Evercore Investment Banking Pitch Book

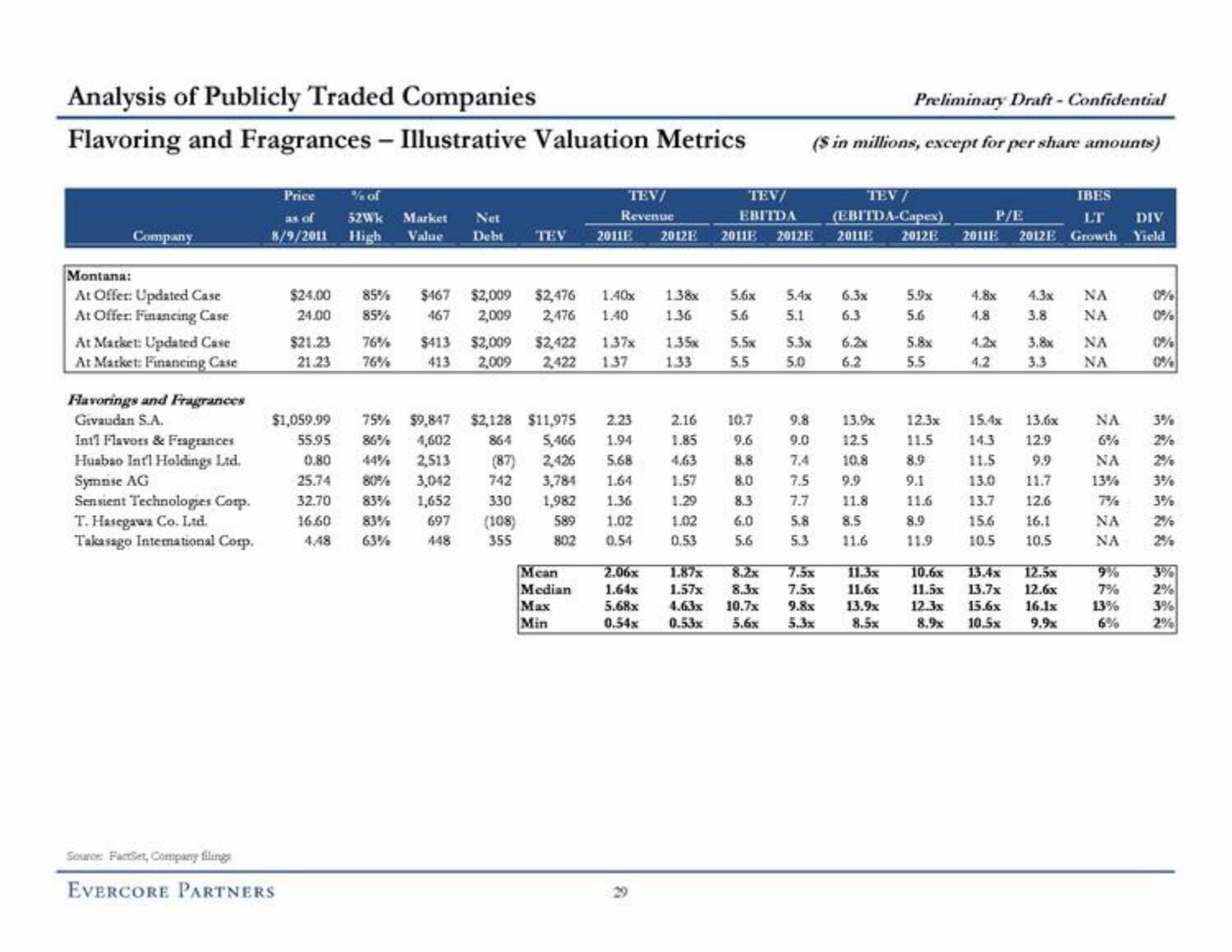

Analysis of Publicly Traded Companies

Flavoring and Fragrances - Illustrative Valuation Metrics

Company

Montana:

At Offer: Updated Case

At Offer: Financing Case

At Market: Updated Case

At Market: Financing Case

Flavorings and Fragrances

Givaudan S.A.

Int'l Flavors & Fragrances

Huabao Int'l Holdings Ltd.

Symnise AG

Sensient Technologies Corp.

T. Hasegawa Co. Ltd.

Takasago International Corp.

Price

as of

8/9/2011

$24.00

24.00

Source: FactSet, Company filings

EVERCORE PARTNERS

$21.23

21.23

$1,059.99

% of

52Wk Market Net

High Value Debt

TEV

75% $9,847 $2,128 $11,975

86% 4,602

44% 2,513

80% 3,042

1,652

697

448

55.95

0.80

25.74

32.70 83%

16.60 83%

4.48 63%

85% $467 $2,009 $2,476

85% 467 2,009 2,476

76% $413 $2,009 $2,422 1.37x

76%

413

2,009 2,422 1.37

(108)

355

TEV/

Revenue

589

802

2.23

864 5,466 1.94

(87) 2,426 5.68

742 3,784 1.64

330 1,982

1.36

1.02

0.54

Mean

Median

Max

Min

2011E 2012E 2011E 2012E

1.40x

1.40

1.38x

1.36

8

1.35x

1.33

2.16

1.85

1.57

1.29

1.02

0.53

2.06x

1.64x

5.68x

0.54x 0.53x

TEV/

EBITDA

5.6x

5.6

5.5x

5.5

Preliminary Draft - Confidential

(S in millions, except for per share amounts)

10.7

9.6

8.8

8.0

8.3

6.0

5.6

5.4x

5.1

5.3x

5.0

1.87% 8.2x 7.5x

1.57x 8.3x 7.5x

10.7x 9.8x

5.6x

5.3x

TEV /

(EBITDA-Capex)

2011E

6.3x

6.3

6.2x

6.2

9.8

13.9x

9.0

12.5

7.4

10.8

7.5 9.9

7.7

5.8

5.3

11.8

8.5

11.6

11.3x

11.6x

13.9x

8.5x

IBES

LT DIV

2012E 2011E 2012E Growth Yield

5.9x

5.6

5.8x

5.5

12.3x

11.5

8.9

9.1

11.6

8.9

11.9

P/E

4.8x

4.8

4.2x

4.2

4.3x

3.8

3.8x

3.3

13.6x

15.4x

14.3 12.9

11.5

9.9

13.0

11.7

13.7 12.6

15.6

16.1

10.5 10.5

10.6x 13.4x 12a

115x 13.7x 12.6x

12.3x 15.6x 16.1x

8.9x 10.5x 9.9x

NA

ΝΑ

NA

NA

0%

0%

9%

7%

13%

0%

0%

3%

2%

NA

6%

NA

13%

3%

7%

3%

NA

2%

ΝΑ 2%

2%

3%

2%View entire presentation