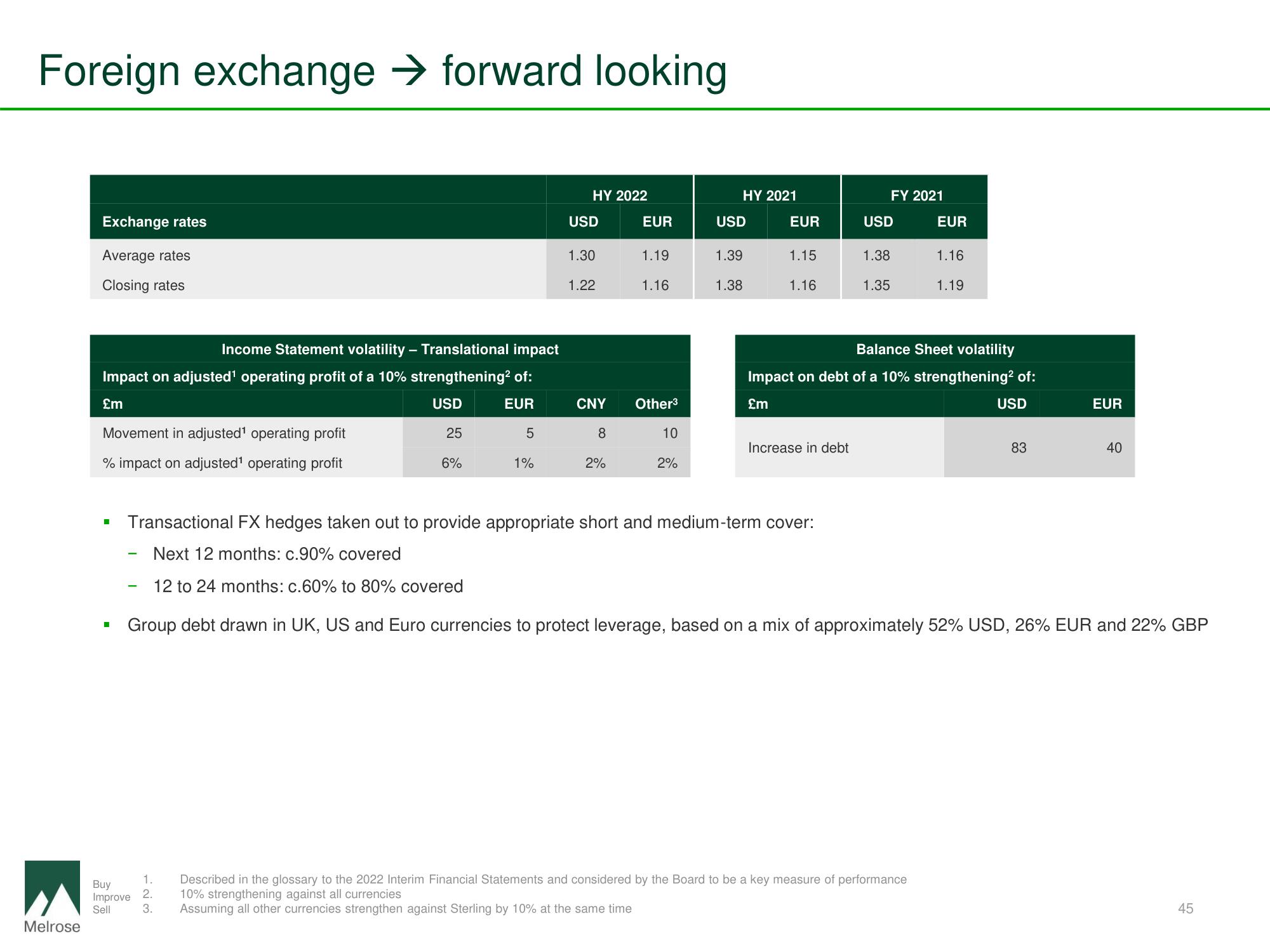

Exchange rates

Average rates

Closing rates

Income Statement volatility - Translational impact

Impact on adjusted¹ operating profit of a 10% strengthening² of:

£m

USD

EUR

5

Movement in adjusted¹ operating profit

% impact on adjusted¹ operating profit

I

→

■

25

1.

Buy

Improve 2.

Sell

3.

6%

1%

HY 2022

USD

1.30

1.22

CNY

8

2%

EUR

1.19

1.16

Other³

10

2%

HY 2021

USD

1.39

1.38

EUR

1.15

1.16

Increase in debt

Transactional FX hedges taken out to provide appropriate short and medium-term cover:

Next 12 months: c.90% covered

12 to 24 months: c.60% to 80% covered

FY 2021

USD

1.38

1.35

Balance Sheet volatility

Impact on debt of a 10% strengthening² of:

£m

USD

EUR

1.16

1.19

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

10% strengthening against all currencies

Assuming all other currencies strengthen against Sterling by 10% at the same time

83

EUR

Group debt drawn in UK, US and Euro currencies to protect leverage, based on a mix of approximately 52% USD, 26% EUR and 22% GBP

40

45View entire presentation