Evercore Investment Banking Pitch Book

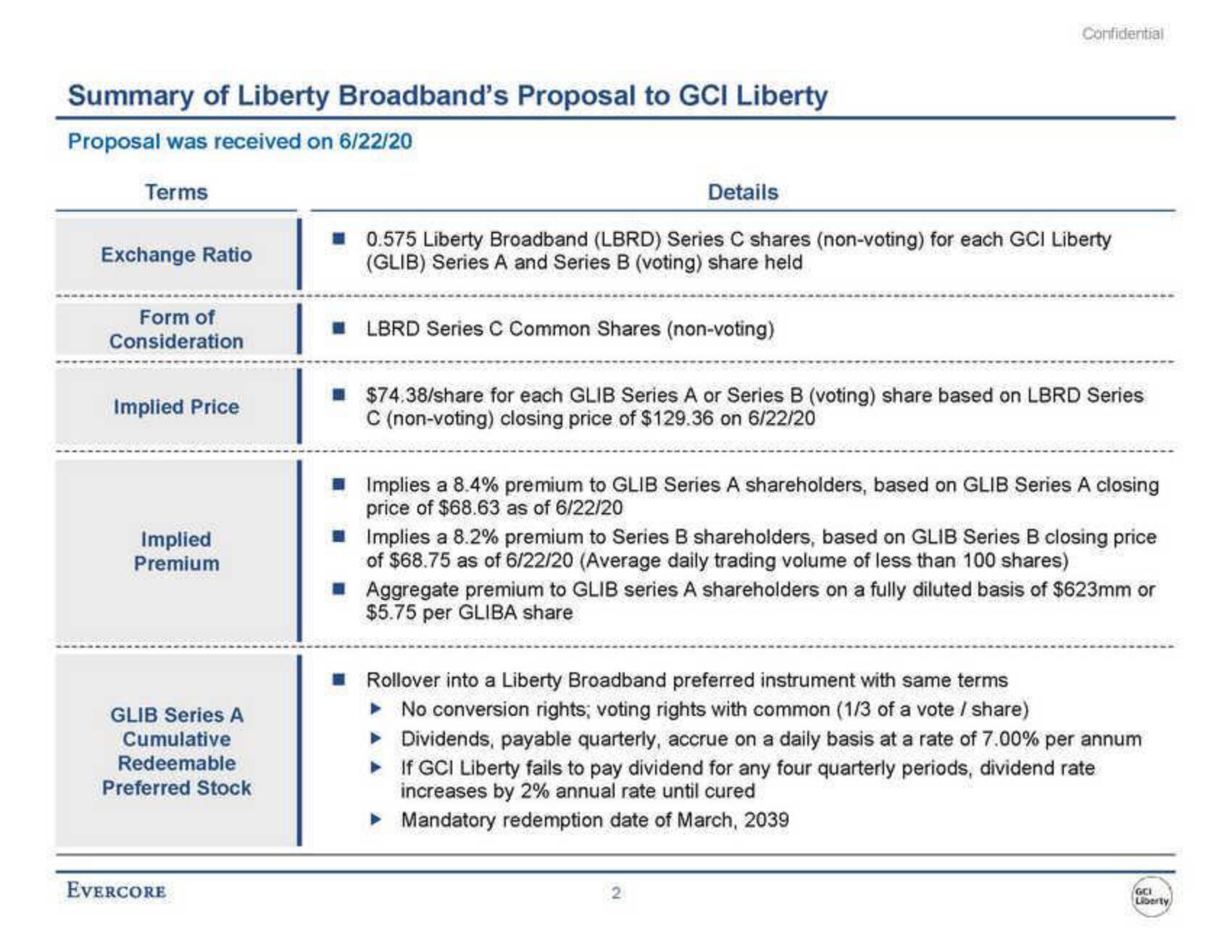

Summary of Liberty Broadband's Proposal to GCI Liberty

Proposal was received on 6/22/20

Terms

Exchange Ratio

Form of

Consideration

Implied Price

Implied

Premium

GLIB Series A

Cumulative

Redeemable

Preferred Stock

EVERCORE

Details

0.575 Liberty Broadband (LBRD) Series C shares (non-voting) for each GCI Liberty

(GLIB) Series A and Series B (voting) share held

LBRD Series C Common Shares (non-voting)

Confidential

$74.38/share for each GLIB Series A or Series B (voting) share based on LBRD Series

C (non-voting) closing price of $129.36 on 6/22/20

Implies a 8.4% premium to GLIB Series A shareholders, based on GLIB Series A closing

price of $68.63 as of 6/22/20

Implies a 8.2% premium to Series B shareholders, based on GLIB Series B closing price

of $68.75 as of 6/22/20 (Average daily trading volume of less than 100 shares)

Aggregate premium to GLIB series A shareholders on a fully diluted basis of $623mm or

$5.75 per GLIBA share

Rollover into a Liberty Broadband preferred instrument with same terms

▸ No conversion rights; voting rights with common (1/3 of a vote / share)

► Dividends, payable quarterly, accrue on a daily basis at a rate of 7.00% per annum

► If GCI Liberty fails to pay dividend for any four quarterly periods, dividend rate

increases by 2% annual rate until cured

▸ Mandatory redemption date of March, 2039

GCI

LibertyView entire presentation