Kinnevik Results Presentation Deck

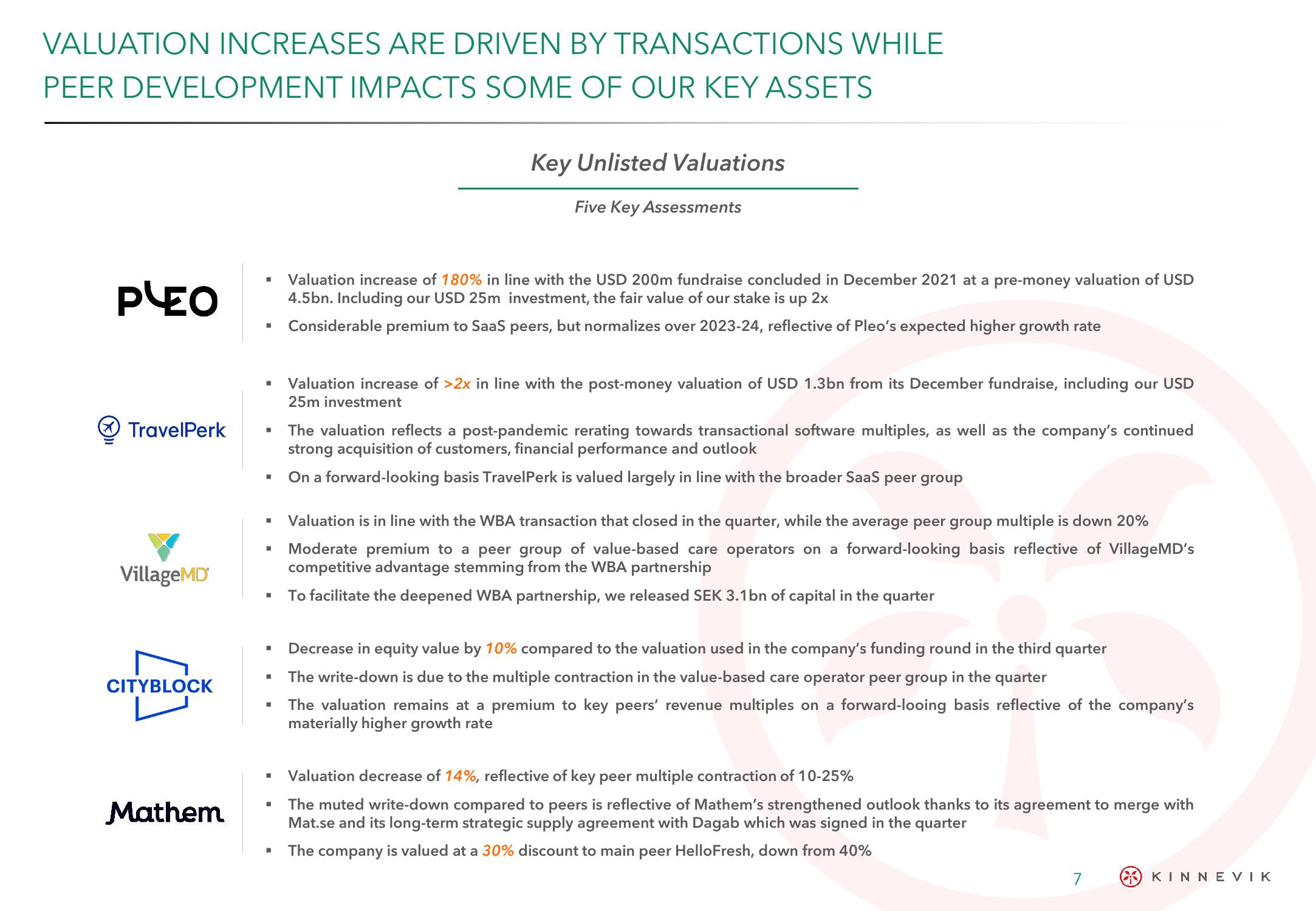

VALUATION INCREASES ARE DRIVEN BY TRANSACTIONS WHILE

PEER DEVELOPMENT IMPACTS SOME OF OUR KEY ASSETS

PLEO

TravelPerk

VillageMD

CITYBLOCK

-

Mathem

I

■

-

■

■

I

I

I

Key Unlisted Valuations

Five Key Assessments

Valuation increase of 180% in line with the USD 200m fundraise concluded in December 2021 at a pre-money valuation of USD

4.5bn. Including our USD 25m investment, the fair value of our stake is up 2x

Considerable premium to SaaS peers, but normalizes over 2023-24, reflective of Pleo's expected higher growth rate

Valuation increase of >2x in line with the post-money valuation of USD 1.3bn from its December fundraise, including our USD

25m investment

The valuation reflects a post-pandemic rerating towards transactional software multiples, as well as the company's continued

strong acquisition of customers, financial performance and outlook

On a forward-looking basis TravelPerk is valued largely in line with the broader SaaS peer group

Valuation is in line with the WBA transaction that closed in the quarter, while the average peer group multiple is down 20%

Moderate premium to a peer group of value-based care operators on a forward-looking basis reflective of Village MD's

competitive advantage stemming from the WBA partnership

To facilitate the deepened WBA partnership, we released SEK 3.1 bn of capital in the quarter

Decrease in equity value by 10% compared to the valuation used in the company's funding round in the third quarter

The write-down is due to the multiple contraction in the value-based care operator peer group in the quarter

The valuation remains at a premium to key peers' revenue multiples on a forward-looing basis reflective of the company's

materially higher growth rate

Valuation decrease of 14%, reflective of key peer multiple contraction of 10-25%

The muted write-down compared to peers is reflective of Mathem's strengthened outlook thanks to its agreement to merge with

Mat.se and its long-term strategic supply agreement with Dagab which was signed in the quarter

The company is valued at a 30% discount to main peer HelloFresh, down from 40%

7

KINNEVIKView entire presentation